Reports

Federal Reserve Members Threaten More “‘Pain’” For Working Families As Top Economic Experts And Other Prominent Voices Warn Interest Rate Hikes Could Backfire

| SUMMARY: The Federal Open Markets Committee (FOMC), the Federal Reserve body which determines interest rates, was expected to continue hiking rates in November and December 2022 despite warnings that doing so would cause a recession and add as many as 3.2 million people to unemployment lines by the end of 2023.

Despite a looming recession and potentially even more pain for low-income and nonwhite families, who have already suffered disproportionate harm from the twin crises of the pandemic and widespread inflation, members of the FOMC have been outspoken about their desire to continue raising rates:

Against the monetary hawkishness of these FOMC members, a wide array of economic experts—including a United Nations body, two Nobel economists, former cabinet officials, and a former Federal Reserve economist—have warned that hiking interest rates too quickly could make inflation worse, could run out of control, and could further hurt working class Americans all while doing little to address inflation drivers like corporate profiteering and continued supply chain stress. These figures include:

In addition to expert economists, a chorus of other prominent voices—including AFL-CIO’s president, nine U.S. senators, and at least ten U.S. House members—have warned against rate hikes, including:

|

Federal Reserve Chairman Jerome Powell—Who Is Member Of The Interest Rate-Setting Federal Open Markets Committee (FOMC)—Has Acknowledged That Trying To Stem Inflation Through Hiking Rates Will Bring “‘Some Pain To Households And Businesses,’” With Unemployment Rolls Potentially Rising By Over 3 Million People By The End Of 2023.

Federal Reserve Chair Jerome Powell Has Acknowledged That Interest Rate Hikes Will Bring “‘Some Pain To Households And Businesses,’” With Unemployment Potentially Increasing By 3.2 Million People By The End Of 2023.

September 2022: Federal Reserve Chair Jerome Powell Said The Central Bank Would Continue Raising Rates Even If It Causes A Recession. “In case the U.S. economy wasn’t hurting enough already, the Federal Reserve has a message for Americans: It’s about to get much more painful. Fed Chair Jerome Powell made that amply clear last week when the central bank projected its benchmark rate hitting 4.4% by the end of the year — even if it causes a recession. ‘There will very likely be some softening of labor market conditions,’ Powell said in his September 21 economic outlook. ‘We will keep at it until we are confident the job is done.’” [CBS News, 09/30/22]

- The Federal Reserve Hikes Interest Rates To Slow Consumption And To Make “Prices Stop Spiraling Higher.” “The Federal Reserve raises interest rates to slow down consumption across the economy: As the cost of borrowing rises, the hope is that people buy fewer things, and prices stop spiraling higher.” [Vox, 10/26/22]

August 2022: Federal Reserve Chair Jerome Powell Acknowledged That Its Interest Rate Hikes Will Bring “‘Some Pain To Households And Businesses.’” “The Fed is firmly resolved to bring down inflation and to ‘keep at it until the job is done,’ Powell said. But that plan — which involves a series of hefty interest rate hikes — will bring ‘some pain to households and businesses,’ he acknowledged.” [CNN, 08/30/22]

Federal Reserve Chair Jerome Powell Said Of Increasing Unemployment To Lower Inflation “‘I Wish There Was A Painless Way To Do That […] ‘There Isn’t.’” “‘I wish there was a painless way to do that,’ Federal Reserve Chair Jay Powell had said. ‘There isn’t.’” [Vox, 10/26/22]

September 2022: Federal Reserve leaders Projected That They Would Continue To Raise Interest Rates, Causing Unemployment Rolls To Increase By A Projected 1.2 Million People By The End Of 2023. “Last month, leaders at the Federal Reserve predicted that, given their plans to continue raising rates, unemployment would rise from 3.7 percent (or 6 million people) to 4.4 percent by the end of 2023. In plain terms, this means an additional 1.2 million people would lose their jobs over the 15-month period.” [Vox, 10/26/22]

A Bank Of America Projection Estimated That 3.2 Million More People Would Be Unemployed By The End Of 2023. “Other financial analysts projected even higher unemployment to result. Bank of America predicted unemployment would reach 5.6 percent by the end of 2023, translating to 3.2 million more people out of their jobs.” [Vox, 10/26/22]

The Federal Open Market Committee (FOMC), Comprised Of The Federal Reserve’s Board Of Governors And Other Federal Reserve Bank Presidents, Sets Interest Rates.

Jerome Powell Is A Member Of The Federal Open Markets Committee (FOMC), Which Determines Monetary Policy. [Federal Open Markets Committee, accessed 10/28/22]

- The Federal Open Market Committee (FOMC) Is A Branch Of The Federal Reserve System That “Determines The Direction Of Monetary Policy” In The U.S. “The term Federal Open Market Committee (FOMC) refers to the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy in the United States by directing open market operations (OMOs).” [Investopedia, accessed 10/28/22]

The FOMC Is Comprised Of 12 Members, Including The Fed’s Board Of Governors, The President Of The Federal Reserve Bank Of New York, And Four Other Reserve Bank Presidents, Who Serve On A Rotating Basis. “The committee is made up of 12 members, including seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining 11 Reserve Bank presidents, who serve on a rotating basis.” [Investopedia, accessed 10/28/22]

The FOMC Meets Regularly To Determine Increases Or Decreases In Interest Rate Hikes. “The FOMC has eight regularly scheduled meetings each year, but they can meet more often if the need should arise. The meetings are not held in public and are therefore the subject of much speculation on Wall Street, as analysts attempt to predict whether the Fed will tighten or loosen the money supply with a resulting increase or decrease in interest rates.” [Investopedia, accessed 10/28/22]

The FOMC Was Expected To Continue Raising Interest Rates In November And December 2022 And Was Expected To Keep Rates Elevated Through 2023, Despite Warnings That It Could Cause A Recession.

The FOMC Was Expected To Raise Interest Rates In Its November And December Meetings. “Most economists see the central bank delivering a 75 basis point rate hike at the Federal Open Market Committee meeting next Wednesday, following by a 50 basis point increase at the December FOMC meeting.” [Insider, 10/28/22]

According To A JPMorgan Strategist, The Fed Was Expected To Keep Interest Rates Elevated The End Of 2023, Despite Warnings That The Fed May “Be Forced To Pivot In Order To Avoid Causing A Recession.” “The Fed won’t pivot from its path of interest rate hikes until the end of next year as inflation is persistent and the economy isn’t slowing as expected, according to JPMorgan strategist Julia Wang. That’s contrary to the outlook of many experts in the market, who have warned this year that the Fed may be forced to pivot in order to avoid causing a recession.” [Insider, 10/28/22]

The JPMorgan Strategist Said A Pivot To Lower Interest Rates Was “Unlikely In The Near Term, Given The Underlying Resilience Of The Us Economy.” “But a pivot is unlikely in the near term, given the underlying resilience of the US economy, Wang said in an interview with Bloomberg on Thursday. ‘The weakness in the economy isn’t really as big or coming as fast as people have expected. I think a lot of indicators on the consumer side actually are still pretty resilient,’ she said, pointing to the recent upside in GDP numbers, which clocked in above expectations on Thursday.” [Insider, 10/28/22]

Interest Rate Hikes Could Place A Higher Burden On Low-Income And Nonwhite Families, Who’ve Already Seen Disproportionate Harm From Inflation And The Pandemic—Notably, A Northwestern University Study Has Found That Lowering Interest Rates Helps Black Workers, Women, And Those Without A High School Diploma.

