Reports

Kroger And Albertsons Claim Merger Would Lower Prices, Contradicting Their Pandemic Price Hikes, Soaring Profits, And Shareholder Payouts

SUMMARY: On October 14, 2022, “grocery giant” Kroger announced plans to buy Albertsons Companies for $24.6 billion, threatening to create a “corporate behemoth” second only to Walmart in grocery industry market share. If the two companies successfully combine, they would control nearly 5,000 stores reaching about 85 million households across the U.S.

With 60% of grocery sales already concentrated among five food corporations and growing criticism of the industry’s power to anti-competitively set prices amid continuing inflation, the Kroger-Albertsons deal has already seen bipartisan objections from Sens. Elizabeth Warren (D-MA), Bernie Sanders (I-VT), and Mike Lee (R-UT), in addition to the United Food and Commercial Workers (UFCW) union and its 1.3 million members.

Kroger and Albertsons have claimed the merger would help reduce food prices for consumers, although food corporations have enjoyed “record earnings” during the pandemic due largely to their market power to pass increased costs onto their customers. Meanwhile, working families have been unfairly burdened by higher prices on groceries and other necessities, posing a particularly acute threat to the 42 million Americans who said they couldn’t afford enough food at the beginning of 2022.

Making matters worse, Kroger and Albertsons’ earnings reports over the course of the pandemic show they are likely to prioritize their shareholders over struggling consumers if their deal goes through:

Kroger

- December 2021: Admitted to “passing along higher cost to the customer where it makes sense to do so.”

- March 2022: Reported “’record performance‘” in its FY 2021 after a record FY 2020, with over $1.6 billion in net income and $2.2 billion in stock buybacks and dividends throughout the year.

- June 2022: CFO Gary Millerchip suggested the company valued shareholders over consumers and employees, stating Kroger would “continue to evaluate opportunities to deploy excess cash to accelerate our growth model and deliver sustainable total shareholder returns.”

- September 2022: Reported nearly $1.4 billion in net income in the first half of its FY 2022, a 129.6% increase over the same period in 2021, while spending over $1.28 billion on stock buybacks and shareholder dividends.

- September 2022: Increased its dividend by 24% and authorized a new $1 billion stock buyback program.

Albertsons

- Since October 2021: Repeatedly admitted to hiking prices for consumers, crediting “retail price inflation” for strong results and saying it was “passing through” costs to customers.

- April 2022: Reported FY 2021 net income rising by 90% to $1.6 billion and shareholder dividends rising 121% to $207 million as its CEO said “we are executing well against industry-wide pressures.”

- July 2022: Albertsons reported Q1 2022 net income rising by nearly 9% to $484 million and shareholder dividends climbing by 35% to $63 million as its CEO touted “strong operating and financial performance across all key metrics.”

October 2022: Kroger, Already A “Grocery Giant,” Announced A $24.6 Billion Plan To Buy Albertsons, Potentially Creating A “Corporate Behemoth” In A Food Industry Already Dominated By Just Five Companies Widely Criticized For Price-Setting Power And “Record Earnings” Amid Continuing Inflation.

October 14, 2022: “Grocery Giant” Kroger Announced Plans To Buy Albertsons In A $24 Billion Deal That Could Create A “Corporate Behemoth,” Second Only To Walmart In Grocery Market Share With Almost 5,000 Stores Reaching About 85 Million Households.

October 14, 2022: “Grocery Giant” Kroger Announced Plans To Acquire Albertsons For $24.6 Billion In A Deal That “Could Reshape The Supermarket Landscape” In The U.S. “The grocery giant Kroger announced plans on Friday to acquire Albertsons in a $24.6 billion deal that could reshape the supermarket landscape in the United States.” [The New York Times, 10/14/22]

If The Deal Proceeds, It Would “Unite Two Of The Country’s Largest Supermarket Chains To Create A Corporate Behemoth” With $209 Billion In Annual Revenue Through Almost 5,000 Stores. “If it is approved by officials, the deal would unite two of the country’s largest supermarket chains to create a corporate behemoth that collectively generates $209 billion in revenue a year and operates nearly 5,000 stores.” [The New York Times, 10/14/22]

Kroger And Albertsons Have A Combined 710,000 Employees And Together Reach About 85 Million Households. “The two companies have a combined 710,000 workers – most of them unionized in an industry with low union rates – nearly 5,000 stores and more than $200 billion in sales. The companies say they reach 85 million households.” [CNN, 10/16/22]

The Acquisition Was Seen As Partly Intended To “Take On Walmart,” The Leading U.S. Grocer. “The acquisition, aimed in part to take on Walmart, comes as record inflation continues to squeeze people’s wallets and as regulators try to rein in the power of giant corporations. That leaves a number of questions about the potentially industry-shifting deal.” [The New York Times, 10/14/22]

- Kroger And Albertsons’ Combined Market Share Of About 16% Would Compete With Walmart’s 21% Market Share, The Highest In The U.S. “Its combined market share of about 16% would help it compete with Walmart Inc., the leader in the US, which commands 21% of the market, as well as online giant Amazon.com Inc.” [Bloomberg, 10/13/22]

Kroger Currently Operates 2,750 Grocery Stores In The U.S. Through Brands Including Ralphs, Dillons, Harris Teeter, Fry’s, King Soopers, And Others. “Kroger, which was founded in 1883, operates 2,750 grocery stores across the United States from its Cincinnati headquarters, and it has a market capitalization of about $32 billion. Its brands include Ralphs, Dillons and Harris Teeter.” [The New York Times, 10/14/22]

[The Kroger Co., accessed 10/17/22]

Albertsons Operates 2,200 Grocery Stores In The U.S. Through Brands Including Safeway, Acme, Vons, Shaw’s, And Others. “Albertsons, based in Boise, Idaho, and founded in 1939, runs 2,200 supermarkets under names like Albertsons, Safeway and Vons. It has a market capitalization of roughly $15 billion.” [The New York Times, 10/14/22]

[Albertsons Companies, accessed 10/17/22]

It Was “Unclear” If Federal Regulators Would Approve The Deal And Investors Were Not Optimistic It Would Proceed, As Legal Experts Have Noted The Companies’ Contradictory Claims That The Deal Could Increase Competition While Consolidating The Market.

Krogers’ And Albertsons’ Boards Unanimously Approved The Acquisition. “The boards of both companies unanimously approved the deal. So what remains is regulatory approval.” [The New York Times, 10/14/22]

The Acquisition Must Be Approved By Federal Regulators, And It Was “Unclear” If The Federal Trade Commission (FTC) Would Approve The Deal. “It is unclear if the F.T.C. or another agency will try to stop the deal. But in an attempt to do so, a regulator can sue to block the merger, forcing companies to decide whether they want to pursue the long and costly process of a trial to prove it is better for them, their shareholders and their customers to combine. Sometimes, they walk away to avoid that hassle.” [The New York Times, 10/14/22]

The FTC Will Likely Examine Whether Kroger And Albertsons Have “Followed Through” On Claims The Companies Made About These Deals And If They Can “Leave Room For A Viable Competitor” In Certain Markets. “The F.T.C will most likely look at what claims the chains made about those earlier deals — and whether they have followed through on them. It will also look intently at whether Kroger and Albertsons can leave room for a viable competitor in markets in which they overlap by selling off stores.” [The New York Times, 10/14/22]

FTC Chair Lina Khan Is “A Critic Of Corporate Consolidation,” And Has Blocked Similar Large Retail Mergers Like Staples’ Proposed Merger With Office Depot. “FTC chair Lina Khan is critic of corporate consolidation, and the regulator has blocked large retail mergers in the past, including Staples’ attempts to combine with Office Depot.” [CNN, 10/16/22]

One Legal Observer Noted That “‘This Is The Type Of Deal That The FTC Wants To Discourage.’” “‘There is a significant risk of a challenge,’ said Andre Barlow of law firm Doyle Barlow and Mazard PLLC. ‘This is the type of deal that the FTC wants to discourage.’” [Reuters, 10/14/22]

