Press Releases

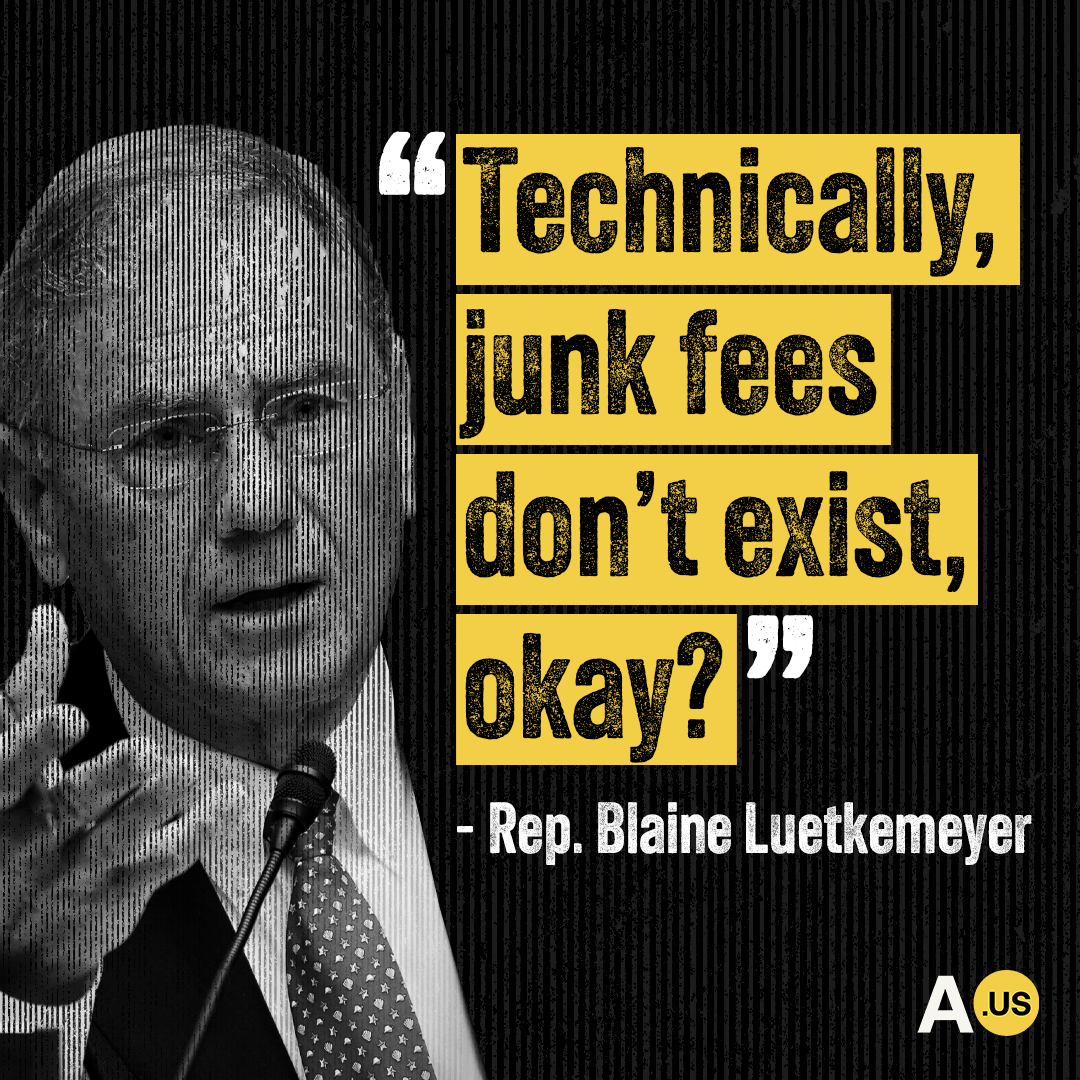

“Junk fees don’t exist, okay?” Says Out-of-Touch Rep. Luetkemeyer, Key MAGA HFSC Member

Washington D.C. – Government watchdog Accountable.US called out the wildly out-of-touch rhetoric by longtime-banker turned Congressman Blaine Luetkemeyer (R-MO) who aggressively defended abusive junk fees – which cost American consumers over $15 billion every year — in response to President Biden’s hugely popular effort to crack down on the practice.

During an interview with The New Republic, Luetkemeyer claimed: “Technically, junk fees don’t exist, okay? That’s a figment of Rohit Chopra’s imagination,” adding, “The bottom line is that all of these different fees and service charges, whatever the different charges are on the bill, are explained in the fine print of all your bills, but you need to read it.” When asked if Luetkemeyer himself reads the fine print on all of his purchases, he scoffed: “I don’t read the fine print on any of that stuff. I’m a busy guy.”

As Accountable.US has documented as part of its ‘MAGA Economics Profile’ project, Rep. Luetkemeyer’s shilling for junk fees is predictable after raking in over $3.3 million from the financial industry – including at least $556,000 in contributions from the three largest banks that made over $6.8 billion in overdraft fees in 2019 and industry groups that have opposed efforts by the CFPB to rein in the worst offenders impacting consumers. Luetkemeyer’s sugar-coating of often-hidden and excessive fees comes as President Biden called on Congress to pass the Junk Fee Prevention Act during his State of the Union address, and following the Consumer Financial Protection Bureau’s introduction earlier this month of a proposed rule cracking down on credit card late fees.

The comments are especially concerning for consumers as Luetkemeyer heads the House Financial Services Committee’s powerful National Security, Illicit Finance, and International Financial Institutions subcommittee.

Congressman Luetkemeyer is so deep in the pocket of big banks that he's lost all touch with everyday families burdened by abusive junk fees.

As a former banker, Luetkemeyer knows full-well how excessive overdraft penalties and predatory hidden fees sap billions of dollars from the pockets of consumers – but he sees this as business as usual, not the drag on the economy it is. Luetkemeyer is content to let his biggest donors manufacture junk fees to pad their profits on the backs of the most vulnerable Americans. Pretending junk fees don’t “exist” at all is just part of the MAGA Majority’s economic plan to put corporations first even when it’s at the expense of everyone else.”

Liz Zelnick, Accountable.US’ Director of Economic Security and Corporate Power.

Don’t Exist? A recent Accountable.US report found that not only do junk fees exist, they keep low-income American families from getting ahead. The report found the top 20 U.S. banks that are most dependent on junk fees disproportionately target lower-income consumers through their branch locations. In fact, nearly 60 percent of these banks’ 4,200+ branches are set up in counties with poverty rates at or higher than the national poverty rate, while over 76 percent of their branches were in counties with median household income levels less than the national median household income. These banks reported on average 41.7% of their 2021 net incomes from service charges that punish vulnerable consumers.

###