The Paycheck Protection Program was created to help struggling small businesses survive the COVID-19 economic crisis. Yet since the program’s inception, many large corporations have claimed millions of dollars in taxpayer assistance. Accountable.US is tracking the money in efforts to provide transparency where the Trump administration has failed to do so. Follow our live blog to stay up to date on the latest news, following the recent disclosure of data on loans under $150,000.

REPORT: Trump Administration Let Private Jet Industry Triple-Dip in Pandemic Aid Despite Sky-high Demand

[JANUARY 19]

Government watchdog Accountable.US released a new analysis finding the Trump administration awarded the private jet industry a staggering $643 million during the pandemic despite high demand for their services. The industry bailouts included $530 million in grants from the Payroll Support Program (PSP), nearly $8 million in Economic Injury Disaster Loan (EIDL) aid, and as much as $107 million in Paycheck Protection Program (PPP) funds meant for struggling small businesses.

Read more>>

REPORT: Shady Multi-Level Marketing and Direct Selling Companies Received $100M in PPP Funds Despite False Claims About COVID-19 Treatments, History of Deceptive Marketing

[JANUARY 19]

Government watchdog Accountable.US released a new analysis, previewed by the New York Post, that identified a number of direct selling companies – which frequently engage in predatory multi-level marketing practices – that raked in over $106 million in forgivable Paycheck Protection Program (PPP) loans. Several of these beneficiaries have been warned by the Federal Trade Commission about making unlawful claims regarding the health benefits of their products in treating COVID-19 and the amount of money their participants could make. Meanwhile, tens of thousands of small businesses in communities of color were shut out of the PPP under the Trump SBA’s poorly designed and managed program.

Read more>>

New York Post: Millions in COVID relief loans given to vitamin sellers flagged by feds

[JANUARY 18]

A trio of supplements sellers snagged millions in coronavirus relief loans last spring — all within weeks of getting dinged by the feds for questionable claims about their products, The Post has learned.

Read more>>

Washington Post: Debt collectors, payday lenders collected over $500 million in federal pandemic relief

[JANUARY 15]

A Texas firm that describes itself as one of the nation’s largest medical bill collectors was racking up consumer complaints last year.

“For months this company has been reporting inaccurate, unverifiable, erroneous things on my credit report and I am sick of it!!!” states one consumer’s report to the Consumer Financial Protection Bureau in January 2020.

Read more>>

Predatory Payday Lenders and Debt Collectors Cash In On Over $580M In PPP Loans

[JANUARY 15]

The Washington Post is reporting that over 1,800 taxpayer-backed Paycheck Protection Program (PPP) loans went to debt collectors and high-interest payday lenders — totaling more than $580 million. According to the analysis, “more than 170 of those recipients have been the subject of a multitude of complaints — each racking up at least 100 with the CFPB.” Among the recipients includes Title Cash, a payday lender that charges up to 456 percent annual interest rates, who cashed in on $3.6 million in taxpayer dollars.

Read more>>

The New York Times: Private Schools Cashed in on P.P.P. Funding

[JANUARY 13]

This spring, when the federal government disbursed billions of dollars in emergency pandemic funding, the traditional K-12 public schools in Los Angeles got an average of about $716,000.

Read more>>

USA Today: Hurting long before COVID-19, failing companies took stimulus money then closed anyway

[JANUARY 13]

Stein Mart Inc. was desperate for shoppers long before COVID-19 forced closures at its discount department stores, scattered mostly throughout the Southeast.

Read more>>

Salon: Watchdog: Mitch blocked key aid but pushed tax break for owner of racehorse “Stimulus Check”

[JANUARY 12]

A watchdog group called on Congress to refocus its priorities on helping struggling communities after the last round of coronavirus relief included numerous tax breaks for corporations and Senate Majority Leader Mitch McConnell’s “rich, horse racing friends.”

Read more>>

Longstanding Issues in PPP Remain in New SBA Rules

[JANUARY 7]

Late yesterday evening, Trump’s Small Business Administration (SBA) released new guidance for the revamped Paycheck Protection Program (PPP). Unfortunately, this new iteration of the PPP continues to neglect longstanding issues concerning minority-owned businesses, fraud, and loopholes allowing loans going to Trump allies.

