Reports

Corporate America Poised To Avoid The Inflation Reduction Act’s New Stock Buyback Tax, Already Announcing $1.5 Billion In Accelerated Share Repurchase Programs To Dodge Roughly $15 Million In New Taxes

| SUMMARY: Immediately after the Inflation Reduction Act (IRA) was signed into law on August 16, 2022, corporate America was already eyeing accelerated share repurchase (ASR) programs as a way to rush their stock buybacks before the IRA’s new 1% on the transactions becomes effective after December 31, 2022.

Sen. Sherrod Brown (D-OH), an early advocate of taxing stock buybacks, has called the IRA’s new levy “‘an important step to rein in corporations rewarding their shareholders over workers.’” This is because stock buybacks, which were illegal until 1982, have faced widespread and bipartisan criticism for artificially inflating corporations’ stock prices to benefit executives and shareholders at the expense of worker pay and more productive long-term investments. Companies have largely preferred buybacks since the passage of the 2017 Trump tax cuts, with corporations spending $1 trillion on buybacks in the first year after its signing. This trend has only continued in recent years. In 2021, companies within the S&P 500 increased buybacks by nearly 70% year-over-year while prioritizing buybacks over capital expenditures in the first half of the year. Most recently, companies within the S&P 500 have spent a record $281 billion on stock buybacks in the first quarter of 2022 alone and the top 100 U.S. companies have spent $816 billion on buybacks in the past year alone. As Wall Street schemes to skirt the IRA, an Accountable.US review has found that five publicly-traded companies have already announced nearly $1.5 billion in ASRs—potentially avoiding the roughly $15 million they would owe under the IRA’s new 1% stock buyback tax—after spending $2.5 billion on buybacks in their most recent fiscal years. This includes:

In addition to these ASRs, three major corporations have recently announced increased future buybacks, including $19 billion in new buyback authorizations:

|

Corporate America Has Been Eyeing Accelerated Share Repurchases (ASRs) As A Means To Avoid The Inflation Reduction Act’s (IRA’s) New 1% Stock Buyback Tax Before It Takes Effect At The End Of 2022.

The Inflation Reduction Act (IRA) Included A 1% Tax On Stock Buybacks—And Corporate Interests Have Immediately Focused On Accelerated Share Repurchases (ASRs) As A Way To Avoid The Tax Before It Takes Effect At The End Of 2022.

The Inflation Reduction Act (IRA)—President Biden’s “Sweeping Climate, Health-Care And Tax Bill”—Included A 1% Excise Tax On Stock Buybacks, Which Was Expected To Raise $74 Billion Over 10 Years. “Democrats are poised to pass the first new corporate taxes in a generation as part of President Biden’s sweeping climate, health-care and tax bill, including a levy on a corporate financial maneuver that was once considered illegal market manipulation. In addition to a proposed 15 percent minimum tax on large corporate profits, lawmakers are set to pass an entirely new 1 percent excise tax on corporate stock buybacks. The stock buyback tax is projected to raise $74 billion over the next decade, according to congressional estimates, and is key to funding some of the big spending on initiatives including credits to buy electric cars.” [The Washington Post, 08/12/22]

- The Inflation Reduction Act, Enacted On August 16, 2022, Ultimately Included The Stock Buyback Tax. “On August 16, 2022, the Inflation Reduction Act of 2022 (the ‘IRA’) was enacted into law. Among other changes to the Internal Revenue Code of 1986, as amended (the ‘Code’), the IRA imposes an excise tax on certain repurchases of corporate stock by certain publicly traded corporations (the ‘Stock Buyback Tax’).” [Vinson & Elkins, 08/22/22]

- President Biden Signed The Inflation Reduction Act Into Law On August 16, 2022. [The White House, 08/16/22]

Shortly After The IRA’s Passage, Wall Street Interests Immediately Focused On Accelerated Share Repurchase (ASR) Programs To Complete Stock Buybacks Before The Stock Buyback Tax Takes Effect After December 31, 2022. “Bankers and lawyers on Wall Street are hunting for ways to help companies buy back shares next year without having to pay millions of dollars in extra tax, a move that risks blunting one of the main revenue generators in President Joe Biden’s climate and health package. […] At the centre of their efforts is the use of accelerated share repurchase (ASR) programmes, a commonly used mechanism allowing companies to complete buybacks that can be worth billions of dollars.” [Financial Times, 08/25/22]

- The IRA’s Stock Buyback Tax Will Apply To Buybacks Made During Any Taxable Year Beginning After December 31, 2022. “1% Excise Tax: The Stock Buyback Tax imposes a 1% excise tax on covered corporations on the fair market value of any stock of the corporation which is repurchased by such corporation during any taxable year beginning after December 31, 2022.” [Vinson & Elkins, 08/22/22]