Interest Rate Hikes Could Continue Hurting Low-Income And Nonwhite Families, Who Were Disproportionately Hurt By The Inflation Of The Last Year—And Black And Hispanic Unemployment Rates Will Likely Continue To Be Much Higher Than White Jobless Rates Even Under Optimistic Projections.

Inflation Has “Disproportionately Hurt Low-Income And Nonwhite Families” Over The Past Year, And The Federal Reserve’s Interest Rate Hikes Could Continue To Hurt Them “In Potentially Longer-Lasting Ways.” “The last year of inflation has disproportionately hurt low-income and nonwhite families — those with the least flexibility in their monthly budgets to absorb higher prices. Now those same groups could be hurt by economic policymakers’ plan to tackle inflation through interest rate hikes, and in potentially longer-lasting ways.” [Vox, 10/26/22]

Economists Have Warned That Even If The Fed Could Keep Unemployment On The Low End Of Projections, That Black And Hispanic People Would Disproportionately Suffer, With The Black Unemployment Rate Double That Of The White One And The Hispanic Rate At 1.5 Times The White Rate. “While some policymakers are trying to figure out if they could reduce inflation while keeping unemployment around 4 or 5 percent, other economists are sounding the alarm on what even this optimistic aggregate figure obscures — the unemployment rate for Black people is generally double that of white people, and for Hispanic people it’s typically 1.5 times the rate.” [Vox, 10/26/22]

Wendy Edelberg, Director Of The Brookings Institution’s Hamilton Project, Noted That “‘It’s Just A Truism That When Bad Things Happen In An Economy, It’s The Marginalized People, The People With Less Power, Who Are Hurt Fastest And Most.’” “‘It’s just a truism that when bad things happen in an economy, it’s the marginalized people, the people with less power, who are hurt fastest and most,’ said Wendy Edelberg, the director of the Hamilton Project, an economics division within the Brookings Institution. ‘That should be fiscal policymakers’ laser focus, at all times but particularly in a downturn.’” [Vox, 10/26/22]

- The Hamilton Project Is “An Economic Policy Initiative At The Brookings Institution.” “Launched in 2006 as an economic policy initiative at the Brookings Institution, The Hamilton Project is guided by an Advisory Council of academics, business leaders, and former public policy makers.” [The Hamilton Project, accessed 10/28/22]

An April 2022 Study By Northwestern University’s School Of Management Found That “Lowering Interest Rates Disproportionately Helped The Employment Prospects For Black Workers, Women, And Those Without A High School Diploma.”

April 2022: A Study Published By Northwestern University’s School Of Management Found That “Lowering Interest Rates Disproportionately Helped The Employment Prospects For Black Workers, Women, And Those Without A High School Diploma.” “In one recent study, researchers found that lowering interest rates disproportionately helped the employment prospects for Black workers, women, and those without a high school diploma. It makes sense — if employers are facing increased competition for labor, they may be less likely to discriminate in the hiring process. Relatedly, over the past year, workers with criminal records and workers with disabilities were more in demand than they have been, as employers struggled to fill vacancies.” [Vox, 10/26/22]

- The Study Was Published By The Northwestern University’s Kellogg School Of Management. [Kellogg Insight, 04/04/22]

In Recent Months, Other Federal Reserve Regional Presidents Who Serve As FOMC Members—Have Come Out In Favor Of Continued Interest Rate Hikes Regardless Of The Toll These Hikes Could Have On Economic Growth And Employment Figures.

October 2022: FOMC Member And Federal Reserve Bank Of New York President John Williams Said The Fed’s Job Was “‘Not Yet Done’” In Addressing Inflation, Despite Acknowledging Continued Rate Hikes Would Cause Higher Unemployment And Slow Economic Growth.

October 2022: Federal Reserve Bank Of New York President John Williams Stated The Federal Reserve’s Job Was “‘Not Yet Done’” In Addressing Rising Inflation Despite The Ongoing Risks Of An Economic Downturn. “Federal Reserve Bank of New York President John Williams said on Monday that while there have been nascent signs of cooling inflation, underlying price pressures remain too high, which means the U.S. central bank must press forward to get inflation under control. ‘Clearly, inflation is far too high, and persistently high inflation undermines the ability of our economy to perform at its full potential,’ Williams said in the text of a speech to be delivered before an audience in Phoenix. ‘Tighter monetary policy has begun to cool demand and reduce inflationary pressures, but our job is not yet done.’” [Reuters, 10/03/22]

- Williams Also Acknowledged That “Lower Economic Growth And Higher Unemployment Are Very Likely To Be Side Effects Of The Fed’s Inflation-Fighting Mission.” “Williams, who also serves as vice chairman of the Fed’s interest rate-setting Federal Open Market Committee, did not offer a view about what’s next for monetary policy. But he said the Fed will continue to press forward with actions aimed at cooling demand, in a bid to help lower inflation back to the Fed’s 2% target. Inflation was at 6.2% in August compared with the same month a year ago. Williams said lower economic growth and higher unemployment are very likely to be side effects of the Fed’s inflation-fighting mission. Economic activity will likely be close to flat this year, with only modest growth next year, and the unemployment rate, now at 3.7%, will likely rise to 4.5% by the close of 2023, he said.” [Reuters, 10/03/22]

- John Williams Also Serves As Vice Chair Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

Williams Admitted Inflation Had Begun Decreasing In Commodity Prices. “Many market participants are questioning the need for rate rises, however, out of fears Fed action will break something in financial markets and send the economy into recession. Others reckon the economy has already seen the worst of the inflation surge and that price pressures are set to ebb of their own accord. In his remarks, Williams acknowledged that some inflation categories, like commodity prices, are already cooling off. But that’s not enough, he said. Goods demand remains very high and labor market and services demand is outstripping available supply. ‘This is resulting in broad-based inflation, which will take longer to bring down,’ he said.” [Reuters, 10/03/22]

July 2022: St. Louis Federal Reserve President And FOMC Member James Bullard Suggested The Economy Could Handle Increased Interest Rates As “‘It Just Doesn’t Seem Like The U.S. Economy Has Been In Recession For The Last Two Quarters.’”