Read more>>

CBS News: Paycheck Protection Program returns with $285 billion, and there’s still room for fraud

[DECEMBER 23]

A popular government-backed small-business loan program to aid companies that have suffered due to the coronavirus is back, with some fixes to earlier flaws in the forgivable, low-interest loans but also several of the same loopholes that can benefit bigger operators over Main Street mom-and pop shops.

Read more>>

CBS News: Strip club owner won’t have to pay back millions in aid meant for small businesses

[DECEMBER 22]

The owner of one of the largest chains of strip clubs in the country, Rick’s Cabaret, as well as a chain of military-themed sports bars called Bombshells, got a lifeline earlier this year from a coronavirus relief program meant for small businesses.

Read more>>

New Relief Bill Leaves Much Work to Be Done

[DECEMBER 22]

Today, after months of delay and mounting difficulties faced by Americans nationwide, Congress at last agreed to a $900 billion stimulus agreement.

Read more>>

USA Today: Arizona charter school got a PPP loan, gave $10 million to shareholder

[DECEMBER 21]

Primavera online charter school, like many businesses this spring, sought help from the federal Paycheck Protection Program to weather the economic disruption of the COVID-19 pandemic.

Read more>>

ABC News 5 Cleveland: Which Ohio cities received the most Paycheck Protection Program money?

[DECEMBER 21]

The Paycheck Protection Program disbursed $18.48 billion to 147,868 recipients in Ohio, according to U.S. Small Business Administration data gathered by the nonprofit government watchdog organization, Accountable.US.

Read more>>

The Hill: Think small business relief was a ‘Success’? Ask businesses in communities of color

[DECEMBER 20]

With coronavirus cases surging and a long winter ahead, many businesses are worried they won’t survive past the holidays. But if one thing is clear at this point in the pandemic, it’s that President Trump and his allies in the Senate have turned their backs on too many small businesses, workers, and their families.

Read more>>

REALITY CHECK: Trump Treasury Officials’ PPP Op-Ed Packed With False and Misleading Claims

[DECEMBER 18]

An op-ed in today’s Wall Street Journal from Trump Treasury officials Michael Faulkender and Stephen Miran that hails the SBA’s Paycheck Protection Program as a “success” and calls for a clean reauthorization of the program is riddled with deceptive or downright false claims, an analysis from government watchdog Accountable.US found. Since its implementation, Accountable.US has documented how the Trump administration’s poor design and management of the program and lack of transparency led to rampant waste, fraud and abuse, gross inefficiency, and the prioritization of the rich and powerful over hundreds of thousands of truly struggling mom and pop stores that were allowed to go under, especially in communities of color.

Read more>>

REPORT: Right-Wing Groups That Have Criticized Pandemic Aid Took Millions in Taxpayer Support from Trump SBA

[DECEMBER 18]

An analysis from government watchdog Accountable.US — previewed in Daily Kos — found that at least 75 conservative organizations, including several that have vocally advocated against pandemic aid, took nearly $20 million in Paycheck Protection Program (PPP) resources meant for struggling mom-and-pop businesses. At least 14 of these right-wing groups took money under a second government aid fund, the Economic Injury Disaster Loan (EIDL) program. Several of the groups are supporters of President Trump, which may help explain why the administration fought tooth and nail in the courts to try to keep loans like this from public view. Of the 75 organizations identified, the identities of roughly half were only revealed in the SBA’s December PPP data drop four months after the program ended, following a lengthy legal battle.

Read more>>

Yahoo News: Tenants of Donald Trump and Jared Kushner companies receive $3.65m in PPP loan money, report says

[DECEMBER 17]

Tenants in real estate properties owned by President Donald Trump and his son-in-law Jared Kushner received $3.65m of loan money through the Paycheck Protection Program (PPP), according to an analysis by NBC News.

Read more>>

Salon: Trump-related vendors got millions in COVID aid — while still getting paid by his campaign

[DECEMBER 16]

More than a half-dozen Trump campaign vendors received in excess of $7 million in coronavirus small business aid — despite collecting more than $60 million from the campaign.