Kroger And Albertsons Said They Would Sell Up To 375 Stores To Ease Concerns From Regulators, But Analysts “Questioned Whether They Might Be Required To Part With More Stores.” “To address likely concerns from regulators that the two grocers will have too much overlap in certain areas of the country, particularly on the West Coast, Kroger and Albertsons said they planned to sell stores to competitors. They said they would also consider spinning off up to 375 stores into a separate, stand-alone company, if needed. Analysts on Friday, however, pushed Kroger executives over whether that plan was sufficient, and they questioned whether they might be required to part with more stores.” [The New York Times, 10/14/22]

Legal Experts Were Skeptical That The Companies Could Claim They’re Increasing Competition While Consolidating The Market. “Regardless, legal experts said it might be difficult for Kroger and Albertsons to make a case that they can foster competition while they simultaneously grow to better take on Walmart. ‘The argument kind of says we’re going to give up on a lot of competition and there are only going to be a couple of big players who effectively compete for most consumers,’ said Daniel Rubinfeld, a law professor at New York University who has reviewed mergers.” [The New York Times, 10/14/22]

Investors Were Not Optimistic That The Acquisition Would Successfully Proceed, WIth Shares Of Both Companies Falling Upon Announcement Of The Proposed Merger. “Investors do not seem optimistic about the companies’ chances of a successful merger. Shares of Kroger ended trading on Friday down more than 7 percent. Shares of Albertsons dropped more than 8 percent.” [The New York Times, 10/14/22]

If Successful, The Acquisition Is Expected To Close In 2024. “The deal, which is expected to close in 2024, would combine two of the largest supermarket chains in the country and create one of its largest private employers.” [CNN, 10/16/22]

Kroger And Albertsons Have Been “Among The Most Active Acquirers” Of Other Companies, With At Least $19.5 Billion In Deals Since 1998—Meanwhile, The Grocery Industry, Which Is Largely Controlled By Just Five National Chains, Has Been Widely Criticized For Concentrating Too Much Pricing Power Among A Small Set Of Companies.

Kroger And Albertsons Have Been “Among The Most Active Acquirers In Recent Years,” With At Least $19.5 Billion In Deals Since 1998. “Kroger and Albertsons have been among the most active acquirers in recent years, including through an $8 billion deal for Fred Meyer (Kroger in 1998), a $2.5 billion purchase of Harris Teeter (Kroger in 2013) and a $9 billion deal for Safeway (Albertsons in 2015).” [The New York Times, 10/14/22]

The “Grocery Industry Has Consolidated In Big Ways” In Recent Decades, With Many Observers Worried That “Too Much Power To Set Prices Rests In The Hands Of Too Few Corporations.” “Through mergers over the past few decades, the grocery industry has consolidated in big ways, and many have worried that too much power to set prices rests in the hands of too few corporations.” [The New York Times, 10/14/22]

“60% Of Grocery Sales Are Already Concentrated Among 5 National Chains,” According To The American Economic Liberties Project:

[Tweet by American Economic Liberties Project, 10/13/22, accessed 10/17/22]

Following Antitrust Deregulation In The 1970s, The Food Industry Has “Consolidated Dramatically,” Increasing Businesses’ “Power To Set Prices And Increase The Likelihood Of Price-Fixing Or Market Manipulation.” “But there’s evidence that monopolistic market structures are making things worse. Food production has consolidated dramatically since the 1970’s after changes in antitrust policy allowed more companies to buy up their competitors. Depending on who you ask, antitrust practitioners say markets are ‘oligopolistic’ or dangerously concentrated when the top four firms control 40% to 50% of the market, or more. Higher levels of concentration give businesses more power to set prices and increase the likelihood of price-fixing or market manipulation.” [Time, 01/14/22]

Kroger And Albertsons Have Claimed Their Combined Size Would Help Reduce Consumer Prices Although Food Corporations Have Enjoyed “Record Earnings” During The Pandemic, Largely Due To Their Market Power To Pass Their Increased Costs On To Consumers.

Kroger And Albertsons Claim That Their Combined Size Would Allow Them To Reduce Prices Through Increased Bargaining Power, While Many Lawmakers, Regulators, And Consumer Regulators Have Warned That Corporations Will Pass Increased Profits To Shareholders Rather Than Consumers. “Kroger and Albertsons argue that their increased size and bargaining power will help them reduce prices, and that the savings can then be passed on to their customers. But lawmakers, regulators and consumer advocates often worry that companies will simply redirect any increase in profit to shareholders.” [The New York Times, 10/14/22]

Price Increases From The Acquisition “Could Have A Painful Impact,” With Food Prices Continuing To Rise After Climbing 11% From September 2021 To September 2022. “But any increase in prices now could have a painful impact, as food prices in general continue to shoot up. The cost of food across the United States last month rose 11 percent from the year before, according to the Bureau of Labor Statistics.” [The New York Times, 10/14/22]

Although Food Companies Have Faced Increased Costs, “These Aren’t Eating Into Their Profits As Economists Might Expect,” With Record Profit Margins Among Publicly Traded Companies. “Food companies do face legitimate increased costs and unique shortages, but these aren’t eating into their profits as economists might expect. In fact, the largest publicly traded companies have never had higher profit margins.” [Time, 01/14/22]

“Record Earnings” Have Suggested That “Food Companies Have Sufficient Market Power To Pass All Their Higher Costs, And Then Some, Onto Consumers.” “Such record earnings suggest that food companies have sufficient market power to pass all their higher costs, and then some, onto consumers.” [Time, 01/14/22]

A 2008 Study By An FTC Official And A Princeton Economist Found That Prices Increased In Four Of The Five Mergers They Evaluated. “A 2008 study conducted by Orley C. Ashenfelter, an economist at Princeton, and Daniel S. Hosken of the Federal Trade Commission, found that in four of the five mergers they evaluated, prices appeared to have increased between 3 and 7 percent. The authors cautioned that the study was not necessarily a reflection of the impact of all deals.” [The New York Times, 10/14/22]

Critics Of The Kroger-Albertsons Deal Include Sens. Elizabeth Warren (D-MA), Bernie Sanders (I-VT), Mike Lee (R-UT), And The United Food And Commercial Workers (UFCW), Which Represents 1.3 Million Workers.

Sen. Bernie Sanders (I-VT) Called The Kroger And Albertsons Deal “‘An Absolute Disaster’” Amid Rising Food Prices Due To “Corporate Greed,” Calling On The Biden Administration To “Reject This Deal.” “What will the political reaction be? […] Likely hot, given the focus on inflation, food prices and corporate consolidation — all right before the midterm elections. Senator Bernie Sanders, independent of Vermont, called the deal an ‘absolute disaster.’” [The New York Times, 10/14/22]

[Tweet by Sen. Bernie Sanders, 10/13/22, accessed 10/17/22]

Sen. Elizabeth Warren (D-MA) Responded To The Kroger And Albertsons Deal By Arguing “‘If We Move In On Antitrust Law, Break Up These Giant Corporations, Then We Get Real Competition And Then We Get Markets That Are Truly Competitive.’” “In an interview with MSNBC on Thursday, Warren alleged that the US had failed to exercise antitrust laws for decades, allowing for more concentration of power and soaring profits for corporations. ‘If we move in on antitrust law, break up these giant corporations, then we get real competition and then we get markets that are truly competitive,’ the Massachusetts Democrat said. ‘That’s good for small businesses, it’s good for consumers, and it actually, in many cases, reduces the need for regulatory oversight. You can count on the markets doing what they need to do.’” [Insider, 10/14/22]

Sen. Mike Lee (R-UT) Stated “He Would Do Everything In His Power To ‘Protect Consumers From Anticompetitive Mergers That Could Further Exacerbate The Financial Strain We Already Feel In The Grocery Store Checkout Aisle.’” “The top Republican on a Senate antitrust subcommittee, Mike Lee of Utah, said in a statement on Friday that he would do everything in his power to ‘protect consumers from anticompetitive mergers that could further exacerbate the financial strain we already feel in the grocery store checkout aisle.’” [The New York Times, 10/14/22]

The United Food And Commercial Workers Union (UFCW), Which Represents 1.3 Million Workers, Said The Deal “Has Serious Implications For Hundreds Of Thousands Of Our UFCW Members And America’s Families Who Are More Concerned Than Ever About Inflation’s Impact On The Price Of Their Food And Groceries.’” “The United Food and Commercial Workers International Union (UFCW), which represents 1.3 million workers in grocery stores, meatpacking plants and other essential industries along the food supply chain also voiced some concern about the proposed merger. ‘The proposed merger has serious implications for hundreds of thousands of our UFCW members and America’s families who are more concerned than ever about inflation’s impact on the price of their food and groceries, prescription drugs, and gas. As America’s largest union of essential workers, protecting the livelihoods of this nation’s grocery workers, union and non-union, is our highest priority,’ UFCW International president Marc Perrone, said in a statement Friday.” [CNN, 10/16/22]

- The UFCW Stated That It Would “‘Oppose Any Merger That Threatens The Jobs Of America’s Essential Workers, Union And Non-Union, And Undermines Our Communities.’” ‘To be clear, the UFCW will oppose any merger that threatens the jobs of America’s essential workers, union and non-union, and undermines our communities,’ he said.” [CNN, 10/16/22]

After A “Record Performance” In 2021 Thanks To “Passing Along Higher Cost To The Customer,” Kroger Saw Net Income Increase by Nearly 130% To $1.4 Billion While Spending Over $1.28 Billion On Shareholder Handouts—In September 2022, Kroger Raised Its Dividend By 24% And Authorized A New $1 Billion Share Repurchase Program.

