Big Banks Profiting Off of You

You’ve seen it in your town, your neighborhood, maybe it’s even affected your own family — big payday lenders have been targeting American consumers for far too long.

Now, the Community Financial Services Association of America (CFSA), a trade group representing the payday loan industry, is threatening the existence of the Consumer Financial Protection Bureau (CFPB), the agency created to defend you and your community against these predatory practices.

Here’s what you need to know about the CFSA

Did you know several of the worst payday offenders serve on CFSA’s board?

CFSA’s board consists of 10 executives from predatory payday lenders, according to their latest 2022 tax filings, and has close ties to Republican politicians and lawmakers. Some of the worst offenders are Ian Mackechnie, head of Amscot Financial, whose Amscot Insurance was convicted of racketeering while he was banned from selling insurance in Florida, and Kip Cashmore, head of USA Cash Services, who was associated with fraud and bribed disgraced Utah AG John Swallow to benefit his payday lending company. Three other payday executives—Robert Zeitler, Vin Thomas, and Kirk Chartier—previously served on the CFSA board in 2021.

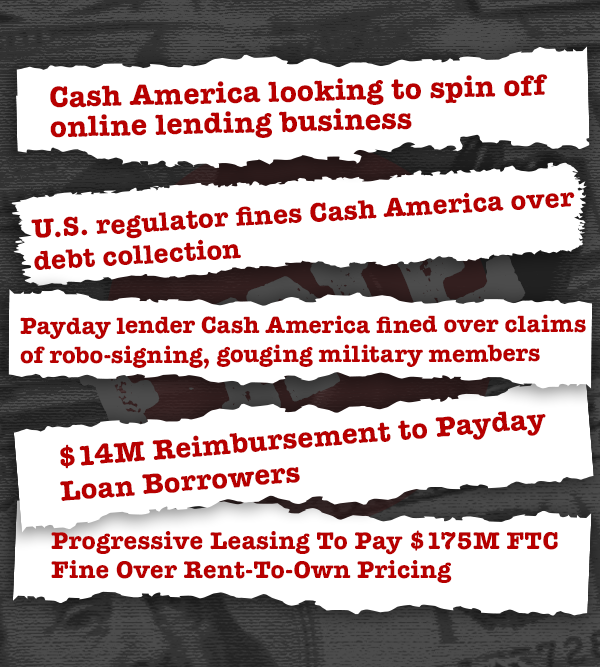

CFSA entities have paid over $200 million in fines brought by regulators seeking to protect your family and friends

- In January 2019, Enova was fined $3.2 million by the Bureau for debiting consumer bank accounts without their authorization. In November 2013, Cash America International, Enova’s parent company at the time, was fined $5 million by the CFPB and forced to pay $14 million in refunds for “violat[ing] the Military Lending Act by illegally overcharging servicemembers and their families.”

- In April 2020, PROG subsidiary Progressive Leasing paid $175 million to settle a Federal Trade Commission (FTC) lawsuit alleging the lender “frequently” misled consumers by charging consumers twice the advertised ticket price for payments on rent-to-own items. Then-FTC director Kelly Slaughter said, however, “the settlement did not go far enough,” as consumers ultimately paid “more than $1 billion in extra fees and charges.”

- In August 2011, QC Holdings agreed to pay $1.9 million to settle a class action lawsuit alleging the company violated Missouri law by “charging exorbitant rates” and “renewing payday loans too many times.”

The CFSA is doling out considerable resources to hurt the Consumer Financial Protection Bureau and leave it unable to defend you and your loved ones from price gouging, sky-high junk fees, and rampant corporate greed. Their motives are clear: those represented by the CFSA and their affiliates have paid over $204 million in fines and restitution to federal and state regulators, while paying at least $3.4 million in settlements from class action lawsuits against them. To them, using the Supreme Court and their Republican friends in Congress to take away your financial protection is a numbers game.

Republicans in Congress are not fighting for you.

CFSA has extensive ties to Republican lawmakers who are trying to kill the CFPB—and we have the receipts.