Banks And Legal Experts Generally Believe That Companies Will Not Have To Pay Taxes On Shares Repurchased Under ASRs Launched In The Remainder Of 2022, Before The Tax Takes Effect. “Banks and legal experts have been coalescing around the view that companies will not have to pay the tax on shares they receive through accelerated buybacks launched this year, said one person involved in the discussions.” [Financial Times, 08/25/22]

Forthcoming Treasury Department Guidance Will Determine Exactly How The Tax Will Be Implemented, And If It Will Apply To When Companies Pay For Their Stock Buybacks, When They Receive Their Purchased Stocks, Or When Investment Banks Purchase Their Stocks In The Market. “Although the programmes are recorded as having been executed on a single day, it often takes several months for banks to complete the trades. The plans hinge on whether forthcoming Treasury guidance will count the day that the company forks over the cash and receives its shares as the date of the buyback, or whether they will have to wait until investment banks actually buy the stock in the open market.” [Financial Times, 08/25/22]

Although Stock Buybacks—Which Were Illegal Until 1982—Have Faced Bipartisan Criticism For Artificially Inflating Corporations’ Stock Prices At The Expense Of Workers And Long-Term Investments, S&P 500 Companies Spent A Record-Breaking $281 Billion On Buybacks In Q1 2022 After Increasing Buybacks By Nearly 70% In 2021 From 2020.

Stock Buybacks—Which Were Illegal Until 1982—Have Faced Bipartisan Criticism For Artificially Inflating Corporations’ Stock Prices To Benefit Executives And Shareholders At The Expense Of Workers And More Productive, Longer-Term Investments.

Stock Buybacks Have Faced Bipartisan Criticism For Artificially Inflating Corporations’ Stock Prices To Benefit Executives Instead Of “Long-Term Investments, Job Creation Or Wage Increases.” “Share buybacks have been targeted by politicians on both sides of the aisle, attracting criticism from Republicans including former president Donald Trump and Florida senator Marco Rubio as well as Democrats such as Senate majority leader Chuck Schumer and Massachusetts senator Elizabeth Warren. Detractors accuse corporate boards of using share buybacks to artificially inflate their stock prices and benefit executives, who are often paid based on share price performance, instead of using their cash for long-term investments, job creation or wage increases for their employees.” [Financial Times, 08/25/22]

Stock Buybacks Were Illegal Until 1982 Because They Created “Artificial Demand” For Corporations’ Shares. “Corporations do not pay taxes on the purchase, and investors generally only pay a capital-gains tax when they sell their shares. Buybacks also allow corporations more leverage in the market by holding on to equity and creating artificial demand for their shares. For those reasons, buybacks were illegal until 1982. The Securities and Exchange Commission lifted that prohibition after reasoning that companies needed to repurchase shares for legitimate reasons, said Will McBride, vice president of federal tax policy at the conservative Tax Foundation think tank.” [The Washington Post, 08/12/22]

Proponents Of The IRA’s Stock Buyback Tax Hope It Will Incentivize Corporations To Make More Productive Investments. “Liberals hope that a new tax will change corporations’ behavior and incentivize businesses to either spend more money on internal investments — many of which can be written off tax bills — or distribute profits as dividends on a more consistent schedule.” [The Washington Post, 08/12/22]

Sen. Sherrod Brown (D-OH), An Early Advocate Of Taxing Stock Buybacks, Has Argued That The IRA’s Tax Is “‘An Important Step To Rein In Corporations Rewarding Their Shareholders Over Workers.’” “In September, Democratic Sens. Ron Wyden (Ore.) and Sherrod Brown (Ohio) introduced legislation for a 2 percent tax, and built the proposal into a ‘menu’ of revenue options to include as an offset in Biden’s social spending agenda, Wyden told The Washington Post. […] ‘We’ve known for years that stock buybacks are a problem — that they distort the market, they lead to less long-term economic growth, and they divert investment from workers,’ Brown said in a statement. ‘This excise tax is an important step to rein in corporations rewarding their shareholders over workers, and one that will make sure taxpayers benefit if they do. No matter how corporations respond to this, workers are better off.’” [The Washington Post, 08/12/22]