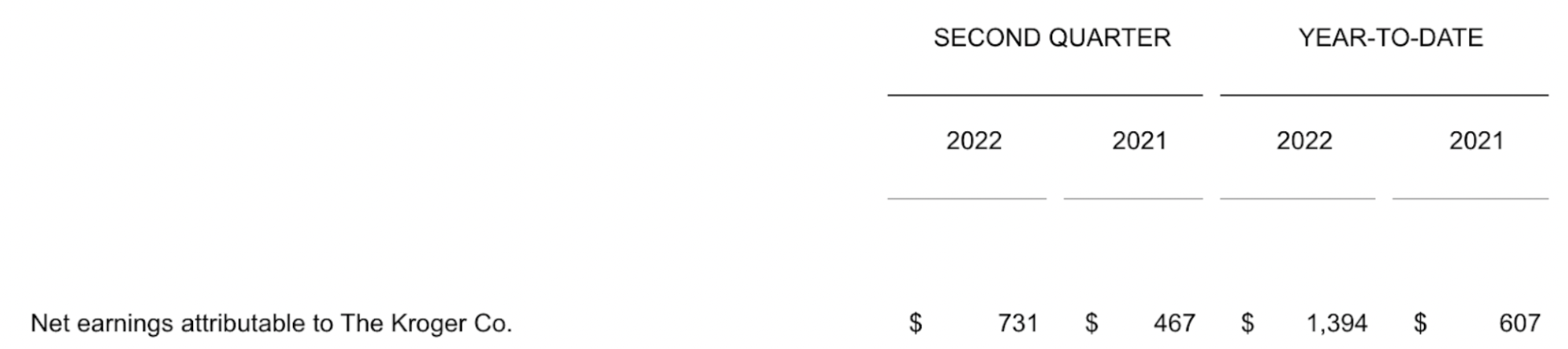

In The First Half Of 2022, Kroger Has Reported Nearly $1.4 Billion In Net Income, A 129.6% Increase Over The Same Period In 2021, While Spending $975 Million On Stock Buybacks And $307 Million On Shareholder Dividends.

In The First Half Of Its FY 2022, Kroger Reported Net Earnings Of Nearly $1.4 Billion, A 129.6% Increase Over $607 Million In The First Half Of Its FY 2021:

[Kroger, 09/09/22]

In Q2 2022, Kroger Spent $309 Million On Stock Buybacks, Bringing Total Buybacks To $975 Million In Just The First Half Of FY 2022. “Additionally, during the quarter, Kroger repurchased $309 million in shares and year-to-date, has repurchased $975 million in shares.” [Kroger, 09/09/22]

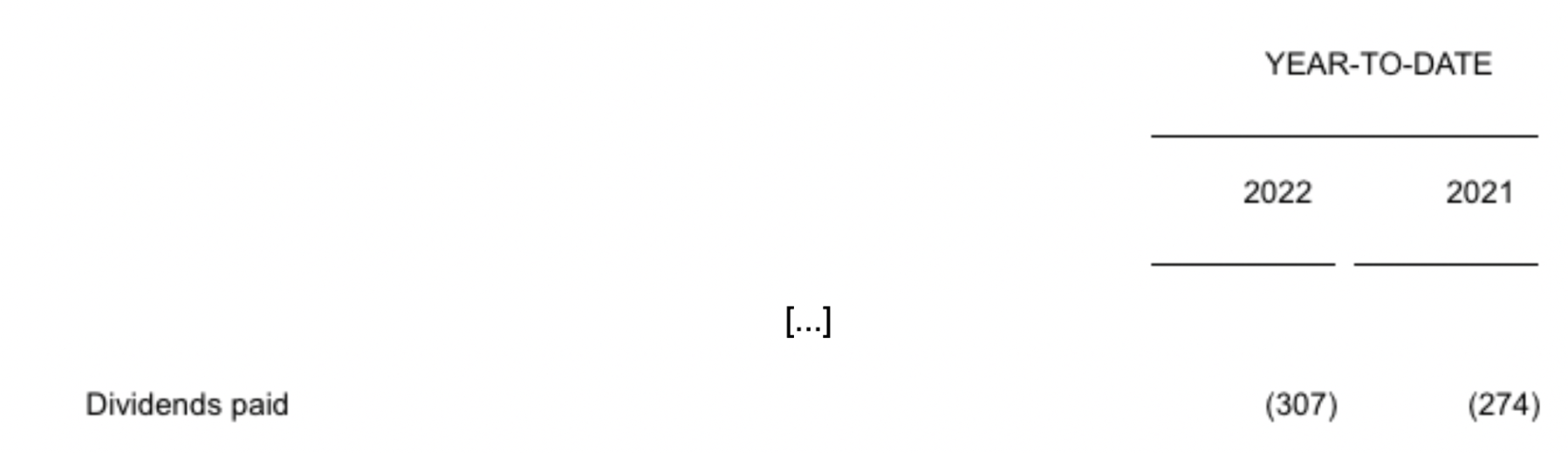

In The First Six Months Of Its FY 2022, Kroger Spent $307 Million On Shareholder Dividends, A 12% Increase Over The $274 Million It Spent In The First Six Months Of Its FY 2021:

[Kroger, 09/09/22]

In June 2022, Kroger’s CFO Suggested The Company Valued Shareholders Over Consumers And Employees, Stating Kroger Would “Continue To Evaluate Opportunities To Deploy Excess Cash To Accelerate Our Growth Model And Deliver Sustainable Total Shareholder Returns”—In September 2022, Kroger Increased Its Dividend By 24% And Authorized A New $1 Billion Stock Buyback Program.

June 2022: In Remarks Suggesting His Company Valued Shareholders Over Consumer Prices, Kroger Chief Financial Officer Gary Millerchip Admitted His Company Would “Continue To Evaluate Opportunities To Deploy Excess Cash To Accelerate Our Growth Model And Deliver Sustainable Total Shareholder Returns.” “Gary Millerchip […] We are operating from a position of financial strength and we’ll continue to evaluate opportunities to deploy excess cash to accelerate our growth model and deliver sustainable total shareholder returns.” [SeekingAlpha, 06/16/22]

In September 2022, Kroger’s Board “Authorized A New $1 Billion Share Repurchase Program.” “On September 9th, the Board of Directors authorized a new $1 billion share repurchase program.” [Kroger, 09/09/22]

In Q2 2022, Kroger Also “Increased Its Dividend By 24%, Marking The 16th Consecutive Year Of Dividend Increases.” “Earlier this quarter, Kroger increased its dividend by 24%, marking the 16th consecutive year of dividend increases.” [Kroger, 09/09/22]

Kroger—Which Admitted To “Passing Along Higher Cost To The Customer Where It Makes Sense To Do So” In December 2021—Had “‘Record Performance In 2021,'” With $2.2 Billion In Stock Buybacks And Dividends Through The Year.