July 2022: St. Louis Federal Reserve President And Member Of The Federal Open Markets Committee James Bullard Suggested The Economy Could Handle Higher Interest Rates And That The “Central Bank Wouldn’t Have To Drive The Economy Into A Recession Or Significantly Raise Unemployment To Bring Inflation Down To Its 2% Target.” “The U.S. economy is healthy and shows little sign of an imminent recession, and can withstand higher interest rates, St. Louis Federal Reserve president James Bullard said Monday. Financial markets are flashing signs that an economic downturn could arrive sometime next year, as Americans grapple with the highest inflation in four decades and the Federal Reserve pushes borrowing costs higher. But Bullard said in an interview with The Associated Press that the central bank wouldn’t have to drive the economy into a recession or significantly raise unemployment to bring inflation down to its 2% target. ‘Now we have lots of inflation, but the question is, can we get (inflation) back to 2% without disrupting the economy? I think we can,’ he said.” [Associated Press, 07/11/22]

- Associated Press HEADLINE: Fed’s Bullard: Solid US economy can handle rising rates [Associated Press, 07/11/22]

- James Bullard Also Serves On The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

Bullard Also Stated He Supported A 75 Basis Points Increase To Interest Rates At The Federal Reserve’s July Meeting, Which Followed A “0.75 Percentage Point Hike At Its June Meeting, The Largest Since 1994.” “Bullard also said he currently supports a 0.75 percentage point increase in the Fed’s benchmark short-term interest rate at its next meeting later this month. Its rate is currently in a range of 1.5% to 1.75%, after a 0.75 percentage point hike at its June meeting, the largest since 1994.” [Associated Press, 07/11/22]

Bullard Further Stated, “‘It Just Doesn’t Seem Like The U.S. Economy Has Been In Recession For The Last Two Quarters.’” “Bullard said that other measures of the economy, such as a broad measure of workers’ and business’ incomes, suggest the economy may have expanded in the first six months of this year. Businesses and other employers also added 2.7 million jobs during that time, a robust total that reflects an optimistic outlook among businesses. ‘It just doesn’t seem like the U.S. economy has been in recession for the last two quarters,’ Bullard said. Bullard also disagreed that the economy needed several years of high unemployment to get inflation back under control, a view articulated several weeks ago by former Treasury Secretary Larry Summers.” [Associated Press, 07/11/22]

September 2022: Boston Federal Reserve President And FOMC Member Susan Collins Reportedly Said The Economy Was “Resilient Enough To Withstand The Higher Interest Rates Needed To Combat Inflation,” Specifically Stating That “‘Accomplishing Price Stability Will Require Slower Employment Growth And A Somewhat Higher Unemployment Rate.’”

September 2022: In Her First Remarks As President Of The Boston Federal Reserve, Susan Collins, Who Also Serves On The Federal Open Markets Committee, Stated The Economy Was “Resilient Enough To Withstand The Higher Interest Rates Needed To Combat Inflation” Despite The Expected Pain Continued Interest Rates Will Have On Consumers And Businesses. “Susan Collins, the new president of the Federal Reserve Bank of Boston, said Monday that a higher unemployment rate will be needed to bring down inflation from unusually high levels, but also suggested any economic downturn would likely be modest. In her first speech as Boston Fed president, Collins said the economy is resilient enough to withstand the higher interest rates needed to combat inflation, which is near a four-decade high. Her comments echoed similar remarks from Raphael Bostic, president of the Atlanta Fed, on Sunday. Fed Chair Jerome Powell has also said that fighting inflation would cause ‘pain’ for households and businesses.” [Fortune, 09/26/22]

- Susan Collins Serves As A Member Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

In Her Remarks, Collins Specifically Stated, “‘Accomplishing Price Stability Will Require Slower Employment Growth And A Somewhat Higher Unemployment Rate,’” While Acknowledging The “‘Apprehension About The Possibility Of A Significant Downturn’” Due To Continued Rate Hikes. “‘Accomplishing price stability will require slower employment growth and a somewhat higher unemployment rate,’ Collins said in a speech to the Greater Boston Chamber of Commerce. Collins acknowledged that job losses are painful and said ‘there is apprehension about the possibility of a significant downturn.’ Yet she maintained that ‘the goal of a more modest slowdown, while challenging, is achievable.’” [Fortune, 09/26/22]

September 2022: Cleveland Federal Reserve President And FOMC Member Loretta Mester Suggested U.S. Markets Weren’t Distressed Enough To Slow The Increase In Interest Rates Due To “‘Persistence In The Inflation Process.’”

September 2022: Cleveland Federal Reserve President And Member Of The Federal Open Markets Committee Loretta Mester Suggested U.S. Financial Markets Were Not Distressed Enough To Force A Change In Planned Interest Rate Hikes. “Federal Reserve Bank of Cleveland President Loretta Mester said Thursday she does not see distress in U.S. financial markets that would alter the central bank’s campaign to lower very high levels of inflation through interest rate hikes. While ‘no one knows for sure’ if there is a big problem lurking in the financial sector right now, ‘so far, we haven’t seen the kind of market dysfunction, even through what’s happening in the global markets right now, we haven’t seen that in the U.S. markets,’ Mester said in an interview on CNBC.” [Reuters, 09/29/22]

- Loretta Mester Serves As A Member Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

Mester Went On To Add That She Believed The Federal Funds Rate Would Need To Go Above 4.6% Due To “‘Persistence In The Inflation Process.’” “Mester said she does not see a case for slowing down on rate rises right now. She noted that at last week’s FOMC meeting officials penciled in a path for the federal funds target rate that will get it to 4.6% next year and said she expects the central bank will likely have to go further than that. ‘I probably am a little bit above that median path because I see more persistence in the inflation process,’ Mester said. Getting above a 4% fed funds rate is important to helping to lower inflation, she said.” [Federal Reserve, accessed 10/05/22]

August 2022: Philadelphia Federal Reserve President And Alternate FOMC Member Patrick Harker Suggested More Interest Rate Hikes Were Necessary, Stating, “‘We Need To Get Inflation Under Control And We Will Do What It Takes To Get It Under Control.’”

August 2022: During An Interview With Bloomberg At The Federal Reserve Bank Of Kansas City’s Annual Gathering In Jackson Hole, Wyoming, Patrick Harker, President Of The Philadelphia Federal Reserve Stated, “We Need To Get Inflation Under Control And We Will Do What It Takes To Get It Under Control.” Patrick Harker: “We need to get inflation under control and we will do what it takes to get it under control. And hopefully we can do that in a way that does not ruin what otherwise is a good economy.” [Bloomberg, (1:29) 08/26/22]

- Patrick Harker Also Serves As An Alternate Member Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

Harker Also Added That If Inflation Continued To Remain The Reserve Would “‘Keep Increasing’” Rates As “‘We’ve To To Get Inflation Under Control.’” “Philadelphia Federal Reserve President Patrick Harker on Thursday said he would like to get interest rates above 3.4% and then ‘maybe sit for a while,’ adding his voice to the recent chorus of policymakers pushing back against market expectations for a series of rate reductions next year. ‘I’d like to see us get to, say, above 3.4% – that was the last median in the SEP (Summary of Economic Projections) – and then maybe sit for a while,’ Harker said in an interview on CNBC from Jackson, Wyoming, where officials are gathering for a major economic conference. ‘But if the data says we need to keep increasing, we keep increasing. We’ve got to get inflation under control. That is Job One.’” [Reuters, 08/25/22]

October 2022: Chicago Federal Reserve President And FOMC Alternate Member Charles Evans Stated The Federal Reserve Has “‘Further To Go’” On Interest Rate Hikes.

October 2022: Chicago Federal Reserve President And Alternate Member Of The Federal Open Market Committee Charles Evans Said Interest Rates Would Likely Reach 4.5% To 4.75% And That “‘We Have Further To Go’ On Rate Hikes.” “Chicago Federal Reserve Bank President Charles Evans on Thursday said the U.S. central bank’s policy rate is likely headed to 4.5%-4.75% by the spring of 2023 as the Fed increases borrowing costs to bring down too-high inflation. ‘We have further to go’ on rate hikes, Evans said at an annual meeting of the Illinois Chamber in Chicago. ‘Inflation is high right now and we need a more restrictive setting of monetary policy.’” [Reuters, 10/06/22]

- Charles Evans Also Serves As An Alternate Member Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

October 2022: Minneapolis Federal Reserve President And Alternate FOMC Member Neel Kashkari Said The Federal Reserve had “‘More Work To Do’” And Was “‘Quite A Ways Away’ From Being Able To Pause Its Aggressive Interest-Rate Hikes.