February 2019: Under The Chairmanship Of Sen. Marco Rubio (R-Fl), The Senate Small Business Committee Released A Report And Policy Recommendations “Eliminate The Preferential Tax Treatment Of Share Repurchases As A Way To Discourage [Buybacks]” With Buybacks No Longer Failling Under Capital Gains Tax Rates. “Republican Sen. Marco Rubio is pushing a new proposal that tackles one of Democrats’ favorite talking points: stock buybacks. The plan, unveiled Tuesday, would eliminate the preferential tax treatment of share repurchases as a way to discourage that behavior. Instead of falling under the capital gains rate, they would be taxed as dividends, which are subject to a wide range of rates. Rubio is the chairman of the Small Business Committee, which is releasing a report on the issue today. It argues equal rates would remove companies’ incentives to buy back stock in the first place. ‘Tax policy changes to end this preference might, on their own, increase investment by shifting shareholder appetite for capital return,’ the report states.” [CNBC, 02/12/19]

S&P 500 Companies Spent A Record $281 Billion On Stock Buybacks In The First Quarter Of 2022 After Breaking Records The Previous Two Quarters And The Top 100 U.S Companies Have Spent $816 Billion On Stock Buybacks In The Year Leading Up To August 2022.

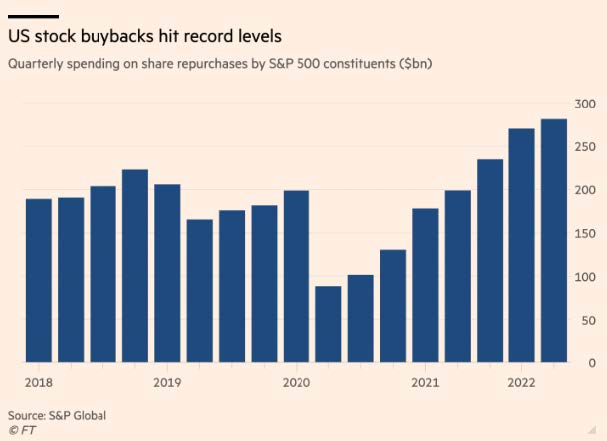

In The First Three Months Of 2022, S&P 500 Companies Spent A Record $281 Billion On Stock Buybacks After Breaking Records The Previous Two Quarters. “Companies in the S&P 500 spent $281bn on share repurchases in the first three months of 2022, according to S&P Global, setting a new record high for the third consecutive quarter.” [Financial Times, 08/25/22]

[Financial Times, 08/25/22]

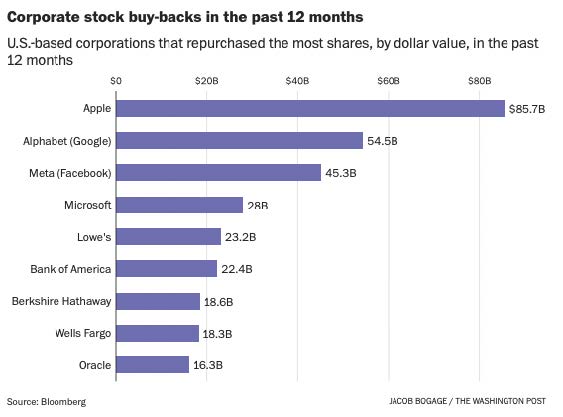

In The Year Prior To August 2022, The Top 100 U.S. Companies Spent $816 Billion On Stock Buybacks. “In the past 12 months, the top 100 U.S. firms purchased $816 billion worth of their own shares, according to Bloomberg data.” [The Washington Post, 08/12/22]

[The Washington Post, 08/12/22]

In 2021, S&P 500 Companies Increased Buybacks By Nearly 70% From 2020, While Prioritizing Buybacks Over Capital Expenditures In The First Half Of The Year.

For The Full Year, S&P 500 Companies Spent A Record $881.7 Billion On Buybacks. A 69.6% Increase From $519.8 Billion In 2020. “For 2021, buybacks were a record $881.7 billion, a 69.6% increase from the $519.8 billion in 2020, and up 9.3% from the record $806.4 billion 2018 level.” [S&P Dow Jones Indices, 03/15/22]

In The First Half Of 2021, S&P 500 Companies Prioritized Stock Buybacks Over Capital Expenditures As They Spent $370.4 Billion On Buybacks, A 29% Increase Year-Over-Year, And $337.17 Billion On Capital Expenditures, An Increase Of Just 4.8% From 2020. “Spending on share buybacks increased much faster than capital expenditures in the first half of the year, after pullbacks in both categories last year amid the pandemic, S&P said in response to a Wall Street Journal data request. Share repurchases at companies in the S&P 500 increased to $370.4 billion, up 29% from the first six months of 2020. Capital spending—which usually goes toward assets such as land, buildings and technology—rose to $337.17 billion, up 4.8% from the year-earlier period.” [Wall Street Journal, 09/14/21]

The 2017 Trump Tax Cuts Caused Corporate Buybacks To Skyrocket In the Immediate Aftermath, With Corporations Spending A Record $1 Trillion In Buybacks In The First Year After Its Enactment And A 2018 Analysis Finding Just 6% Of The Tax Windfall Went To Employees, While 60% Went To Shareholders.