December 2021: In An Earnings Call, Kroger Admitted To “Passing Along Higher Cost To The Customer Where It Makes Sense To Do So.” “Gary Millerchip […] And during the third quarter, Kroger saw higher product cost inflation in most categories. We are being disciplined in managing these increases. Our teams are doing an excellent job working to minimize the effects on our customers and our financial model by using our data and working closely with our suppliers. We are passing along higher cost to the customer where it makes sense to do so.” [Seeking Alpha, 12/02/21]

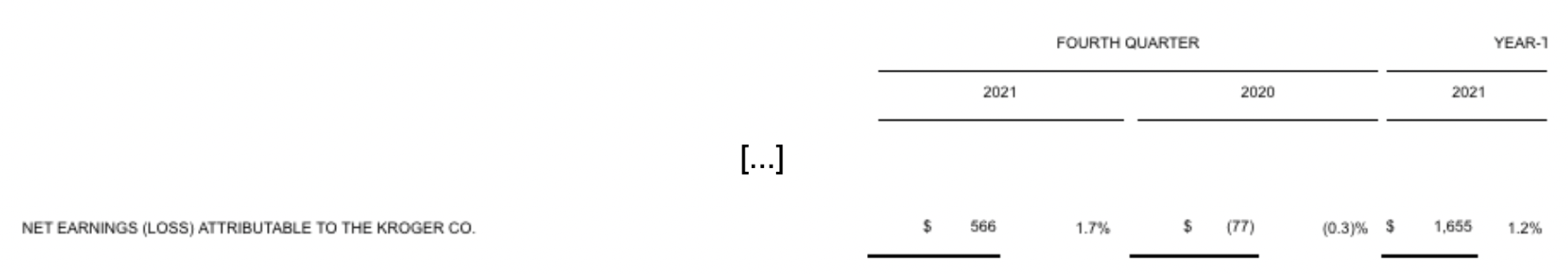

FY 2021: Kroger Had $1.655 Billion In Net Income:

[Kroger, 03/03/22]

In 2021, Kroger Spent $2.2 Billion On Shareholder Handouts, Including $1.6 Billion In Stock Buybacks And $589 Million In Dividends With Kroger Increasing Its Dividend By 17 Percent. “In total, Kroger returned $2.2 billion to shareholders in 2021. Kroger repurchased $1.6 billion of shares in 2021, under its board authorizations. Kroger also increased the dividend by 17 percent from 72¢ to 84¢ marking the 15th consecutive year of dividend increases, which resulted in a payout of $589 million.” [Kroger, 03/03/22]

Kroger Chairman And CEO Rodney McMullen Stated The Company Enjoyed “Record Performance” Not Only In 2021 But Also 2020. “Comments from Chairman and CEO Rodney McMullen […] ‘Our strategy of leading with fresh and accelerating with digital propelled Kroger to record performance in 2021, on top of record results in 2020. We are incredibly proud of our associates who continue to deliver for our customers through the pandemic.'” [Kroger, 03/03/22]

Albertsons Has Repeatedly Admitted To Hiking Prices While It Saw FY 2021 Net Income Soar By 90% To $1.6 Billion And Shareholder Dividends Climb By 121% To $207 Million—Albertsons Subsequently Saw Q1 2022 Net Income Continue To Rise By 9% To $484 Million And Dividends Increase By 35% To $63 Million Year-Over-Year.

Albertsons Companies Has Repeatedly Admitted To Increasing Prices For Consumers Since At Least October 2021.

April 2022: In Its FY 2021 Earnings Call, Albertsons CEO Vivek Sankaran Said “We Enhanced Our Pricing And Promotion Capabilities” As Part Of Its Efforts To “Fund Future Growth And Offset Inflation.” “Vivek Sankaran — Chief Executive Officer […] Increasing productivity, our next priority, allowed us to continue to fund future growth and offset inflation. In the second year of our three-year $1.5 billion savings program, we enhanced our pricing and promotion capabilities, further rationalized indirect spend, and expanded our national buying initiatives.” [The Motley Fool, 04/12/22]

April 2022: In Its FY 2021 Earnings Call, Albertsons Chief Financial Officer Sharon McCollam Also Credited Q4 2021’s Strong Results Partly To “Retail Price Inflation.” “Sharon McCollam — President and Chief Financial Officer […] Thank you, Vivek, and good morning, everyone. It’s great to be here with you today. Our fourth quarter ’21 results were strong across all key metrics. Identical sales were up 7.5% and up 19.3% on a two-year stacked basis, with momentum continuing into Q1 ’22. Retail price inflation, as well as market share gains, contributed to these results.” [The Motley Fool, 04/12/22]

January 2022: In Its Q3 2021 Earnings Call, Albertsons Companies CEO Vivek Sankaran Admitted The Company Was “Passing Through” Increased Costs To Consumers. “Simeon, here’s how I — let me just provide some context on inflation. First, the cost increases are real, right? We are seeing it in our supply base. I think they’re seeing it in ingredients, packaging, transportation, labor, and we are seeing it in our own business when you think about even our own brands program and such. So the cost inflation is absolutely real. When we think about what we are passing through, the net-net, we have passed through — the inflation we have passed through is less than the inflation we’ve incurred, right? And the way we do that is to make sure that we are judicious about the categories where we pass it through. We don’t pass through as much on the essential categories that customers need every day. And we try to balance that out.” [Seeking Alpha, 01/11/22]

October 2021: Albertsons Acknowledged “Passing Through Some Price Increases To Shoppers” And Its CEO Noted, “‘We Have Not Seen Material Change In Customer Behavior'” In Response To Price Changes. “Albertsons Cos. projected higher inflation for the rest of the year, driven by higher supply-chain and labor costs across the food industry. The Boise, Idaho-based supermarket chain is passing through some price increases to shoppers but said it is also offering cheaper alternatives. Executives said consumers are still spending heavily on groceries as they stay at home and cook more than they did before the pandemic. ‘We have not seen material change in customer behavior,’ Chief Executive Officer Vivek Sankaran said Monday during a call with analysts.” [Wall Street Journal, 10/18/21]

April 2022: Albertsons Reported FY 2021 Net Income Rising By 90% To $1.6 Billion And Shareholder Dividends Rising 121% To $207 Million As Its CEO Said “We Are Executing Well Against Industry-Wide Pressures.”

April 2022: In Its FY 2022 Earnings Release, Albertsons CEO Vivek Sankaran Said “We Are Executing Well Against Industry-Wide Pressures’” And That“‘We Are Pleased With Our Fourth Quarter And Full-Year 2021 Results.’” “‘We are pleased with our fourth quarter and full-year 2021 results and the continuing momentum we are seeing as we enter 2022,’ said Vivek Sankaran, CEO. ‘Our strategy is working, and we are executing well against industry-wide pressures. We want to recognize and thank all of our retail, distribution and manufacturing teams for their commitment to and care of our customers and their communities.’” [Albertsons Companies, 04/12/22]

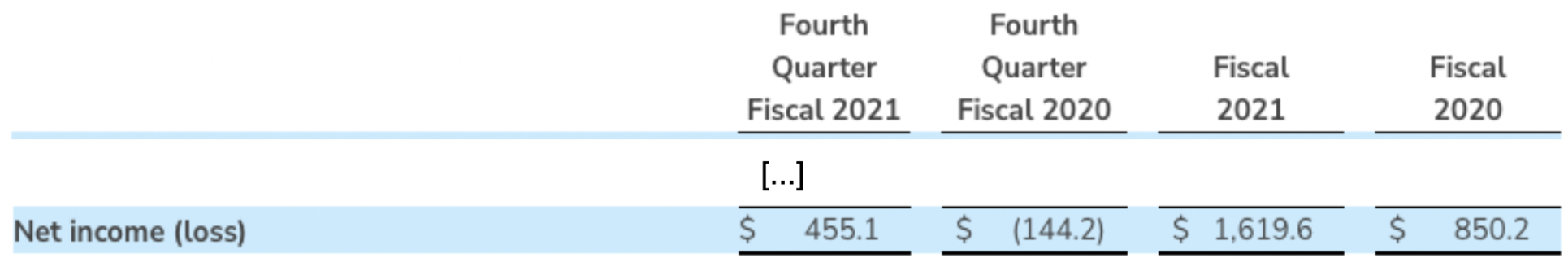

FY 2021: Albertsons’ Net Income Was $1.6 Billion—$769 Million Or 90% More Than Its FY 2020 Net Income Of $850 Million:

[Albertsons Companies, 04/12/22]