Read more>>

Millions in PPP Funds Went to Wealthy Celebrities, Musicians, Influencers

[DECEMBER 15]

Today, Accountable.US released a new report cataloguing several wealthy musicians, celebrities, and influencers who received loans through the Trump Small Business Administration’s (SBA) Paycheck Protection Program (PPP) while mom-and-pop businesses lost out. The list documents wealthy actors and two musical acts featured on Taylor Swift’s newly released album Evermore who snapped up small business funds as hundreds of mom-and-pop shops — especially in communities of color — were boxed out and left to fend for themselves.

Read more>>

NBC: Anti-gay nonprofits, businesses received millions in Covid-19 aid

[DECEMBER 12]

A number of organizations, schools and businesses with either a history of anti-LGBTQ advocacy or policies that explicitly discriminate against lesbian, gay, bisexual, transgender and queer individuals have received millions in pandemic relief funding, according to an NBC News analysis of data released last week by the Small Business Administration.

Read more>>

Final PPP Data Reveals Oil, Gas, and Mining Scored Billions While Wind and Solar Were Left in the Cold

[DECEMBER 11]

New analysis finds that the Trump Small Business Administration’s (SBA) flawed Paycheck Protection Program (PPP) has been abused by fossil fuel and extractive corporations to rake in billions of dollars. In striking contrast, only 1,100 recipients in the wind and solar sector were awarded funds, while over 22,000 polluting extractive resource corporation cashed in after a review of SBA data.

Read more>>

Washington Post: Small-business loans to big companies prompt Congress to overhaul PPP rules

[DECEMBER 11]

Ongoing revelations about how big businesses and chains were able to secure hundreds of millions of dollars in funding from the Paycheck Protection Program are shaping discussions in Congress about which employers should be eligible if another $300 billion is approved under another proposed stimulus package.

Read more>>

REPORT: Over $2.7 Billion In PPP Money Went To Well-Off Individuals With No Employees

[DECEMBER 11]

An analysis from government watchdog group Accountable.US shows that nearly 130,000 recipients of Paycheck Protection Program loans were self-employed individuals with no employees and making over $100,000 annually — but still received $20,833 in PPP funding, the maximum amount allowed by the legislation. This is the same loan program that all but shut out business owners in communities of color from accessing funding and is now infamous for the avoidable millions lost in waste, fraud, and abuse.

Read more>>

Small Business Advocates Urge Congress: Don’t Repeat Trump PPP’s Mistakes That Abandoned Communities of Color, Most in Need

[DECEMBER 11]

View Zoom Call Recording Here

Following last week’s mammoth, court-mandated data drop from the Trump Small Business Administration (SBA) of recipients of Paycheck Protection Program (PPP) loans under $150K, government watchdog Accountable.US hosted a press call with leading small business advocates to discuss how the program’s problems with inequity, lack of transparency, and inefficiency were even worse than previously known. As Congress continues to negotiate the next major coronavirus package that will likely include additional small business aid, advocates called on Congress to not repeat the same mistakes that allowed over 100,000 small businesses to shutter and expect a different result. New aid must be data-driven, transparent and targeted to those who need it most — not the rich, powerful, and big corporations.

Read more>>

REPORT: At Least 25 Hate Groups Got Nearly $5M in Aid from Trump SBA, Including Two White Nationalist Groups

[DECEMBER 10]

An analysis from government watchdog Accountable.US of last week’s major, court-mandated data drop of SBA Paycheck Protection Program loan recipients found that at least twenty-five organizations designated as hate groups by the Southern Poverty Law Center received approximately $4.8 million in forgivable PPP loans from the Trump administration, including vile white nationalist groups New Century Foundation and VDARE Foundation.

Read more>>

Mnuchin Relief Bill Offers Little Help to Struggling Americans

[DECEMBER 9]

Amid ongoing COVID-19 surges across the nation, Treasury Secretary Steve Mnuchin reportedly made an offer to House Speaker Nancy Pelosi for a $916 billion coronavirus relief package. Unfortunately, like all other moves by the Trump administration and its congressional allies to get the ongoing public health and economic crises under control, the proposal does far too little for the American people.