Corporations Spent A Record $1 Trillion In Buybacks In The First Year After The 2017 Trump Tax Cuts Were Enacted, With A 2018 Analysis Finding Just 6% Of The Tax Windfall Went To Employees, While 60% Went To Shareholders.

The Number Of Stock Buybacks Increased Drastically Upon Passage Of The 2017 Tax Cuts And Jobs Act, With A 2018 Analysis By Just Capital Finding Just 6% Of The Tax Windfall Went To Employees, While 60% Went To Shareholders. “Now, the Tax Cuts and Jobs Act has resulted in a drastic increase in the usage of stock buybacks, far beyond even these 20-year upward trends. Since passage of the tax law, stock buybacks have already doubled in the beginning of 2018, as compared to the same period in 2017 (Domm 2018). Various estimates have shown that more than $200 billion of new stock buyback programs have been authorized after the tax bill was passed, as outlined in a special report from the Democratic Caucus of the U.S. Senate (2018). An analysis by Just Capital (2018) found that just 6 percent of the tax windfall is going to employees, while 60 percent is going to shareholders.” [Roosevelt Institute, March 2018]

Corporations Spent A Record $1 Trillion On Stock Buybacks In The First Year After The 2017 Trump Tax Cuts. “Corporations have increasingly used stock buyback initiatives to benefit their shareholders while avoiding the income taxes that would apply to dividend distributions that are functionally equivalent. In the first year after the Republican’s 2017 tax reform bill, corporations repurchased a record $1 trillion in their own stocks. This provision from Senate Democrats would at very least impede companies’ ability to engage in stock buybacks totally tax free.” [ITEP, 08/05/22]

After President Biden Signed The IRA Into Law, At Least Five Corporations Announced $1.49 Billion In ASRs After Spending Over $2.5 Billion On Stock Buybacks In Their Most Recent Fiscal Years.

August 18, 2022: Kohl’s Corporation—With Over 1,100 Stores In 49 States—Entered An ASR As Part Of Its $500 Million Stock Buyback Program After Spending $1.4 Billion On Stock Buybacks In Its FY 2021 Compared To Just $8 Million In FY 2020.

August 18, 2022: Kohl’s Corporation Entered Into An Accelerated Share Repurchase Agreement As Part Of Its Previously Announced $500 Million Stock Buyback Program. “Accelerated Share Repurchase Agreement […] On August 18, 2022, the Company entered into an accelerated share repurchase agreement (ASR), pursuant to its previously announced share repurchase program, to repurchase approximately $500 million of the Company’s common stock.” [Kohl’s Corporation SEC Form 8-K Exhibit 99.1, 08/18/22]

- President Biden Signed The Inflation Reduction Act Into Law On August 16, 2022. [The White House, 08/16/22]

Kohl’s Corporation Claims To Be “A Leading Omnichannel Retailer,” With Over 1,100 Stores In 49 States. “Kohl’s (NYSE: KSS) is a leading omnichannel retailer. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl’s App, Kohl’s offers amazing national and exclusive brands at incredible savings for families nationwide. Kohl’s is uniquely positioned to deliver against its strategy and its vision to be the most trusted retailer of choice for the active and casual lifestyle.” [Kohl’s Corporation, 08/24/22]

Kohls Spent $1.4 Billion On Stock Buybacks In Its FY 2021 Compared To Just $8 Million In FY 2021 After The Suspension Of Its Buyback Program In Q1 2020. “We paid cash for treasury stock purchases of $1.4 billion in 2021 compared to $8 million in 2020. During the first quarter of 2021, we reinstated our share repurchase program which had been suspended in the first quarter of 2020 in response to COVID-19. Share repurchases are discretionary in nature.” [Kohl’s Corporation SEC Form 10-K, 03/17/22]

August 23, 2022: American Vanguard Corporation—An Agricultural And Specialty Products Company—Announced A $20 Million ASR After Spending Over $4.5 Million On Stock Buybacks In Its FY 2021.