October 2022: Minneapolis Federal Reserve President And Alternate Member Of The Federal Open Market Committee Neel Kashkari Said The Federal Reserve Had “‘More Work To Do’” In Decreasing Inflation And Was “‘Quite A Ways Away’ From Being Able To Pause Its “Aggressive” Interest-Rate Hikes. “Minneapolis Federal Reserve Bank President Neel Kashkari on Thursday said the U.S. central bank has ‘more work to do’ on bringing down inflation, and is ‘quite a ways away’ from being able to pause its aggressive interest-rate hikes. ‘I’m not comfortable saying we are going to pause’ until there is evidence that underlying inflation is cooling, Kashkari said at the Bremer Financial Corporation Fall Leadership Conference. There is ‘almost no evidence’ that inflation has peaked, he said.” [Reuters, 10/06/22]

- Neel Kashkari Also Serves As An Alternate Member Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

August 2022: Dallas Federal Reserve President And Alternate FOMC Member Lorie Logan Said The Federal Reserve’s “‘Number One Priority Has To Be To Restore Price Stability,’” While Suggesting More Interest Rate HIkes Would Be Needed.

August 2022: Dallas Federal Reserve President And Alternate Member Of The Federal Open Market Committee Lorie Logan Said The Fed’s “‘Number One Priority Has To Be To Restore Price Stability’” Due To The “‘Significant Implications And Hardships’ For Businesses And People Around The World’” Caused By Inflation. “Federal Reserve Bank of Dallas President Lorie Logan, in her first public remarks since taking office last week, said that high inflation must be curbed. ‘Our number one priority has to be to restore price stability,’ she told a virtual town hall Wednesday hosted by her bank. Logan has just returned from the Fed’s annual policy retreat in Jackson Hole, Wyoming, where she said central bankers were single-minded in their determination to curb price pressures. ‘The clear priority was bringing inflation down because it’s having significant implications and hardships’ for businesses and people around the world, she said.” [Bloomberg, 08/31/22]

- Lorie Logan Also Serves As An Alternate Member Of The Federal Reserve’s Federal Open Market Committee, Tasked With Setting Interest Rates. [Federal Reserve, accessed 10/05/22]

A Wide Array Of Economic Experts—Including A United Nations Body, Two Nobel Economists, Former Cabinet Officials, And A Former Federal Reserve Economist—Have Warned That Hiking Interest Rates Too Quickly Could Make Inflation Worse, Could Run Out Of Control, And Could Further Hurt Working Class Americans While Doing Little To Address Inflation Drivers Like Corporate Profiteering And Continued Supply Chain Stress.

In An October 2022 Agency Report, The United Nations Criticized The Federal Reserve And Other Central Banks For Seeking To Reduce Inflation Through Interest Rate Hikes Despite The Risk Of A Global Recession, With A Senior Official Suggesting It Was “‘A Very Dangerous Approach.’”

October 2022: The United Nations Conference On Trade And Development (UNCTAD) Released A Report Accusing The Federal Reserve And Other Central Banks Of Risking A Global Recession With Their Continued Interest Rate Hikes. “The Federal Reserve and other central banks risk pushing the global economy into recession followed by prolonged stagnation if they keep raising interest rates, a United Nations agency said Monday. […] In its annual report on the global economic outlook, the United Nations Conference on Trade and Development said the Fed risks causing significant harm to developing countries if it persists with rapid rate rises. The agency estimated that a percentage point rise in the Fed’s key interest rate lowers economic output in other rich countries by 0.5%, and economic output in poor countries by 0.8% over the subsequent three years.” [Wall Street Journal, 10/03/22]

In Releasing The Report, Rebeca Grynspan, Secretary General Of The United Nations Conference On Trade And Development, Said, “The Current Course Of Action Is Hurting The Most Vulnerable, Especially In Developing Countries And Risks Tipping The World Into A Global Recession.’” “There’s still time to step back from the edge of recession,” UNCTAD Secretary-General Rebeca Grynspan said. “We have the tools to calm inflation and support all vulnerable groups. But the current course of action is hurting the most vulnerable, especially in developing countries and risks tipping the world into a global recession.” [Wall Street Journal, 10/03/22]

Instead Of Interest Rate Hikes, The UNCTAD Recommended Policymakers “‘Focus On Measures That Target Price Spikes Directly, Including Price Caps Funded By One-Off Taxes On The Unusually Large Profits Being Made By Many Energy Companies.’” “UNCTAD said rather than increase rates, which will do little to ease shortages of energy and food, policy makers should focus on measures that target price spikes directly, including price caps funded by one-off taxes on the unusually large profits being made by many energy companies.” [Wall Street Journal, 10/03/22]

Richard Kozul-Wright, Who Led The Creation Of The Report, Questioned Central Banks’ Current Approach To Handling Inflation, Stating, “‘Do You Try To Solve A Supply-Side Problem With A Demand-Side Solution? We Think That’s A Very Dangerous Approach.’” “‘Do you try to solve a supply-side problem with a demand-side solution?’ asked Richard Kozul-Wright, head of the team in charge of the report, in an interview. ‘We think that’s a very dangerous approach.’” [Wall Street Journal, 10/03/22]

Joseph Stiglitz—A Nobel Economist And Former Council Of Economic Advisers Chairman—Warned That Hiking Rates “‘Too High, Too Fast, Too Far’” Would Increase Inflation In Goods And Housing, Would Make It “‘More Difficult’” To Invest In Inflation-Driving Supply Chain Stress, And That Corporations Would Actually Continue Hiking Prices In Anticipation of Rate Increases.

Joseph Stiglitz—A Nobel Prize-Winning Economist, Columbia University Professor, And Former Council Of Economic Advisers Chairman— Said Hiking Rates “Too High, Too Fast, Too Far” Would Actually Increase Inflation In The Goods And Housing Sectors. “Nobel Prize-winning economist and Columbia University Professor Joseph Stiglitz told CNBC that hiking ‘too high, too fast, too far’ would stoke inflation in goods and housing.” [CNBC, 09/02/22]

- Stiglitz Was Also A Former Member And Chairman Of The Council Of Economic Advisers And A Former Chief Economist And Senior Vice President At The World Bank. “A recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979), he is a former senior vice president and chief economist of the World Bank and a former member and chairman of the (US president’s) Council of Economic Advisers.” [Columbia University, accessed 10/28/22]

Stiglitz Said, “‘Will Raising Interest Rates Lead To More Oil, Lower Prices Of Oil, More Food, Lower Prices Of Food? Answer Is Clearly Not.’” “‘Will raising interest rates lead to more oil, lower prices of oil, more food, lower prices of food? Answer is clearly not. In fact, the real risk is it will make it worse,’ he told CNBC at the economic conference held on the shores of Lake Como.” [CNBC, 09/02/22]

Stiglitz Said That Raising Rates Would “‘Make It More Difficult’” To Make Investments To Alleviate “‘Supply-Side Bottlenecks That Are Causing Such Havoc On Our Economy.’” “‘Why? Because what we need to do is to make investments to relieve some of these supply-side bottlenecks that are causing such havoc on our economy. It’s going to make it more difficult.’” [CNBC, 09/02/22]