Read more>>

Trump Official Tied to Firm That Took Over $116,000 In PPP Money When He Was in Congress

[DECEMBER 8]

When he was a member of Congress, current Director of National Intelligence John Ratcliffe’s spouse’s law firm accepted a six-figure government loan authorized by the CARES Act, according to a story published in the Dallas Morning News.

Read more>>

REPORT: $9M Main Street Lending Program Loan Went To Firm Tied To Convicted Felon Who Was Sentenced to Prison For Tax Fraud 3 Weeks Later

[DECEMBER 7]

New reporting by the Kansas City Star reveals that a $9 million taxpayer-backed Main Street Lending Program (MSLP) loan went to a Kansas-based trash collection company that reports having just three drivers and was recently controlled by a convicted tax felon. Warren L.C. — whose management was transferred from Thomas Fritzel to his wife sometime after May 2019 — was approved for the loan just three weeks before Mr. Fritzel checked into in a federal prison in South Dakota for tax fraud. See additional details about the loan HERE from government watchdog Accountable.US.

Read more>>

WASHINGTON BLADE: Anti-LGBTQ school where Karen Pence teaches obtained $725K in PPP money

[DECEMBER 4]

A Christian school in Virginia infamous for banning LGBTQ teachers and students after second lady Karen Pence took a teaching job there obtained nearly $725,000 in PPP funds despite its anti-LGBTQ policies, the Washington Blade has learned.

Read more>>

Unemployment Remains Unacceptably High as McConnell Again Lowballs Struggling Families

[DECEMBER 4]

The Labor Department’s November jobs report shows that the Trump recession shows no signs of slowing down — leaving behind a worsening mess for President-elect Joe Biden. The unemployment rate is at an unacceptably high 6.7 percent and an even worse 10.3 percent in the African American community. More than 20 million Americans continue to draw jobless benefits amid an uncontrolled pandemic that has claimed the lives of nearly 270,000 Americans and is expected to claim hundreds of thousands more. This on top of a “benefits cliff” and eviction crisis looming just weeks away. Yet, Trump’s top Senate ally Mitch McConnell continues to drag his feet on delivering urgently needed relief for workers, small businesses and states — dismissing a growing number of colleagues from his own party that are ready to support a serious bipartisan pandemic package.

Read more>>

INSIDER: Jake Paul’s company took a PPP bailout loan for over $30,000 before the YouTuber’s summer pandemic partying

[DECEMBER 3]

Despite his poor record on COVID-19 safety and his statement that the pandemic was a “hoax,” controversial YouTuber and boxer Jake Paul accepted a $34,800 Paycheck Protection Program (PPP) bailout loan from the federal government in April.

Read more>>

Last Night’s New PPP Data Shows Aid Overwhelmingly Went to Larger Companies

[DECEMBER 3]

Last night, following months of obfuscation, delays, and a lost legal battle, Trump’s Small Business Administration (SBA) finally released information last night on recipients of Paycheck Protection Program (PPP) loans up to $150,000. While the program was billed as a much-needed relief program for mom-and-pop businesses struggling to weather the tough economic conditions brought on by COVID-19, it’s clear from the data that it was not small businesses, but fraudsters and well-connected larger businesses, that won out in the PPP.

Read more>>

SALON: New PPP data shows two dozen businesses at Trump and Kushner properties received federal loans

[DECEMBER 2]

The Small Business Administration (SBA) on Tuesday released extensive new data indicating that half of the coronavirus Paycheck Protection Program’s (PPP) $522 billion in taxpayer-funded loans went to only 5% of recipients, according to preliminary reviews.

Read more>>

Celebrity-Owned Businesses Received PPP Loans, According to New Data

[DECEMBER 2]

New data discloses recipients of PPP loans under $150,000, including a number of businesses owned by well-known celebrities. Among these celebrities are Ryan Gosling, Sofia Vergara, Mary-Kate and Ashley Olsen, The Killers, Rae Sremmurd and more.

Search the data >>

Over 500,000 PPP Loan Recipients Reported Saving 0 Jobs

[DECEMBER 2]

Search the data >>

FORBES: New PPP Loan Data Reveals Most Of The $525 Billion Given Out Went To Larger Businesses—And A Few With Trump, Kushner Ties

[DECEMBER 2]

After months of litigation, the Small Business Administration finally revealed the name of every business that received a loan under the Paycheck Protection Program on Tuesday night, and early analysis reveals that a majority of the forgivable funds—intended for smaller businesses needing emergency relief for payroll, rent or mortgage expenses—actually went to bigger businesses, including some with ties to President Donald Trump and his administration.

