MAGA Economics, Press Releases

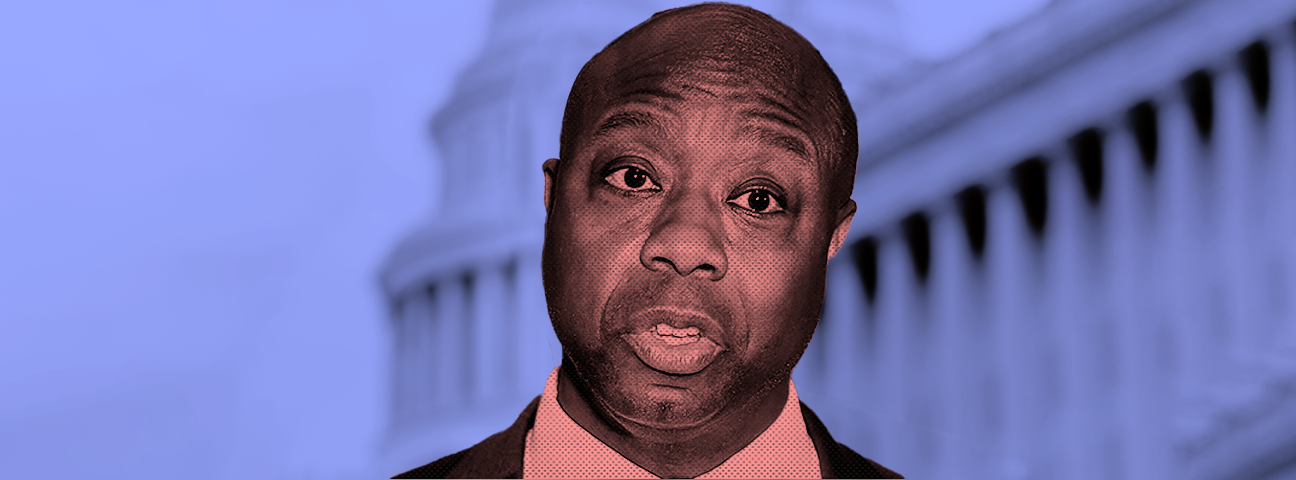

‘MAGA Economics’ Project Spotlights Senator Tim Scott

Washington D.C. – U.S. Senator Tim Scott (R-SC), ranking member of the Senate Banking Committee, is the latest entry in the ‘MAGA Economics’ profile series by government watchdog Accountable.US. The project serves as a regularly updated public resource showing how key MAGA Republicans in the House and Senate are doing the bidding of industry special interests at the expense of consumers and the economy while taking substantial amounts of money from industry sectors they are supposed to oversee. CLICK HERE: Tim Scott (R-SC) ‘MAGA Economics’ Profile

Senator Tim Scott is among the most vocal critics of consumer protection efforts and defenders of abusive triple-digit interest rates in Congress, leaving no mystery why industry special interests like predatory lenders have invested nearly $10 million in his political career. While Senator Scott should be celebrating the Consumer Financial Protection Bureau’s success in returning billions of ill-gotten dollars to victims of industry abuse, he’s made it his mission to obstruct and weaken the bureau on behalf of his industry donors.”

Liz Zelnick, Director of Accountable.US’ Economic Security & Corporate Power.

- Friend of Industry: Sen. Tim Scott has taken over $9.6 million from the finance, insurance, and real estate industries, far more than he has taken from other sectors. Sen. Scott’s major individual donors include over $3 million from billionaire debt collection magnate Benjamin Navarro, whose company drew controversy for boosting debtor lawsuits in the first months of the pandemic. Sen. Scott has also taken hundreds of thousands of dollars from hedge fund billionaires Paul Singer and Daniel Loeb, known for his “nasty” business tactics.

- Consumer Protection Opponent: Sen. Scott, who has opposed reining predatory loan interest rates, has a long history of opposing the Consumer Financial Protection Bureau. Sen. Scott has signed his name to several bills to undermine the CFPB, including one to strike down a rule making it easier for harmed consumers to sue abusive companies, one to make the Bureau “prioritize” business interests, and another to hobble the CFPB’s independence. Consumer advocates note the CFPB has been so successful protecting consumers because its independent funding structure is free from political influence and the whims of Congress.

- Defender of Predatory Lending: Sen. Scott has repeatedly worked to help the financial industry. This includes cosponsoring a major deregulatory bill that successfully weakened post-2008 financial crisis reforms and voting for Trump administration rules that allowed predatory lenders to avoid state interest rate caps, forcing consumers into cycles of debt.

SEE PREVIOUS ‘MAGA ECONOMICS’ PROFILES FROM ACCOUNTABLE.US: House Financial Services Committee Chairman Patrick McHenry ; U.S Rep. Blaine Luetkemeyer (R-MO) ; U.S. Rep. Andy Barr (R-KY)

###