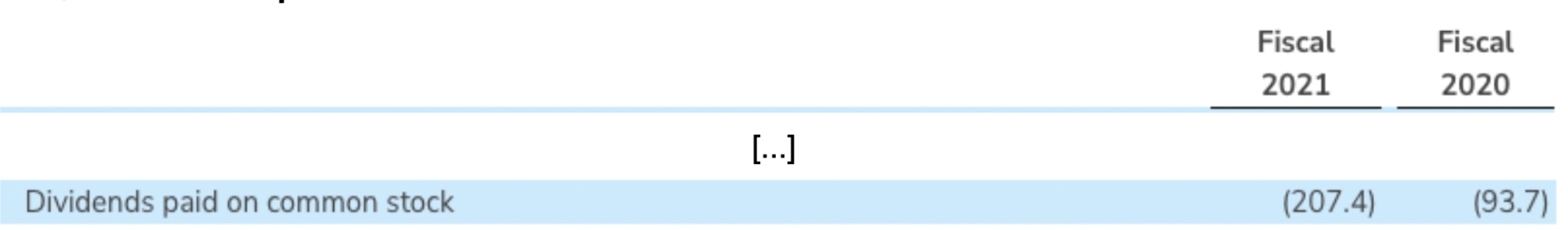

FY 2021: Albertsons Spent $207.4 Million On Shareholder Dividends—$113 Million Or 121% More Than The $93 Million It Spent In FY 2020:

[Albertsons Companies, 04/12/22]

July 2022: Albertsons Reported Q1 2022 Net Income Rising By Nearly 9% To $484 Million And Shareholder Dividends Climbing By 35% To $63 Million As Its CEO Touted “Strong Operating And Financial Performance Across All Key Metrics.”

July 2022: In Its Q1 2022 Earnings Release, Albertsons Ceo Vivek Sankaran Touted “Strong Operating And Financial Performance Across All Key Metrics.” “‘In the first quarter, our teams continued to deliver strong operating and financial performance across all key metrics, and we continued to gain market share,’ said Vivek Sankaran, CEO. ‘As we look forward to the balance of the year, while we are thoughtful about the macro environment and the possible implications on consumer behavior, our teams have consistently demonstrated their ability to adapt to a changing back drop in real time.’” [Albertsons Companies, 07/26/22]

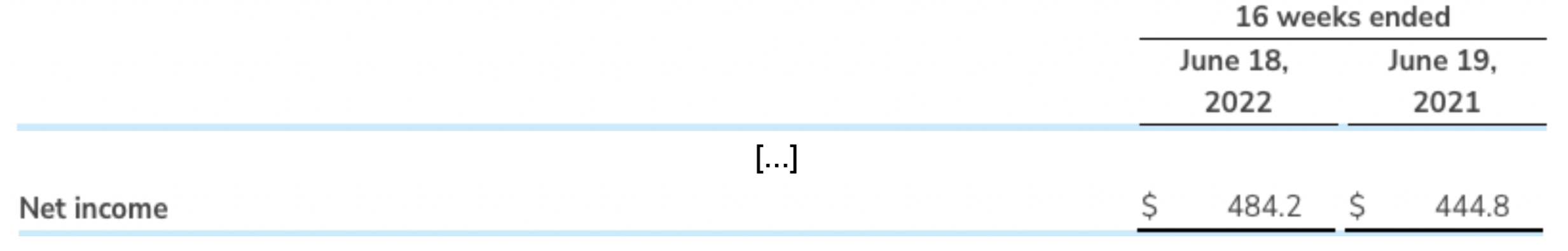

Q1 2022: Albertsons Had A Net Income Of $484 Million—$39 MIllion Or Nearly 9% More Than Its Q1 2021 Net Income Of $444 Million:

[Albertsons Companies, 07/26/22]

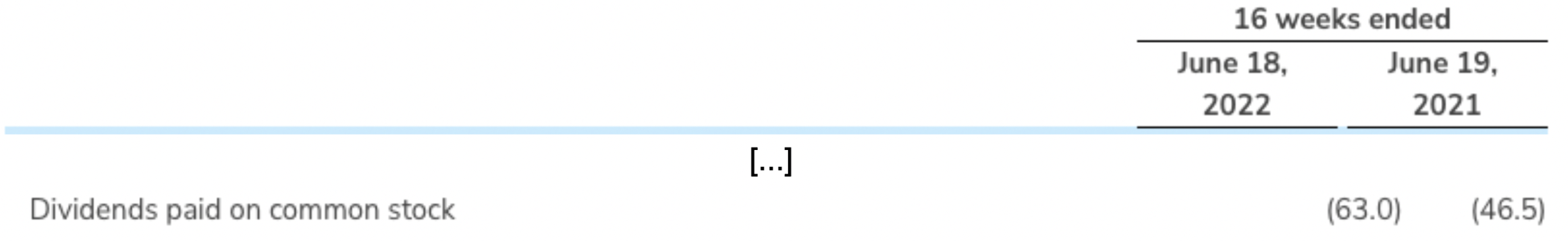

Q1 2022: Albertsons Spent $63 Million On Shareholder Dividends—$16.5 Million Or 35% More Than The $46.5 Million It Spent In Q1 2021:

[Albertsons Companies, 07/26/22]

Since 2018, Kroger’s Chairman And Chief Executive Officer’s Executive Compensation Has Increased By Over $6 Million To $18.1 Million In 2021, While The Median Employee Annual Total Compensation Only Increased By $1,851, Resulting In The CEO Pay Ratio Widening From 483–To–1 To 679–To–1.

Since 2018, Kroger’s Chairman And Chief Executive Officer Rodney McMullen Has Seen His Executive Compensation Increase By Over 50% From $12 Million To $18 Million.

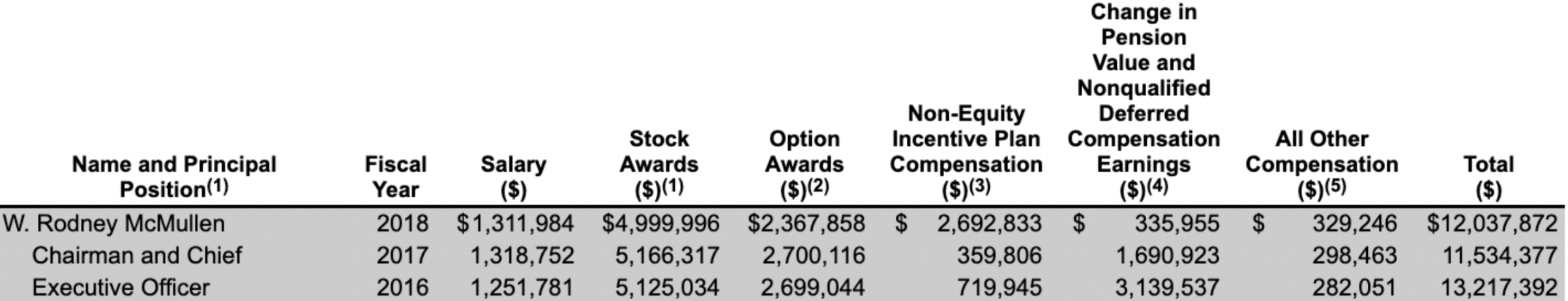

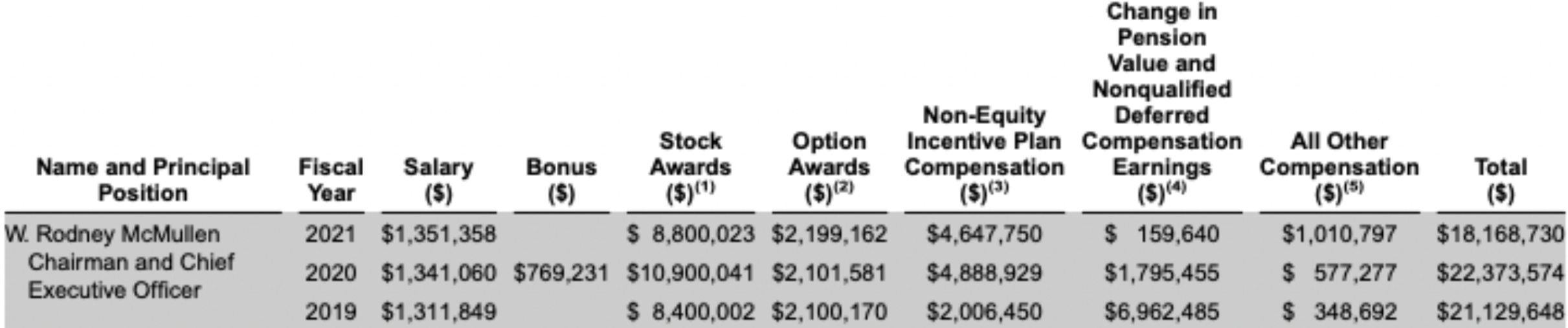

In 2018, Kroger’s Chairman And Chief Executive Officer Rodney McMullen’s Executive Compensation Was $12,037,872:

[Kroger Via Securities And Exchange Commision DEF-14A, 05/14/19]

By 2021, Kroger’s Chairman And Chief Executive Officer Rodney Mcmullen Had Seen His Executive Compensation Increase By Over $6 Million––Or 50%––To $18,168,730:

[Kroger Via Securities And Exchange Commision DEF-14A, 05/02/22]

From 2018 To 2021, Kroger’s CEO Pay Ratio Widened From 483–To–1 To 679–To–1, As The Median Employee Annual Total Compensation Only Increased By $1,851.

In 2018, Kroger’s Median Employee Annual Total Compensation For 2018 Was $24,912, Resulting In A CEO Pay Ratio Of 483–To–1. “As reported in the Summary Compensation Table, our CEO had annual total compensation for 2018 of $12,037,872. Using this Summary Compensation Table methodology, the annual total compensation of our median employee for 2018 was $24,912. As a result, we estimate that the ratio of our CEO’s annual total compensation to that of our median employee for fiscal 2018 was 483 to 1.” [Kroger Via Securities And Exchange Commision DEF-14A, 05/14/19]

By 2021, Kroger’s Median Employee Annual Total Compensation Only Increased By $1,851, While The CEO Pay Ratio Widened To 679–To–1. “As reported in the Summary Compensation Table, our CEO had annual total compensation for 2021 of $18,168,730. Using this Summary Compensation Table methodology, the annual total compensation of our median associate for 2021 was $26,763. As a result, we estimate that the ratio of our CEO’s annual total compensation to that of our median associate for fiscal 2021 was 679 to 1.” [Kroger Via Securities And Exchange Commision DEF-14A, 05/02/22]

Despite Kroger Boasting That “Supporting Our Associates Is Incredibly Important,” A 2022 Article Revealed That Since 2018, Kroger Has Been “Aware That Its Workers Can’t Afford Basic Necessities And Struggle To Survive,” With The Decline In Real Wages “Largely To Blame” For Food Insecurity Among Employees And Unions Continued Negotiations For Better Conditions.

In September 2022, Members Of The Columbus Chapter Of The United Food & Commercial Workers (UFCW) Union Rejected Kroger’s Contract Offer And Voted To Authorize A Strike, With Local President Randy Quickel Pinning What Comes Next “‘In Kroger’s Hands’” And Workers Expressing Frustration With The Offer.

September 2022: The Columbus Chapter Of The United Food & Commercial Workers (UFCW) Union Voted Against Kroger’s Third Tentative Agreement, With 81% Of The Union Voting To Authorize A Strike. “Earlier this week, the Cincinnati-based grocery store chain presented a third tentative agreement to members of UFCW Local 1059, the Columbus chapter of the United Food & Commercial Workers Union. Over the course of three days, 6,719 members voted on the contract with 55% of them voting against it. Following the contract vote, 81% of the union voted to authorize a strike – though a strike has not been called at this time.” [10 WBNS, 09/16/22]

In A Statement, UFCW Local President Randy Quickel Said What Comes Next Was “‘In Kroger’s Hands,’” Having Asked The Company To Come Back To The Negotiating Table, While Also Preparing For A Potential Strike. “UFCW Local President Randy Quickel said in a statement the union has asked Kroger to come back to the negotiating table. The major sticking point is believed to be over what Kroger has offered as a wage increase. In its message to workers, the union also said what comes next is ‘in Kroger’s hands.’ ‘Strike preparation and planning has already been underway, since Kroger characterized their proposal as a ‘Last Best Final Offer.’ Please prepare for that possibility,’ the email read. Quickel said that 82 stores and around 12,500 workers fall within the Columbus division.” [NBC4, 09/16/22]

In An Email, A Union Member And Kroger Worker “Expressed Frustration” With Kroger’s Latest Offer, Revealing That They Worked “‘50 Hour Weeks Of Back-Breaking Nonstop Labor,’” While “‘Kroger Cared More About The Returning Customer Than It Did The Safety And Lungs Of’” Its Workers. “A union member, who asked to remain anonymous, expressed frustration with the company over its latest offer and with the union. ’We work 50 hour weeks of back-breaking nonstop labor. We work holidays and never get a vacation near the holiday season,’ the worker said in an email. ‘We were forced to work during the peak of the pandemic surrounded by angry, entitled, sometimes violent customers; customers who came in sick with COVID to get their at-home tests and cough drops. Every member at my store caught COVID more than once and it wasn’t because we weren’t being safe. It’s because Kroger cared more about the returning customer than it did the safety and lungs of the people getting harassed or threatened for toilet paper!’” [The Columbus Dispatch, 09/19/22]

A January 2022 Article Revealed That Since 2018, Kroger Has Been “Aware That Its Workers Can’t Afford Basic Necessities And Struggle To Survive,” With “At Least 1 In 5 Kroger Associates Were On Food Stamps” As Employees Demanded The Company To “‘Pay Us What We Are Worth.’”

January 2022: A More Perfect Union Obtained A “‘Confidential’” Internal Presentation Revealed That Since 2018, Kroger Has Been “Aware That Its Workers Can’t Afford Basic Necessities And Struggle To Survive” As “Thousands Of Employees Live In Poverty And Rely On Food Stamps And Other Public Aid.” “An explosive new document obtained by More Perfect Union reveals that supermarket giant Kroger has long been aware that its workers can’t afford basic necessities and struggle to survive. The internal presentation, titled ‘State of the Associate’ and marked ‘confidential,’ warned Kroger executives in 2018 that hundreds of thousands of employees live in poverty and rely on food stamps and other public aid as a result of the company’s low pay.” [A More Perfect Union, 01/13/22]

The 2018 Presentation Found That “At Least 1 In 5 Kroger Associates Were On Food Stamps” And That 27% Of Workers Who Quit Cited Low Wages. “The presentation found that at least 1 in 5 Kroger associates were on food stamps, including at least 25% of ‘very loyal’ associates who frequently also shop at Kroger stores. It said low wages were cited by 27% of workers who quit the company.” [A More Perfect Union, 01/13/22]

The 2018 Presentation Included Quotes From Unnamed Employees, Including On That Admitted “‘I Literally Work At A Grocery Store And Can’t Afford To Eat Regularly,’” And Asked The Company To “‘Pay Us What We Are Worth.’” “The presentation is peppered with quotes from unnamed employees that foretell the internal labor uprising that would come a few years later. ‘Something is wrong when the people who are actually making this company profitable are the ones deepest in poverty,’ said one employee quoted from an internal survey. ‘I literally work at a grocery store and can’t afford to eat regularly. In short, pay us what we are worth; we know you can afford it.’” [A More Perfect Union, 01/13/22]

A 2022 Economic Roundtable Survey Found That Over Three-Quarters Of Kroger Employees In Three States Were “Food Insecure,” With The Decline In Real Wages “Largely To Blame.”

January 2021: An Economic Roundtable Survey Found That Over One-Third Of 10,000 Kroger Employees In Three States Were “Worried About Eviction” And Over Three-Quarters Were “Food Insecure.” “A survey by nonprofit Economic Roundtable found more than one-third (36%) of 10,000 employees at Kroger-owned stores in Southern California, Colorado, and Washington said they were worried about eviction. More than three-quarters (78%) are food-insecure. And 1 in 7 Kroger workers faced homelessness in the past year.” [Business Insider, 01/14/22]

The Decline In Real Wages “Are Largely To Blame,” With The Most Experienced Food Clerks Seeing Wages Decline 11 To 22 Percent Since 1990. “The report noted that the decline in ‘real wages’ — wages adjusted for inflation — over the past three decades are largely to blame. The most experienced Kroger food clerks, the highest paid in the company, saw wages decline 11 to 22 percent across since 1990, according to the study. The average worker in some states saw real pay declines of about 3% in the past few decades, Dreier, who is also an urban policy professor at Occidental College, told Insider.” [Business Insider, 01/14/22]

Since The Release Of The 2018 Survey, Kroger Has Touted Its Role “As A Leading Employer In The United States,” And Boasted That “Supporting Our Associates Is Incredibly Important.”