Read more>>

NBC NEWS: Release of PPP loan recipients’ data reveals troubling patterns

[DECEMBER 2]

Sweeping data released by the Small Business Administration on who benefited from pandemic relief programs raises questions about the equitability and distribution of loans intended for small businesses, an initial analysis by NBC News shows.

Read more>>

Government Watchdog Releases Searchable Database of New PPP Loan Data

[DECEMBER 2]

After months of dodging and delaying, the Small Business Administration (SBA) was forced today to release its remaining data on businesses and individuals that received loans through the Paycheck Protection Program (PPP). The new data follows July’s disclosure by the SBA, which revealed the businesses that received $150,000 or more in PPP loans — data that only came to light after intense public pressure from government watchdog Accountable.US and other groups.

Read more >>

New Data on Paycheck Protection Program Loans Released

[DECEMBER 1]

The Small Business Administration released previously undisclosed data on Paycheck Protection Program loans under $150,000.

Search the data >>

Workers Pay Price of Trump Administration Failures as Elected Leaders Look to Pump More Money in Failed Programs

[UPDATED: JULY 28]

Today, the Senate is set to release a new coronavirus aid proposal that would cut federal unemployment benefits by $400, even as recent reporting shows that 1/5 workers have filed unemployment claims and the Department of Labor released data showing that unemployment claims are rising for the first time since March. These crucial benefits have kept millions out of poverty thus far, and the emerging deal between Congress and the White House would devastate American families that have relied on government assistance to survive in this time of unprecedented economic turmoil. Instead, the next relief package being released today appears to include another $100 billion for the Paycheck Protection Program (PPP).

Find out more>>

What We Know from More Businesses Permanently Closing

A new Yelp analysis shows that permanent business closures are now outpacing temporary closures. Even worse, the increased consumer interest that occurred in May while states began reopening their economies correlates with the resurging coronavirus infections we saw in June. This lays bare one simple fact: we cannot solve the economic crisis facing this country without first solving the public health crisis.

Read more.

As Partial PPP Extension Looms, Big Questions Remain

There is broad agreement that our small businesses need help in these challenging times, especially with the resurgence of the coronavirus raging across the country. Senate lawmakers and the White House are considering several proposals, but news reports indicate they have not yet reached a consensus. One point they seem to agree on is extending the Small Business Administration’s (SBA) broken Paycheck Protection Program (PPP) in some way, shape, or form, but key details are lacking to address fundamental problems with the program.

Learn more.

Senate Hearing Highlights How Horribly Trump Admin Has Failed Minority-Owned Businesses

Thursday’s Senate Committee on Small Business hearing examined how badly the Trump administration has failed to provide adequate financial assistance to businesses in communities of color struggling during the COVID-19 pandemic. Instead of helping mom-and-pop shops and small local operators, millions of dollars from the Small Business Administration’s (SBA) Paycheck Protection Program (PPP) were funneled to wealthy and well-connected publicly-traded companies. In fact, one survey reviewing applications in May found only 12% of Black and Latinx business owners received the SBA relief they had applied for.

Our statement>>

BREAKING: Watchdog Statement on U.S. Reaching 4M COVID Cases

The New York Times is reporting that today, the United States reached another tragic milestone in the COVID-19 pandemic: four million confirmed cases of the virus.

Read our statement in response.

REPORT: Wells Fargo reported giving only one large PPP loan to a Black-owned business

According to new reporting by Salon, of the more than 12,000 SBA Paycheck Protection Program loans that Wells Fargo handled valued at $150,000 or higher, the bank reported distributing only one PPP loan to a Black-owned business. Additionally, unlike other lenders, Wells Fargo neglected to disclose any job retention data for over 8,000 of these loans and reported ZERO jobs saved for the remainder of the 12,000+ loans it made. The other 4 biggest U.S. banks only neglected to report jobs data on only about 290 of the more than 78,000 PPP loans they handled.