Stiglitz Said Of Corporate Profiteering, “‘There’s A Well-Defined Theory That Points Out That When Interest Rates Go Up, Firms … Take More Advantage Of Raising Prices Today.’” “The second reason, Stiglitz said, was evidenced by the fact that margins for major corporations have been rising along with their input costs. ‘They’ve not only been passing on the cost but passing it on even more. There’s a well-defined theory that points out that when interest rates go up, firms … take more advantage of raising prices today.’” [CNBC, 09/02/22]

Stiglitz Added That “‘Raising Interest Rates In Non-Competitive Markets May Lead To Even More Inflation.’” “‘So raising interest rates in non-competitive markets may lead to even more inflation,’ he said.” [CNBC, 09/02/22]

Stigliz Noted A Federal Reserve Study Showing That Interest Rate Hikes Get “‘Reflected In Rents,’” Potentially Increasing Housing Costs. “Finally, he continued, there is the potential for increasing costs in an important component of inflation: housing. ‘You raise interest rates, it gets reflected in rents, and there’s a Federal Reserve study showing that,’ he said.” [CNBC, 09/02/22]

Stiglitz Warned That Interest Rates Will Rise Faster Than Housing Prices Fall, Increasing The “‘Intergenerational Divide In Our Society’” Where Younger Generations Have Lesser Access To The Housing Market. “Stiglitz had further concerns about the U.S. economy’s impact on citizens. One was that interest rates will continue to be raised faster than house prices fall — ‘prices are remaining high, they’re not going to come down as fast as interest rates are going up and that’s going to increase the intergenerational divide in our society,’ he said.” [CNBC, 09/02/22]

Nobel Economist Peter Diamond Said Of Interest Rate Hikes, “‘It Seems To Me The Message Is You Go Slow,’” Warning That The Fed’s Economic Models “‘Aren’t As Relevant As People Are Thinking’” And That Expectations Could “‘Spin Out Of Control’” If The Central Bank Hikes Rates And Is Not Able To Stem Inflation.

Peter Diamond, A Nobel Prize Winning Economist, Warned That The Fed’s Economic Models “‘Aren’t As Relevant As People Are Thinking,’” Adding That “‘It Seems To Me The Message Is You Go Slow’ On Interest Rate Hikes. “In the interview, Diamond said the models of the U.S. economy that the Fed uses to see trends ‘aren’t as relevant as people are thinking.’ But the same is true for critics of the Fed such as Larry Summers, former U.S. Treasury Secretary and director of the National Economic Council, he added. ‘The pandemic recession was different. The recovery is different. We’re not flying blind, but [there] is uncertainty,’ he said. As a result, ‘it seems to me the message is you go slow,’ Diamond said.” [Morningstar, 09/19/22]

- Peter Diamond Is A Nobel Prize Winning Economist. “Peter Diamond, winner of the Nobel Prize in economics in 2010, has shied away from the press for most of his long and illustrious career, explaining that he’s concerned about being misunderstood. Given the chance to interview him, MarketWatch jumped at it.” [Morningstar, 09/19/22]

Although He Said He Agreed With Raising Rates Some, He Said “‘75 Basis Point Moves At A Blow Are Too Big.’” “Diamond said he agreed with the central bank’s desire to raise interest rates, but ‘75 basis point moves at a blow are too big.’” [Morningstar, 09/19/22]

Diamond Warned About Public Confidence In The Fed, Saying “‘To Trigger A Recession And Not Get Inflation Down To The Satisfaction Of Expectations Is An Invitation To Higher Expectations. This Is Going To Spin Out Of Control.’” “The failure to bring inflation down sharply would erode the public’s confidence that the Fed can do the job. When you set a high bar, you are inviting people to be disappointed. ‘To trigger a recession and not get inflation down to the satisfaction of expectations is an invitation to higher expectations. This is going to spin out of control,’ Diamond said.” [Morningstar, 09/19/22]

Robert Reich, University Of California Berkeley Professor And Former Clinton Labor Secretary Noted That Interest Rate Hikes Wouldn’t Address Increased Prices From Corporate Profiteering, Noting That Corporations “‘Raised Prices, We Now Know, More Than Their Costs Went Up.’”

Interest Rate Hikes Were Seen To Not Address Corporate Profiteering, Seen As “Another Inflation Driver,” With Record Corporate Profits In The First Half Of 2022. “Interest-rate hikes also don’t address another inflation driver: Companies raising their prices far beyond the cost increases for raw materials. Federal data shows corporate profits in the first half of this year soared to record levels, with plenty of retail and consumer-goods companies boasting of their power to hike prices to investors.” [CBS News, 09/30/22]

Robert Reich, University Of California Berkeley Professor And Former Clinton Labor Secretary, Noted Said Of Corporate Profiteering, “‘They Raised Prices, We Now Know, More Than Their Costs Went Up.’” “’A year ago, a month ago, they said, ‘We have to raise prices because our costs have gone up.’ ‘They raised prices, we now know, more than their costs went up,’ said Robert Reich, labor secretary under former president Bill Clinton and now a professor at the University of California, Berkeley.” [CBS News, 09/30/22]

Reich Added, “’The Public Needs To Understand That The Average Big Company Has Much More Pricing Power Than It Ever Had Since The Turn Of The Last Century.’” “’The public needs to understand that the average big company has much more pricing power than it ever had since the turn of the last century,’ he added.” [CBS News, 09/30/22]

Former Federal Reserve Economist And Council Of Economic Advisers Senior Economist Claudia Sahm Said “It Is Inexcusable, Bordering On Dangerous For The Fed To Be Raising Rates So Aggressively,” Warning It Would Cause “Great Pain” Without Addressing Longer-Term Economic Issues.

Former Federal Reserve Economist Claudia Sahm Anc Council Of Economic Advisers Senior Economist Has Noted That “At Least Half Of Today’s Inflation Comes From Supply-Chain Issues,” Contradicting Arguments That Rising Worker Pay Is To Blame For Inflation. “The Fed fears a so-called wage-price spiral, in which workers demand ever-higher pay to stay ahead of inflation and companies pass those higher wage costs on to consumers. But experts disagree that wages are the main driver of today’s red-hot inflation. While worker pay has risen an average of 5.5% over the last year, it’s been eclipsed by even higher price increases. At least half of today’s inflation comes from supply-chain issues, noted former Fed economist Claudia Sahm in a tweet.” [CBS News, 09/30/22]

- Claudia Sahm Was A Section Chief In The Division Of Consumer And Community Affairs At The Federal Reserve Board And A Senior Economist At The Council Of Economic Advisers. “Claudia Sahm is a senior fellow at the Jain Family Institute. Previously, she was the director of macroeconomic policy at the Washington Center for Equitable Growth. She has policy and research expertise on consumer spending, fiscal stimulus, and the financial well-being of households. She is the author of the “Sahm Rule,” a reliable early signal of recessions that she developed as a way to automatically trigger stimulus payments to individuals in a recession. Sahm was also a section chief in the Division of Consumer and Community Affairs at the Federal Reserve Board, where she oversaw the Survey of Household Economics and Decisionmaking. Before that she worked for 10 years in the Division of Research and Statistics on the staff’s macroeconomic forecast. She was a senior economist at the Council of Economic Advisers in 2015–2016. Sahm holds a Ph.D. in economics from the University of Michigan (2007) and a B.A. in economics, political science, and German from Denison University (1998).” [Washington Center for Equitable Growth, accessed 10/28/22]