During Kroger’s Q4 2021 Earnings Call, Chairman And CEO Rodney McMullen Touted Kroger’s Role “As A Leading Employer In The United States.” “Rodney McMullen — Chairman and Chief Executive Officer […] For our more than 450,000 associates, we strive to create a culture of opportunity, and we take seriously our role as a leading employer in the United States. Kroger has provided an incredible number of people with their first jobs, new beginnings, and lifelong careers. ”[The Motley Fool, 03/03/22]

Kroger’s Chief Financial Officer Praised The Company’s Employees, Highlighting Their “Dedication To Serve Our Customers And Support Each Other Throughout The Pandemic.” “Gary Millerchip — Chief Financial Officer […] Before I get into our results in more detail, I would like to start by echoing Rodney’s appreciation to our fantastic associates. Their dedication to serve our customers and support each other throughout the pandemic has been nothing short of incredible.” [The Motley Fool, 03/03/22]

Kroger’s CEO Continued That “Supporting Our Associates Is Incredibly Important.” “Rodney McMullen — Chairman and Chief Executive Officer […] And as Gary mentioned, now we — incrementally, it’s about $1.2 billion per year that we are investing in supporting our associates. We think supporting our associates is incredibly important.” [The Motley Fool, 03/03/22]

Durings Kroger’s Q2 2022 Earnings Call, Kroger’s CEO Revealed “We Are Making Progress On Retention” With “Improved Onboarding Guidelines” And “Introduc[ing] A New Financial Coaching Service Tool.” “Rodney McMullen — Chairman and Chief Executive Officer […] We saw more people apply to work at Kroger this quarter as we continue to attract talented associates. Our current associates, we are making progress on retention. We’ve rolled out improved onboarding guidelines and implemented career planning tools. In addition, as part of our commitment to associate wellness, we recently introduced a new financial coaching service tool for hourly associates.” [The Motley Fool, 09/09/22]

The 2021 Consumer Price Index Showed That Prices Increased By 7%—Disproportionately Raising Lower-Income Families’ Everyday Expenses While The Biggest Corporations Were Able To Raise Prices And See Near-Record Margins During The Pandemic.

The 2021 Consumer Price Index Showed That Overall, Prices Increased By 7% From December 2020 To December 2021.

From December 2020 To December 2021, The Price For All Items Within The Consumer Price Index Increased 7 Percent, “The Largest December To December Percent Change Since 1981.” “From December 2020 to December 2021, consumer prices for all items rose 7.0 percent, the largest December to December percent change since 1981. Over the year, food prices increased 6.3 percent, a larger percentage increase than the 12-month increase of 3.9 percent in 2020. Food at home prices increased 6.5 percent in 2021, the largest over-the-year increase since 2008.” [U.S. Bureau of Labor Statistics, accessed 02/16/22]

- The Consumer Price Index Is The U.S. Bureau Of Labor Statistics’ Measure Of Price Changes Paid By “Urban Consumers For A Market Basket Of Consumer Goods And Services.” “The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.” [U.S. Bureau of Labor Statistics, accessed 03/02/22]

- The Consumer Price Index Tracks Price Changes Across Several Common Categories Of Goods And Services, Including Food, Energy, Commodities, Medical Care, And Others. [U.S. Bureau of Labor Statistics, 01/14/22]

Overall, Companies In The S&P 500 Saw Near-Record Operating Margins In 2021 Because They Were Able To Raise Prices.

Despite Increased Costs, Companies Within The S&P 500 Saw Their Operating Margins “Remai[n] Close To A Record 13% Through Most Of 2021” Thanks To Price Increases. “Profit margins: This is the critical component of corporate profitability, since it measures how much profit a company is able to retain after paying costs. S&P 500 operating margins have remained close to a record 13% through most of 2021 because corporations, while faced with higher costs, were able to raise prices.” [CNBC, 01/13/22]

Companies Within The S&P 500 Had A “Remarkable 2021” With Overall Earnings Up “Approximately 49%.” “Fourth quarter earnings for the S&P 500 are expected to be up 22.4%, according to Refinitiv, capping off a remarkable 2021 where overall earnings will be up approximately 49%.” [CNBC, 01/13/22]

- The S&P 500 Is A “Market-Capitalization-Weighted Index Of 500 Leading Publicly Traded Companies In The U.S, And Generally “Considered One Of The Best Gauges Of Large U.S. Stocks.” “The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market cap because there are other criteria that the index includes. […] Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.” [Investopedia, 02/15/22]

Increased Prices Are “Particularly Devastating” To Lower-Income Families, Who Have To Spend A Greater Share Of Their Income On Necessities Like Shelter, Food, And Utilities.

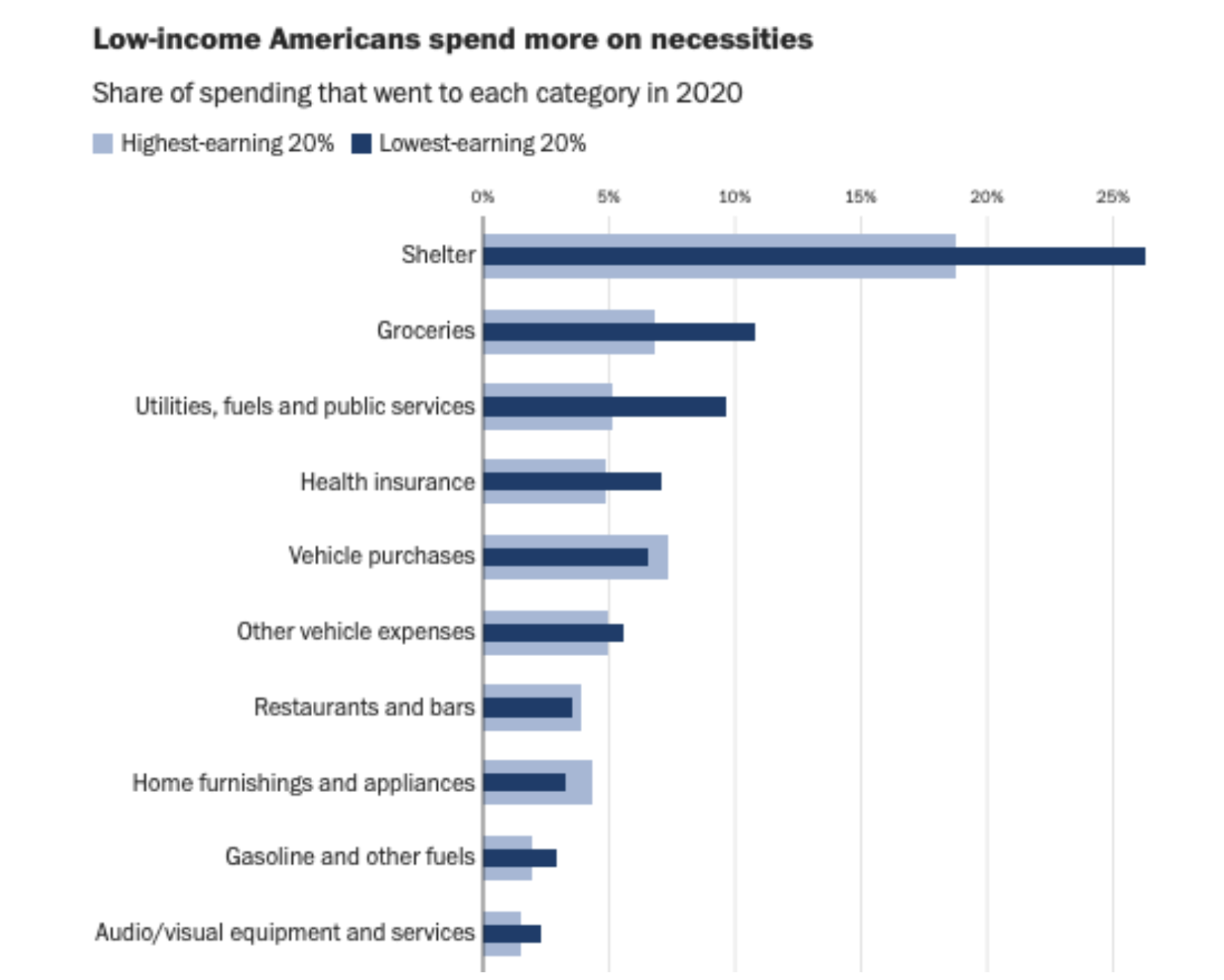

Increased Prices Are “Particularly Devastating To Lower-Income Households With Already Tight Budgets,” With Most Of Their Expenses Going To Necessities Such As Food, Energy, And Housing. “While inflation is rising everywhere, price hikes are particularly devastating to lower-income households with already tight budgets. Nearly all their expenses go to necessities — food, energy, housing — which have seen some of the largest increases at different points over the past year.” [The Washington Post, 02/13/22]