Learn more.

As 1.4 Million More Lose Jobs and Income Cliff Looms, Trump’s Senate Allies Eye Unemployment Benefit Cuts While Still Overlooking PPP’s Failures

Trump & Allies Aim to Help Industry Execs As Workers Face Cliff

New reports indicate that President Trump and his allies are once more looking out for big corporations as they plan for another relief package — but remain virtually silent for workers.

With additional unemployment benefits from the CARES Act slated to expire soon, Americans desperately need support from Washington. But rather prioritizing benefits and assistance to workers and their families, the Trump administration is looking to a tax credit cash-out and payroll tax cut to help out wealthy corporate executives.

Learn more.

MEMO: Admin’s Poorly Executed PPP Calls Into Question Design, Data and Dispensing of Taxpayer $

When Congress passed the CARES Act, it created the Paycheck Protection Program (PPP) as a lifeline for small businesses struggling to survive the historic COVID-19 public health and economic crisis. For all the Trump administration’s talk of the program’s success, in reality, it failed in many ways.

Here is what we know.

This week in PPP catastrophes…

[JULY 17]

Another week is coming to a close, and we’re left with more questions than ever about the Trump administration’s limited data dump surrounding recipients of Paycheck Protection Program (PPP) funds. Here’s what we have learned.

Government Accountability Experts Discuss how Next PPP Must Include Proper Transparency, Oversight

Government accountability experts from Accountable.US, a nonpartisan watchdog group that exposes corruption across all levels of government, American Oversight, and Project on Government Oversight (POGO) discussed how Congress must redesign any new small business relief measure so that it is transparent, data-driven, and aligned with the needs of the communities that need the help the most.

Learn more here>>>

Trump Recession Deepens as 1.3 Million More File for Unemployment, PPP Still Leaving Small Businesses Behind

[UPDATED: JULY 16 – 1:30 PM EST]

The U.S. economy fell further into recession as 1.3 million more workers entered the unemployment ranks this week. Yet with enhanced benefits set to run out in a matter of days and despite 75% public support for extending them, the President’s allies in Congress are considering drastic reductions as the struggles of out-of-work families compound. And while the Trump SBA’s corrupt and mismanaged Paycheck Protection Program has been extended, lawmakers did not bother to fix the program’s fundamental flaws that allowed 110,000 small businesses to shutter, especially in communities of color.

Read our response >>

Big Oil Cashes In While Renewable Energy Given Paltry Support

After reporting last week in The Guardian revealed that some 5,600 Big Oil and fossil fuel industry companies had reeled in between $3 and $6.7 billion in Payroll Protection Program (PPP) monies meant for small businesses, Accountable.US found that only 239 wind and solar companies received a maximum of $188 million in PPP funds.

Learn more >>

Lawmakers Highlight Admin’s Failure to Get States PPE & Tests

At the House Homeland Security Committee hearing on “Reviewing Federal and State Pandemic Supply Preparedness and Response,” the Trump administration came under fire for its continued failure to help states get the resources they need to protect people from COVID-19.

Read our response here>>

New Bloomberg Analysis Shows PPP Data Riddled with Errors, Casting Doubt on Program’s Efficacy

[UPDATED: JULY 14 – 3:30 PM EST]

A new Bloomberg analysis shows that the recently released data for more than $521 billion in Paycheck Protection Program (PPP) loans are filled with errors — including loan amounts and number of jobs retained — raising more questions than answers on how the program was executed.

Read our response here.

Four days later, who we know got PPP funds…

After much stalling and handwringing, the Trump administration this week finally released limited information on recipients of the Paycheck Protection Program (PPP). While the released data only represents 14% of the federal relief fund recipients and 75 percent of the money doled out, the trends are clear: this program was poorly designed, allowing big corporations with ties to the Trump administration, through donors or K-Street lobbyists, to exploit it while many actual small businesses got shut out.

Here’s some of what we’ve learned.