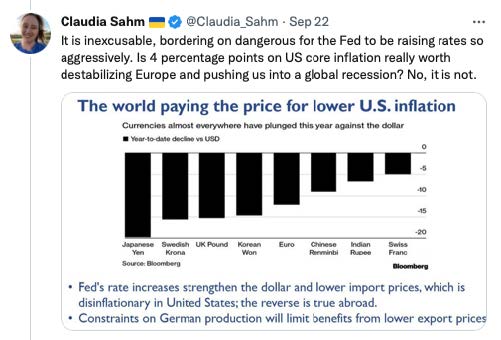

Sahm Tweeted That “It Is Inexcusable, Bordering On Dangerous For The Fed To Be Raising Rates So Aggressively”:

[Tweet by Claudia Sahm, 09/22/22, accessed 10/28/22]

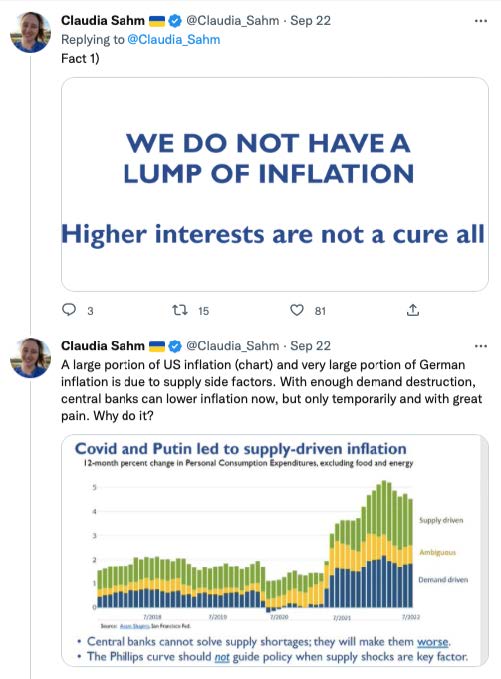

Sahm Tweeted That “Higher Interest Rates Are Not A Cure All,” Noting That “Demand Destruction” Through Interest Rate Hikes Would Only Be Effective “Temporarily” And Would Cause “Great Pain”:

[Tweet by Claudia Sahm, 09/22/22, accessed 10/28/22]

Dean Baker—Co-Founder Of The The Center For Economic And Policy Research And Former Consultant For The World Bank And The U.S. Congress’ Joint Economic Committee—Warned That Higher Interest Rates Won’t Have “‘Much Impact’” On Rising Oil Or Wheat Prices, Not Helping Much To Stem Rising Food And Energy Costs.

Dean Baker—Co-Founder Of The Center For Economic And Policy Research Who Has Also Been A Consultant For The World Bank And The U.S. Congress’ Joint Economic Committee—Noted That Higher Interest Rates “Are Not Going To Have Much Impact On The Price Of Wheat Or Oil.” “‘Higher interest rates from the Fed are not going to have much impact on the price of wheat or oil, except insofar as other central banks also raise rates and slow growth elsewhere, in response to the Fed’s actions,’ Dean Baker, co-director of the Center on Economic and Policy Priorities, tweeted on Tuesday.” [CBS News, 09/30/22]

- Dean Baker, Co-Founder Of The Center For Economic And Policy Research, Was Previously An Assistant Professor At Bucknell University And A Consultant At The World Bank, The Joint Economic Committee Of The U.S. Congress, And The Oecd’s Trade Union Advisory Council. [“Dean Baker co-founded CEPR in 1999. […] Dean previously worked as a senior economist at the Economic Policy Institute and an assistant professor at Bucknell University. He has also worked as a consultant for the World Bank, the Joint Economic Committee of the U.S. Congress, and the OECD’s Trade Union Advisory Council.” [Center for Economic and Policy Research, accessed 10/28/22]

Economists Have Doubted That Interest Rates “Can Do Much To Lower The Cost Of Food And Energy, The Other Major Components Of Working-Class Budgets.” “But while rate hikes have already started to slow the surge in housing prices, economists doubt they can do much to lower the cost of food and energy, the other major components of working-class budgets.” [CBS News, 09/30/22]

Amid Concerns That The Fed Won’t “Be Able To Hit The Brakes” On Interest Rate Hikes Soon Enough, Roosevelt Director Of Macroeconomic Analysis Mike Konczal Warned That There’s Doubt The Central Bank Can “‘Increase Unemployment Just A Little’” And Further Saddling The Economy With Mass Job Losses.

Roosevelt Institute Director Of Macroeconomic Analysis Mike Konczal Warned That There’s Doubt The Fed Can “‘Increase Unemployment Just A Little,’” And That It Will Be Difficult To Reintegrate Potentially Millions Of People Back Into The Workforce After They’ve Been Unemployed. “‘One thing that’s a very open debate and a very important subtext to all the fights is the question of whether the Fed can actually increase unemployment just a little,’ said Mike Konczal, the director of Macroeconomic Analysis at the Roosevelt Institute, a left-leaning think tank. ‘And with every million who lose their jobs, it’s that much harder to reintegrate them [into the labor force] later on.’” [Vox, 10/26/22]

There Has Been Concern That The Fed Won’t “Be Able To Hit The Brakes When They Decide They’ve Done Enough” Interest Rate Hikes, Creating A Recession It “Created But Cannot Control.” “The question is whether the Federal Reserve will be able to hit the brakes when they decide they’ve done enough — or whether it will be too late, and the economy will be hurtling downhill toward a recession that the Fed created but can’t control.” [Vox, 10/26/22]

Economic Policy Institute Research Director Josh Bivens Has Warned “‘We Are Now Pointing The Plane At The Ground Pretty Hard And Hitting The Accelerator,’” Called It A “‘Fallacy’” That The Fed Can Hike Rates Without Widespread Consequences, And Said He Was “‘So Worried’” That There Will Be Inadequate Public Assistance During A Recession.

Economic Policy Institute Research Director Josh Bivens Said He Was “‘So Worried About The Fed Potentially Overshooting’” Its Interest Rate Hikes Because Economic Hawks Have Blamed Inflation On “‘Generous’” Public Assistance Efforts, Undermining Their Use During A Potential Recession. “‘It’s one of the reasons I’m so worried about the Fed potentially overshooting, that we just won’t do that much to help people since we’re told that helping people too generously is what got us into this mess,’ said Bivens of the Economic Policy Institute. ‘I think that’s wrong, but I’m still totally worried about this dynamic.’ Bivens also warned that if Republicans control Congress, it might be in their interest to prolong economic hardship ahead of the next presidential election.” [Vox, 10/26/22]

- Congressional Republican Leadership Has “For Months Attacked Democrats’ Covid Policies For Driving Inflation.” “Republicans are expected to win control of the House, and Republican Leader Kevin McCarthy has for months attacked Democrats’ Covid policies for driving inflation. This raises the question: If the economy does spiral and workers lose their jobs or their workable hours, what kind of assistance might they expect to receive in that scenario?” [Vox, 10/26/22]