According to FEC records, the CFSA has contributed a combined $96,000 to current Republican members on the House Financial Services Committee (HFSC) and Senate Banking Committee. Among the top recipients of these contributions are staunch anti-CFPB Rep. Blaine Luetkemeyer (R-MO), current HFSC Chairman Patrick McHenry (R-NC), and Senate Banking Ranking Member Tim Scott (R-SC). Those members signed a July 2023 amicus brief supporting the CFSA’s challenge against the CFPB.

JUNK FEES AND THEIR DEFENDERS

Big Bank CEOs price-gouge Americans with billions of dollars in hidden and high-cost junk fees like $42 overdraft charge on a gallon of milk or escalating late penalties. Industry lobbyists and their conservative friends in Congress claim consumers should be grateful for these junk fees when in fact they serve one purpose: padding profits and CEO bonuses. To lower costs for everyday families, the Biden administration is cracking down on these greedy practices while pro-small business lawmakers introduced the Credit Card Competition Act to help lower record-high credit card swipe fees that get passed onto consumers. Industry lobbyists are spending millions to stop these efforts to save you money, and Congressional Republicans in their pocket are doing their bidding. Learn more about the industry executives making your life more expensive here.

RIGHT WING JUDGE SHOPPING

Greedy financial industry CEOs and lobbyists use our courts to protect their profits at Americans’ expense. Because they know right-wing power players are on their side, they’re suing regulators and the Biden administration in some of the most conservative courts in the country—and helping shady, ultra-right groups push their agenda.

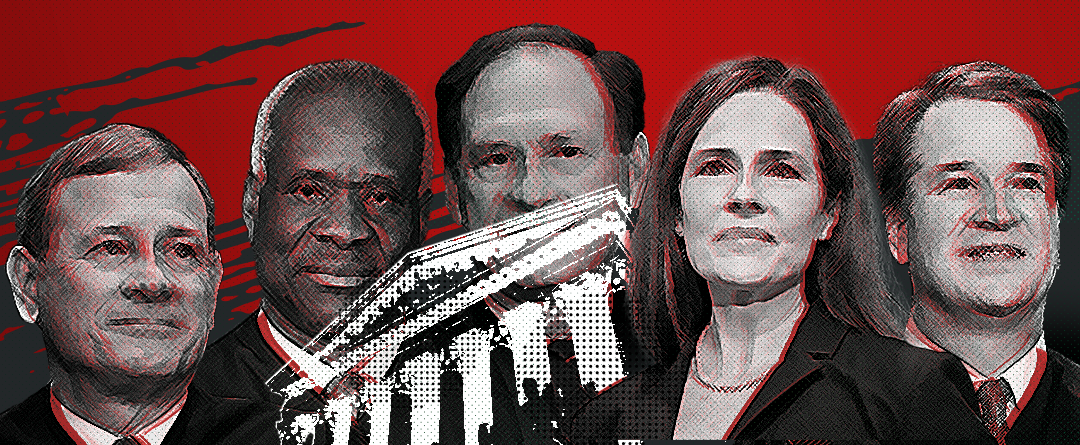

CONFLICTED COURTS

A pivotal case that could determine the future of the Consumer Financial Protection Bureau is unfolding, and other industry groups are lining up to sue the Biden Administration when their bottom line is threatened. It’s no secret that certain billionaires closely linked to Supreme Court justices stand to gain financially if the consumer watchdog is dismantled. These glaring conflicts of interest pose a direct threat to the protections safeguarding consumers like you.

POLLING

Voters across the country are voicing their concerns about high costs, but they believe the Biden administration’s efforts to crack down on junk fees and price gouging will help consumers like them.

Stay Informed

Get the latest news on how we’re holding big business, government officials, and special interests accountable, and what you can do to get involved.

By submitting your cell phone number, you are agreeing to receive period text messages from Accountable.US, including automated text messages. Message and data rates may apply. Text HELP for more information. Text STOP to stop receiving messages.