Only 143 Out Of Over 650,000 Large PPP Loans Go To Black-Owned Firms As Communities Of Color Continue To Call For Help From Trump Administration

[UPDATED: JULY 9 – 5:30 PM EST]

Thursday’s House Financial Services Subcommittee hearing revealed that only 143 Black-owned firms received a Paycheck Protection Program (PPP) loan over 150 thousand dollars, showing just how badly the Trump administration has failed to provide adequate financial assistance to businesses in communities of color struggling during the COVID-19 pandemic. Instead of helping mom-and-pop shops and small local operators, millions of dollars from the Small Business Administration’s (SBA) PPP were doled out to wealthy and well-connected publicly-traded companies.

Learn more >>

PPP Data Raise More Questions Than Answers

After weeks of stonewalling, the Trump administration acquiesced this week and released partial information on certain recipients under the Paycheck Protection Program (PPP), accounting for just 14% of recipients.

Unfortunately, the error-riddled data that was released raises more questions than it answers on how the program was administered and on the integrity of the program as a whole.

Read more >>

Trump Targets School Funding as PPP Funds Flow to Private and Charter Schools

The Trump administration announced that it might cut federal funding for K-12 schools nationwide that refuse to reopen amid the continuing COVID-19 pandemic. Meanwhile, millions from Trump’s Paycheck Protection Program (PPP) went to support private and charter schools, many of which have not lost their major funding streams during the crisis.

More here >>

Companies That Received Millions In Taxpayer-Funded Bailouts Have Extensive Federal Violations

A newly released investigation by The Guardian finds that a number of energy companies that took Payroll Protection Program (PPP) funds have been fined millions more for environmental and workplace safety violations.

Read our reaction >>

Trump has failed minority-owned businesses. Here’s how Congress can help.

Accountable.US President Kyle Herrig and former Small Business Administration (SBA) Deputy Administrator Marie Johns published an op-ed in USA Today on how Trump’s Paycheck Protection Program (PPP) has failed minority-owned small businesses and what Congress can do to fix the broken program.

More here >>>

Error-Ridden PPP Data Show Taxpayer Funds Funneled to the Wealthy & Well-Connected

[UPDATED: JULY 7 – 3:00 PM EST]

Yesterday, the Trump administration released a limited collection of data about recipients of Paycheck Protection Program (PPP) assistance. The program has been rampantly mismanaged from the start, allowing big businesses and publicly–traded companies to exploit the program with little transparency or oversight. The data released yesterday has been riddled with errors, raising questions about the PPP’s integrity. All the while, actual small businesses — especially those run by people of color — have been left to struggle or close entirely.

Here’s just some of what the data has revealed so far:

DISCLOSURE “DEBACLE” SHOWS PROGRAM NOT WORKING AS INTENDED

- Axios: “Within hours [of the PPP data disclosure], several well-known companies and investment firms on the list denied that they had ever applied for PPP loans, let alone received them.

- “Be smart: There were over 660,000 companies listed. And reporters only called a tiny percentage of them. If the error rate *we* found is representative of the larger sample, then who knows how many PPP loans there really were, or what companies they went to. Imagine if small businesses got shut out of the initial pool, and then shut down or laid off employees, if the initial pool wasn’t actually exhausted?

- There’s going to need to be an audit, and not just the promised reviews of companies that got loans north of $2 million.

- Was this just a bunch of fat fingers? Fraud? Incompetence? A combination of all three?

- The bottom line: The purpose of these PPP disclosures was to better understand how the program worked, particularly ahead of a phase 4 stimulus. What we’ve learned is that we need even more disclosures.”

- Washington Post: “Nearly 90,000 companies in the program took the aid without promising on their applications they would rehire workers or create jobs.”

BAILOUTS FOR THE WEALTHY & SPECIAL INTERESTS

- CNBC: Top private jet companies got $200 million from the government under CARES Act

- CNBC: “All together, more than 400 country clubs and golf resorts received PPP funding.”

- Forbes: Billionaire Kanye West’s Yeezy Received A Multimillion-Dollar PPP Loan

- Washington Post: Treasury, SBA data show small-business loans went to private-equity backed chains, members of Congress

- CNBC: Wealth management firms among those that have taken PPP loans during coronavirus pandemic

- Fortune: Banks will collect billions in fees on PPP small business loans, according to a new report

- Washington Post: “In Maryland, more than 100 private, parochial and charter schools reportedly got infusions of federal money, including a string of well-known schools in the Washington suburbs… Each of the four drew $2 million to $5 million, according to the data.”