Bivens Has Warned That “The Fed Has Set Off A Runaway Train” Where Unemployment Is Hard To Stop. “The danger, Bivens said, is that the Fed has set off a runaway train. Once unemployment starts rising sharply, it’s hard to make it stop. Rather than neatly halting at the 4.4% rate projected by Fed officials, the jobless numbers could easily keep rising.” [CBS News, 09/30/22]

Bivens Said, “’This Idea That There’s An Inflation Dial That The Fed Can Just Haul On Really Hard And Leave Everything Else Untouched, That’s A Fallacy.’” “’This idea that there’s an inflation dial that the Fed can just haul on really hard and leave everything else untouched, that’s a fallacy,’ Bivens said.” [CBS News, 09/30/22]

Bivens Said, “‘We Are Now Pointing The Plane At The Ground Pretty Hard And Hitting The Accelerator.’” “Instead of the soft landing for the economy the Fed says it’s aiming for, Bivens added, ‘we are now pointing the plane at the ground pretty hard and hitting the accelerator.’” [CBS News, 09/30/22]

Rutgers And University Of Massachusetts Amherst Assistant Professors Co-Wrote A Piece Warning That “Inducing A Recession” Through Rate Hikes Was “A Bad Choice For Economic Growth,” With Black And Brown Communities Likely To Bear The Burden Of A Recession And With “Corporate Profiteering” And Other Factors To Blame For Inflation.

August 2022: Rutgers And University Of Massachusetts Amherst Assistant Professors Co-Wrote An Opinion Piece Titled, “Inflation Is Causing Real Pain. But Raising Interest Rates Will Make It Worse.” [The Guardian, 08/17/22]

- The Opinion Piece Was Written By Rutgers Assistant Professor Mark Paul And University Of Massachusetts Amherst Assistant Professor Isabella Weber. “Mark Paul is an assistant professor at the Edward J Bloustein School of Planning and Public Policy at Rutgers University […] Isabella Weber is an assistant professor of economics at the University of Massachusetts Amherst and the author of How China Escaped Shock Therapy” [The Guardian, 08/17/22]

The Piece Argued That “Inducing A Recession” Through Interest Rate Hikes Was “A Bad Choice For Economic Growth,” Placing The Burden On Black And Brown Communities Who Already Carried “The Heaviest Weight” During The Pandemic And The Inflationary Period. “This is not only a bad choice for economic growth; inducing a recession has wide-ranging electoral and social consequences. The burden of the pandemic and inflation has been distributed very unequally with low-income households and Black and brown communities carrying the heaviest weight in both emergencies. Relying on rate hikes means shifting the burden once more on their backs.” [The Guardian, 08/17/22]

The Piece Argued That Fed Rate Hikes Were “Not The Right Choice For The Woes Of Our Times,” With “Too Little Investment, Too Few Quality Jobs, Corporate Profiteering And International Conflict” Already Sagging The Economy. “In fact, higher rates are akin to slamming on the economic brakes, slowing investment, often leading to layoffs, and certainly dragging down construction of desperately needed new housing. In today’s economy, where much of our economic woes stem from too little investment, too few quality jobs, corporate profiteering and international conflict, Fed tightening is not the right choice for the woes of our times.” [The Guardian, 08/17/22]

The Piece Argued That Instead Of Hiking Interest Rates, Policymakers Should “Employ A Surgical Approach That Reins In The Price Increases That Have Been Driving Inflation” While Investing In Solving Supply Chain Issues. “Today American policymakers face a stark choice. Either, they can fight inflation by continuing to hike interest rates to generate unemployment and bring down aggregate demand. Or, they can employ a surgical approach that reins in the price increases that have been driving inflation, while encouraging investments to overcome chronic supply chain issues.” [The Guardian, 08/17/22]

The Piece Concluded, “We Need More Than The Fed To Fight Inflation And Respond To Price Shocks,” Praising Economists Who See That “Inflation Can Be Driven By Something Other Than Workers Getting Too Much Of The Economic Pie.” “We need more than the Fed to fight inflation and respond to price shocks. With economists finally coming around to the idea that inflation can be driven by something other than workers getting too much of the economic pie, it’s high time for policymakers to act.” [The Guardian, 08/17/22]

November 2, 2022: After The Fed Announced A New Rate Hike, AFL-CIO President Liz Shuler Warned It Would Have A “‘Direct And Harmful Impact’” On Working Families And Noted Continued Hikes Do “‘Not Address The Underlying Causes Of Inflation,’” Including Corporate Profits, The War In Ukraine, And Other Factors.

November 2, 2022: AFL-CIO President Liz Shuler Criticized The Fed For An Additional Hike, Warning Of A “‘Direct And Harmful Impact’” On Working Families. “AFL-CIO President Liz Shuler on Wednesday criticized the Federal Reserve for issuing another interest rate hike, warning that the move will have a ‘direct and harmful impact’ on working families. The labor leader’s remarks come after Fed officials raised interest rates by three-quarters of a percentage point, the sixth rate hike since the Fed ramped up its efforts to slow the economy and tame inflation in March.” [The Hill, 11/02/22]

- The AFL-CIO Is A Federation Of 58 National And International Labor Unions That Represent 12.5 Million Workers. “The American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) works tirelessly to improve the lives of working people. We are the democratic, voluntary federation of 58 national and international labor unions that represent 12.5 million working people.” [AFL-CIO, accessed 11/03/22]

- Shuler’s Statement Followed The Fed’s November 2, 2022 Interest Rate Hike Announcement. “The Federal Reserve’s decision today to raise interest rates by .75% will have a direct and harmful impact on working people and our families.” [AFL-CIO, 11/02/22]

Shuler Argued The Fed Was Continuing To Raise Rates Even As It “‘Admits Those Rates Could Ruin Our Current Economy As Unemployment Remains Low And People Are Able To Find Jobs.’” “‘The Fed seems determined to raise interest rates, though it openly admits those rates could ruin our current economy as unemployment remains low and people are able to find jobs,’ Shuler said in a statement.” [The Hill, 11/02/22]

Shuler Said “‘The Fed’s Actions Will Not Address The Underlying Causes Of Inflation — The War In Ukraine, Climate Change’s Effect On Harvests And Corporate Profits, And An Increase In The Chances That The United States Enters A Recession.’” “‘The Fed’s actions will not address the underlying causes of inflation — the war in Ukraine, climate change’s effect on harvests and corporate profits, and an increase in the chances that the United States enters a recession.’” [The Hill, 11/02/22]

On The Day Of The Rate Hike, UBS Chief Economist Paul Donovan Wrote A Piece Arguing That Fed Chair Jerome Powell Was Offering “Little Insight” Into How Rate Hikes Tame Inflation—Saying Powell Was “Chanting ‘Hike, Hike, Hike’ With Malicious Glee”—While Arguing That Inflation Was Spurred By Corporate Profiteering.