A Washington Post Study Found That Lower-Income Earners Spent A Greater Share Of Their Total Spending On Categories Of Goods And Services That Saw The Highest Levels Of Inflation During The Pandemic. “Of the 10 categories with the highest levels of pandemic inflation analyzed by The Washington Post, lower earners spent a greater share of their total spending on most of them, from natural gas to beef. (The highest earners outspent the lowest on cars and furniture.)” [The Washington Post, 02/13/22]

[The Washington Post, 02/13/22]

Higher Food Prices Exacerbate Inequality—More Acutely Among Minority Communities—And Disproportionately Harm The 42 Million Americans Who Said They Couldn’t Afford Enough Food As Of January 2022.

Increased Food Prices Have Been “Exacerbating The Wealth And Income Disparities Between The Richest And Poorest Americans.” “Prices are rising for nearly everything, biting into everyone’s income. But the surging cost of food, specifically, hits especially hard, exacerbating the wealth and income disparities between the richest and poorest Americans.” [CNN (Opinion), 01/26/22]

Higher Food Prices “Exacerbate Food Security,” Which Affects The 42 Million Americans Who Said They Couldn’t Afford Enough Food In January 2022. “These levitating prices exacerbate food insecurity. According to the Census Bureau’s Household Pulse Survey, 42 million Americans said in early January that they lacked sufficient food because they couldn’t afford to buy enough.” [CNN (Opinion), 01/26/22]

- In April 2021, The Number Of Americans Experiencing Food Insecurity Was Only Half Of What It Was In January 2022 Due To Federal Stimulus Efforts. “That number is nearly double what it was in April as prices rose and stimulus payments (e.g., checks, enhanced federal unemployment insurance) dwindled or ended.” [CNN (Opinion), 01/26/22]

Families Struggling Against Food Insecurity Generally Have Household Income Levels Below The Poverty Level And Minorities Are Far More Likely To Be Affected By Food Insecurity. “Food-insecure families tend to have incomes below the poverty line of $26,500 for a family of four, but those with incomes just above it or in the lower middle class are also feeling food pressure. Additionally, ethnic minority groups (Black 17%, Hispanic 15%) are more likely than their White (6%) peers to cite food insecurity, according to The Conference Board’s calculations of the Census Bureau’s Household Pulse Survey.” [CNN (Opinion), 01/26/22]

Inflation Has Largely “Canceled” Out Increased Wages During The Pandemic.

Although Wages Have Grown During The Pandemic, They Have Been Largely “Canceled” Out By Rising Prices. “You got a raise last year or switched jobs to get one. Congratulations! You’re one of the many Americans who saw their paychecks get bigger. Unfortunately, unless your wages or salary grew much higher than the national average of 4.5 percent last year, inflation likely canceled it out. That means that while you might be making more money, you can buy less stuff with it.” [Vox, 02/16/22]

Americans Saw Rising Prices As “The Most Urgent Issue Currently Facing The U.S” As Of Mid-February 2022.

As Of Mid-February 2022, Americans Saw Inflation As “The Most Urgent Issue Currently Facing The U.S.” “Americans in a new survey list inflation as the most urgent issue currently facing the U.S., followed by immigration and the COVID-19 pandemic. The Quinnipiac University Poll survey found that 27 percent of respondents see inflation as the country’s most urgent issue, followed by 12 percent for immigration and 10 percent saying COVID-19.” [The Hill, 02/16/22]

The Biden Administration Has Made Fighting Inflation A “‘Top Priority,'” Including Efforts To Stem Profiteering Among Heavily-Concentrated Meatpackers.

May 1, 2022: President Biden Said Fighting Inflation Was A “‘Top Priority'” During His First State Of The Union Address. “President Biden used his State of the Union address to refocus the nation on how far the economy has come since the pandemic recession. But he also highlighted his plans to help slow rapid price gains, underscoring the challenge Democrats face ahead of the midterm elections: Inflation is painfully high, voters are unhappy about it, and the most tried and true way to cool price increases involves hurting growth and the labor market.” [The New York Times, 03/01/22]

- Headline: Biden Says Fighting Inflation Is ‘Top Priority’ as Prices Bite Consumers [The New York Times, 03/01/22]

As Part Of The Effort, Biden Said He Would Begin A “‘Crackdown'” On Ocean Shippers’ Soaring Costs As Well As Cutting The Costs Of Prescription Drugs. “Mr. Biden said his administration would begin a ‘crackdown’ on ocean shipping costs, which have soared during the pandemic. He suggested that the administration wanted to cut the cost of prescription drugs, an ongoing push of his.” [The New York Times, 03/01/22]

January 2022: President Biden Met With Family Farmers And Ranchers As Part Of His Effort To “Pressure The Four Biggest Meatpacking Companies Into Easing Prices For Consumers,” As He Pointed To Anti-Competitive Consolidation Behind The “Soaring Prices.” “President Joe Biden met virtually with family farmers and ranchers on Monday to highlight his administration’s ongoing effort to support independent meat processors, and to pressure the four biggest meatpacking companies into easing prices for consumers. With meat and poultry prices leading the broader nationwide increase in the cost of groceries, the White House has spent months arguing that anti-competitive consolidation within the meatpacking industry is to blame for the soaring prices.” [CNBC, 01/03/22]

- “Four Companies – Tyson, JBS, Marfrig And Seaboard – Control As Much As 85% Of The Nationwide Meatpacking Business, According To A White House Estimate.” [CNBC, 01/03/22]

July 2021: President Biden Issued An Executive Order With “72 Initiatives Designed To Increase Competition And Limit The Power Of Large Corporations Across A Wide Range Of Industries,” Including Provisions To Address Shipping And Railroad Industry Fees. “In seeking to protect workers and consumers from what his administration views as the harmful consequences of corporate consolidation, President Biden is enlisting support from regulators across the executive branch in what the White House has described as an overarching, ‘whole-of-government’ effort. As part of the executive order Mr. Biden signed on Friday, the White House is asking more than a dozen federal agencies for input and action on 72 initiatives designed to increase competition and limit the power of large corporations across a wide range of industries.” [The New York Times, 07/09/21]

- The Order Encouraged The Federal Maritime Commission To Pursue “Vigorous Enforcement Against Shippers Charging American Exporters Exorbitant Charges.” “In the Order, the President: […] Encourages the Federal Maritime Commission to ensure vigorous enforcement against shippers charging American exporters exorbitant charges.” [The White House, 07/09/21]

- The Order Sought To “Confront Consolidation And Perceived Anticompetitive Pricing” In The Rail Industry To Address “Aggressive Pricing.” “The Biden administration will push regulators to confront consolidation and perceived anticompetitive pricing in the ocean shipping and railroad industries as part of a broad effort to blunt the power of big business to dominate industries, according to a person familiar with the situation. The administration, in a sweeping executive order expected this week, will ask the Federal Maritime Commission and the Surface Transportation Board to combat what it calls a pattern of consolidation and aggressive pricing that has made it onerously expensive for American companies to transport goods to market.” [The Wall Street Journal, 07/08/21]