- The Hill: Lobbying groups received millions in PPP loans

- The Guardian: Over 5,600 fossil fuel companies have taken at least $3bn in US Covid-19 aid

- STAT News: Venter Institute, Yumanity, and other biopharma companies among recipients of PPP loans

- Bloomberg: Hundreds of Coal Companies Got $170 Million in U.S. Virus Aid

- Washington Post: The Technology 202: Many tech companies received large coronavirus relief loans

FUNDS FOR THE TRUMP–CONNECTED

- AP: “As much as $273 million in federal coronavirus aid was awarded to more than 100 companies that are owned or operated by major donors to President Donald Trump’s election efforts”

- AP: “…the Trump supporters who run these companies have contributed at least $11.1 million since May 2015 to Trump’s campaign committees, the Republican National Committee and America First Action, a super PAC that has been endorsed by Trump, the AP review found. Each donor gave at least $20,000.”

- AP: Trump donors among early recipients of coronavirus loans

- CNBC: Pro-Trump lobbyists worked with firms that received small business relief loans

- Alana Abramson: Another Trump GOP donor who scored big on PPP loans: Ralph Herzka, CEO of real estate firm Meridian Capital Group, which received between $5 and $10 million Herzka has given $150k to Trump victory since 2018, per fec filings.”

[UPDATED: JULY 6 – 7:00 PM EST]

Following the partial release of Paycheck Protection Program (PPP) loan data, Accountable.US President Kyle Herrig penned a letter to the Small Business Administration’s (SBA) inspector general urging that he open an investigation into the irregularities in the data.

The letter is available here.

ICE detention facility, Immigration Centers of America – Farmville, LLC received a PPP loan between $2-5 million

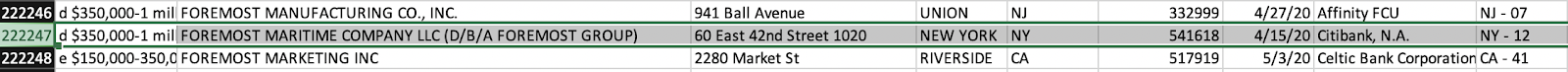

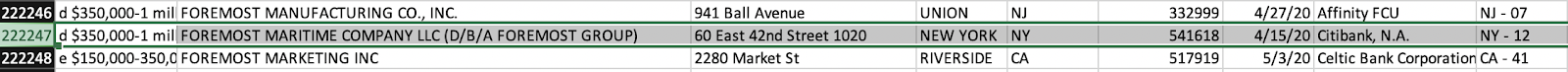

Transportation Secretary Elaine Chao’s family’s shipping company, the Foremost Group, received $350k-$1m in PPP loans.

[UPDATED: JULY 6 – 4:30 PM EST]

Admin Bails Out Vape Shops Amid Respiratory Pandemic

[UPDATED: JULY 6 – 1:30 PM EST]

Amid the public health crisis surrounding COVID-19, an illness that targets the lungs, the Trump administration gave $876,515 of Paycheck Protection Program (PPP) assistance to Healthier Choices Management Corp. — a company whose subsidiaries operate ten vape stores.

In addition to offering financial support to shops selling e-cigarettes, which evidence suggests may have severe impacts on lung health in the short and long term, the administration also gave a hand to an industry that may not need the help. Tobacco and marijuana have proven to be largely recession-proof products, not taking huge dips in sales even in times of serious economic downturn.

And tobacco sellers have even seen an increase in sales amid the COVID-19 crisis — even as more than 100,000 small businesses have been forced to shutter.

Learn more>>

Newly-Released, Limited Data Show Admin Failure on Paycheck Protection Program

[UPDATED: JULY 6 – 12:30 PM EST]

The Trump administration begrudgingly released partial information on loan recipients of the Small Business Administration’s (SBA) Paycheck Protection Program (PPP), after months of growing public pressure to disclose who received funds and how taxpayer dollars were spent.

The new data reveals more evidence of the PPP’s rampant mismanagement: this program intended to help small businesses has benefited large companies, special interests, and shockingly, states that we largely unharmed by the crisis when the aid was approved.

Learn more >>