November 2, 2022: Chief Economist At UBS Global Wealth Management Paul Donovan Wrote A Financial Times Piece Titled “Fed Should Make Clear That Rising Profit Margins Are Spurring Inflation” [Financial Times, 11/02/22]

- Paul Donovan Is “Chief Economist At UBS Global Wealth Management.” “The writer is chief economist at UBS Global Wealth Management.” [Financial Times, 11/02/22]

Donovan Wrote That Fed Chair Jerome Powell Was Offering “Little Insight Into How He Expects Higher Rates To Tame Inflation,’” Saying Powell Was “Chanting ‘hike, Hike, Hike’ With Malicious Glee.” “In the world’s financial markets, US Federal Reserve chair Jay Powell is increasingly cast in the role of playground bully — looming over the prostrate form of the global economy and chanting ‘hike, hike, hike’ with malicious glee. US policy rates are rising relentlessly. However, Powell’s public remarks offer little insight into how he expects higher rates to tame inflation.” [Financial Times, 11/02/22]

Donovan Said The “Current Inflation Story” Was Companies Passing On Higher Costs To Customers And Taking “Advantage Of Circumstances To Expand Profit Margins.” “This is the current inflation story. Companies have passed higher costs on to customers. But they have also taken advantage of circumstances to expand profit margins. The broadening of inflation beyond commodity prices is more profit margin expansion than wage cost pressures.” [Financial Times, 11/02/22]

Ahead Of The November Rate Hike, Sen. Elizabeth Warren (D-MA) Led A Letter Signed By Three Other Senators And 10 House Members Telling Fed Chair Jerome Powell He Was Raising Rates At “‘An Alarming Pace’” And Accused Him Of A “‘Disregard For The Livelihoods Of Millions Of Working Americans.’”

Ahead Of The Rate Hike, Nearly A Dozen Members Of Congress Sent A Letter To Fed Chair Jerome Powell Saying They Were “‘Deeply Concerned’” That Rate Hikes “‘Risk Slowing The Economy To A Crawl While Failing To Slow Rising Prices That Continue To Harm Families.’” “Earlier this week, a dozen Democrats wrote in a letter to Federal Reserve Chair Jerome Powell that they are ‘deeply concerned that your interest rate hikes risk slowing the economy to a crawl while failing to slow rising prices that continue to harm families.’” [The Huffington Post, 11/02/22]

- The Letter, Dated October 31, 2022, Was Signed By Sen. Warren, Three Other Senators, And Seven House Members. [Sen. Elizabeth Warren, 10/31/22]

The Letter Also Told Powell He Was Raising Interest Rates At An “‘Alarming Pace’” And Accused Him Of A “‘Disregard For The Livelihoods Of Millions Of Working Americans.’” “Sen. Elizabeth Warren this week led nearly a dozen Democratic lawmakers in telling Powell he was raising rates at an ‘alarming pace.’ In a letter, first reported by POLITICO, they accused him of a ‘disregard for the livelihoods of millions of working Americans.’ It was the largest effort by Democrats to question Powell’s actions and was striking because the party has been reluctant to criticize the Fed.” [Politico, 11/02/22]

Ahead Of The November Rate Hike, Sen. Sherrod Brown (D-OH) Sent A Letter To Fed Chair Jerome Powell Arguing That Rate Hikes That Increase Unemployment “‘Risk The Livelihoods Of Millions Of Americans Who Can’t Afford It’”

October 25, 2022: Sen. Sherrod Brown (D-OH) Sent A Letter To Fed Chair Jerome Powell Reminding Him Of The Fed’s “Responsibility To Maintain Full Employment” And That Its “Fight Against Inflation Must Not Hurt Workers.” “Today, Sen. Sherrod Brown (D-OH), Chair of the Senate Committee on Banking, Housing, and Urban Affairs, sent a letter to Jerome Powell, Chair of the Board of Governors of the Federal Reserve, to remind the Federal Reserve of its responsibility to maintain full employment. The letter makes clear that the Fed’s fight against inflation must not hurt workers.” [Sen. Sherrod Brown, 10/25/22]

Sen. Brown Said, “‘For Working Americans Who Already Feel The Crush Of Inflation, Job Losses Will Make It Much Worse. We Can’t Risk The Livelihoods Of Millions Of Americans Who Can’t Afford It.’” “‘As you know, the Federal Reserve is charged with the dual mandate of promoting maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy,’ wrote Brown. ‘For working Americans who already feel the crush of inflation, job losses will make it much worse. We can’t risk the livelihoods of millions of Americans who can’t afford it. I ask that you don’t forget your responsibility to promote maximum employment and that the decisions you make at the next FOMC meeting reflect your commitment to the dual mandate.’” [Sen. Sherrod Brown, 10/25/22]

Sen. Brown Argued That “A Family’s ‘Pocketbook’ Needs Have Little To Do With Interest Rates, And Potential Job Losses Brought About By Monetary Over-Tightening Will Only Worsen These Matters For The Working Class.” “The Federal Reserve’s tools work to lower inflation by reducing demand for economic activities sensitive to interest rates. However, a family’s ‘pocketbook’ needs have little to do with interest rates, and potential job losses brought about by monetary over-tightening will only worsen these matters for the working class.” [Sen. Sherrod Brown, 10/25/22]

Sen. Brown Previously “Urged Action On Corporate Price Gouging And Consolidation” Rather Than Rate Hikes. “Brown has long fought to protect Americans’ pocketbooks against inflation. In July, he released a statement on the FOMC’s rate hike and urged action on corporate price gouging and consolidation to ease consumer costs.” [Sen. Sherrod Brown, 10/25/22]

October 2022: Sen. Chris Van Hollen (D-MD) Said Of Interest Rate Hikes, It’s “‘Important That They Not Choke Off The Job Recovery.’”

October 2022: Sens. Chris Van Hollen (D-MD) Said Of Fed Interest Rate Hikes, It’s “‘Important That They Not Choke Off The Job Recovery.’” “Several Democrats expressed concerns about the risks of rate hikes in a Politico article earlier this month. Sen. Chris Van Hollen (D-Md.) said it’s ‘important that they not choke off the job recovery,’ and Sen. Tina Smith (D-Minn.) said higher interest rates aren’t ‘all that effective for some of the most significant inflationary pressures that we’re facing.’ But they and other Democrats still said they thought Powell was doing a good job.” [Huffington Post, 10/26/22]

October 2022: Sen. Tina Smith (D-MN) Argued That Interest Rate Hikes Weren’t “‘All That Effective For Some Of The Most Significant Inflationary Pressures That We’re Facing.’”

October 2022: Sen. Tina Smith (D-MN) Argued That Higher Interest Rates Aren’t “‘All That Effective For Some Of The Most Significant Inflationary Pressures That We’re Facing.’” “Several Democrats expressed concerns about the risks of rate hikes in a Politico article earlier this month. Sen. Chris Van Hollen (D-Md.) said it’s ‘important that they not choke off the job recovery,’ and Sen. Tina Smith (D-Minn.) said higher interest rates aren’t ‘all that effective for some of the most significant inflationary pressures that we’re facing.’ But they and other Democrats still said they thought Powell was doing a good job.” [Huffington Post, 10/26/22]

June 2022: Sens. Ben Cardin (D-MD) And John Hickenlooper (D-CO) Expressed Concern About Rate Hikes, With Cardin Noting That Raising Rates “‘Has A Major Negative Impact, Certainly On Affordable Housing.’”

June 2022: Sens. John Hickenlooper (D-CO) And Ben Cardin (D-MD) Expressed Concern About Rate Hikes, With Cardin Saying, “‘When You Raise Interest Rates It Has A Major Negative Impact, Certainly On Affordable Housing.’” “Back in June, Sens. John Hickenlooper (D-Colo.) and Ben Cardin (D-Md.) voiced concerns as well. ‘When you raise interest rates it has a major negative impact, certainly on affordable housing,’ Cardin told The Hill.” [Huffington Post, 10/26/22]