MAGA Economics

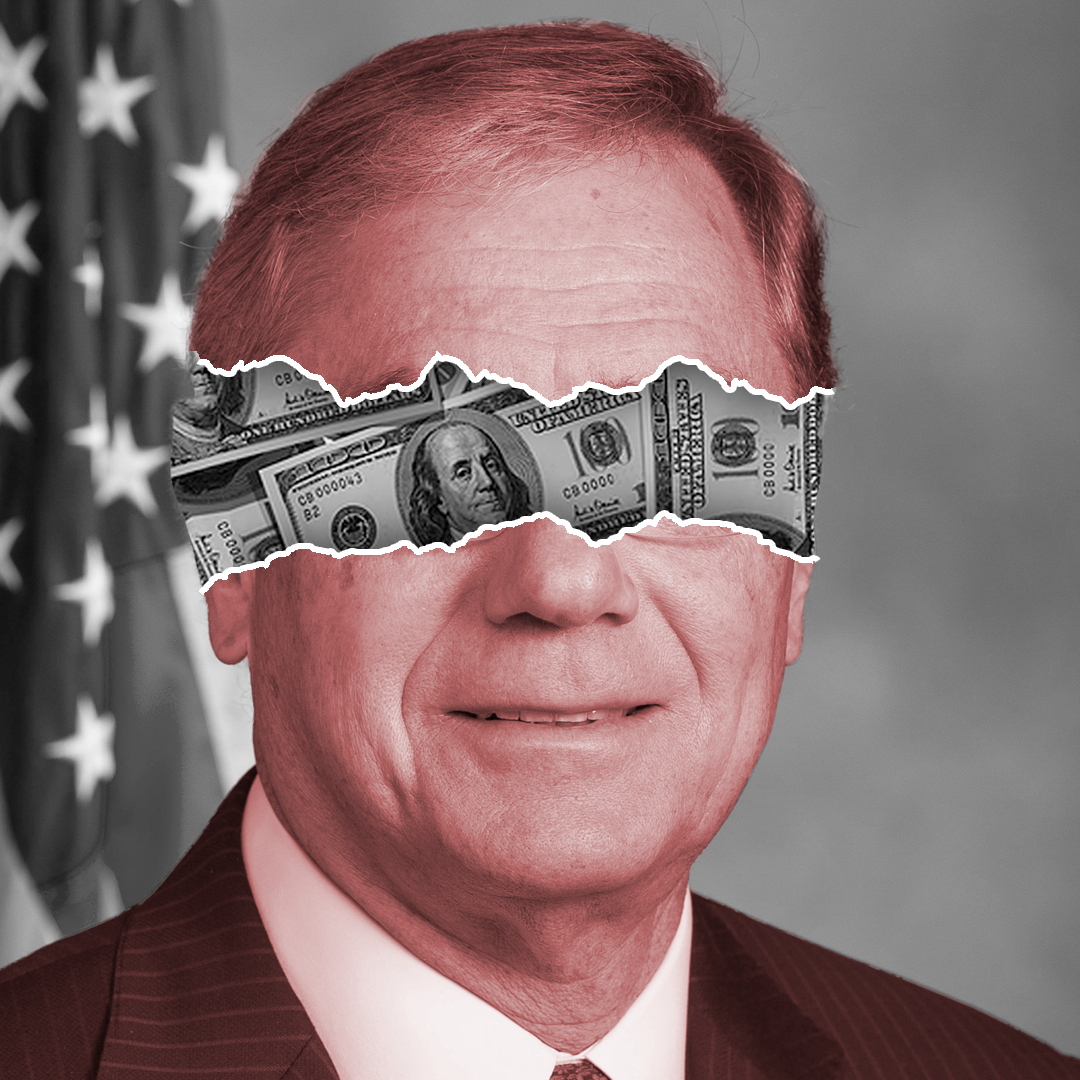

Rep. Blaine Luetkemeyer

ANTI-CFPB CRUSADER

Rep. Blaine Luetkemeyer is a frequent opponent of the Consumer Financial Protection Bureau and its efforts defending consumers. In 2017, Luetkemeyer cosponsored a Congressional Review Act resolution that successfully invalidated the Bureau’s arbitration rule meant to protect consumers’ right to class action lawsuits against bad financial actors.

Luetkemeyer has also introduced and sponsored industry-supported legislation weakening the Bureau’s authority and effectiveness, including legislation forcing the Bureau and other regulators to prioritize corporate profits over consumer protections.

PAYDAY LENDING CRONY

Rep. Blaine Luetkemeyer has received nearly $250,000 from payday lenders over his career, the most of any sitting member of Congress.

Rep. Luetkemeyer most notably led the charge against the Obama administration’s Operation Choke Point meant to crack down on the flow of money to fraudulent merchants, including the payday industry. Rep. Luetkemeyer has received nearly $90,000 coming from the American Financial Services Association, a trade association representing the high-cost lending industry that personally applauded Luetkemeyer’s efforts to stop the program.

ANTI-CONSUMER AND PRO-BANK

Rep. Luetkemeyer is a longtime opponent of consumer protections, having frequently introduced legislation benefiting the financial and insurance industries, of which he was a part, even as a member of the Missouri state legislature.

As a Missouri House Representative, Luetkemeyer introduced legislation making it more difficult to file insurance-related lawsuits while balking at a proposed ban against insurers relying on credit reports—a practice disproportionately harming low-income and minority consumers.

As a member of Congress, Luetkemeyer has supported legislation eroding Dodd-Frank post-crisis reforms and legislation criticized as “prioritiz[ing] corporate profits over the health and safety of the American public.”

Stay Informed

Get the latest news on how we’re holding big business, government officials, and special interests accountable, and what you can do to get involved.

By submitting your cell phone number, you are agreeing to receive period text messages from Accountable.US, including automated text messages. Message and data rates may apply. Text HELP for more information. Text STOP to stop receiving messages.