August 23, 2022: American Vanguard Corporation Announced A $20 Million Accelerated Share Repurchase Plan. “American Vanguard Corporation (NYSE: AVD) today announced that it has entered into an accelerated share repurchase (‘ASR’) plan under the terms of which it will repurchase $20 million worth of its common stock. This will be in addition to its existing 10b5-1 repurchase plan dated March 14, 2022.” [American Vanguard SEC Form 8-K Exhibit 99.1, 08/23/22]

- President Biden Signed The Inflation Reduction Act Into Law On August 16, 2022. [The White House, 08/16/22]

American Vanguard Corporation Is “A Diversified Specialty And Agricultural Products Company That Develops And Markets Products For Crop Protection And Management, Turf And Ornamentals Management And Public And Animal Health.” “American Vanguard Corporation is a diversified specialty and agricultural products company that develops and markets products for crop protection and management, turf and ornamentals management and public and animal health. American Vanguard is included on the Russell 2000® and Russell 3000® Indexes and the Standard & Poor’s Small Cap 600 Index.” [American Vanguard SEC Form 8-K Exhibit 99.1, 08/23/22]

American Vanguard Corporation Spent Over $4.5 Million On Stock Buybacks In Its FY 2021 After Having No Buybacks In 2020. “Finally, the Company used $4,579 to repurchase common stock in 2021. The Company did not repurchase stock in 2020.” [American Vanguard Corporation SEC Form 10-K, 03/11/22]

August 24, 2022: Popular, Inc.—Puerto Rico’s “Leading Financial Institution” And A Top 50 U.S. Bank By Asset Size—Announced A $231 Million ASR After Spending Over $350.5 Million On Stock Buybacks In Its FY 2021.

August 24, 2022: Popular, Inc. Announced A $231 Million Accelerated Share Repurchase Agreement With The Initial Payment Of $231 Million For 2,339,241 Shares Made On August 26, 2022. “Popular, Inc. (‘Popular’ or the ‘Corporation’) (NASDAQ: BPOP) announced today that on August 24, 2022 it entered into an accelerated share repurchase agreement (the ‘ASR Agreement’) to repurchase an aggregate of $231 million of Popular’s common stock. Under the terms of the ASR Agreement, on August 26, 2022 the Corporation will make an initial payment of $231 million and receive an initial delivery of 2,339,241 shares of Popular’s Common Stock (the ‘Initial Shares’).” [Popular, Inc. SEC Form 8-K Exhibit 99.1, 08/25/22]

- President Biden Signed The Inflation Reduction Act Into Law On August 16, 2022. [The White House, 08/16/22]

Popular, Inc. Claims To Be “The Leading Financial Institution In Puerto Rico” And “Ranks Among The Top 50 U.S. Banks By Assets.” “Popular, Inc. (NASDAQ: BPOP) is the leading financial institution in Puerto Rico, by both assets and deposits, and ranks among the top 50 U.S. bank holding companies by assets. Founded in 1893, Banco Popular de Puerto Rico, Popular’s principal subsidiary, provides retail, mortgage and commercial banking services in Puerto Rico and the U.S. Virgin Islands.” [Popular, Inc. SEC Form 8-K Exhibit 99.1, 08/25/22]

Popular, Inc. Spent Over $350.5 Million On Stock Buybacks In Its FY 2021:

![]()

[Popular, Inc. SEC Form 10-K, 03/01/22]

Popular, Inc. Has Projected An Effective Tax Rate Of 18-20% For The Remainder Of Its FY 2022. “For the quarter ended March 31, 2022, the Corporation recorded an income tax expense of $50.5 million, compared to $75.6 million for the previous quarter. The decrease in income tax expense was mainly attributable to lower income before tax and higher exempt income during the first quarter of 2022. The effective tax rate (“ETR”) for the first quarter of 2022 was 19.3%, compared to 27% in the fourth quarter of 2021. The ETR of the Corporation is impacted by the composition and source of its taxable income. The Corporation expects its ETR for the year 2022 to be within a range from 18% to 20%.” [Popular, Inc. SEC Form 8-K Exhibit 99.1, 03/31/22]

August 25, 2022: Synopsys, Inc.—An S&P 500 Electronics Company—Announced A $240 Million ASR After Spending $753 Million On Stock Buybacks In Its FY 2021 And Enjoying A 6.1% Effective Tax Rate That Same Year.

August 25, 2022: Synopsys, Inc. Announced That It Entered Into A $240 Million Accelerated Share Repurchase Agreement Set To Be Completed By November 18, 2022. “Synopsys, Inc. (Nasdaq: SNPS) today announced that it has entered into an accelerated share repurchase agreement (ASR) with Bank of America, N.A. to repurchase an aggregate of $240 million of Synopsys stock. Under the terms of the ASR, Synopsys will receive an aggregate initial share delivery of approximately 535,000 shares, with the remainder, if any, to be settled on or before November 18, 2022, upon completion of the repurchases.” [Synopsis, Inc. SEC Form 8-K Exhibit 99.1, 08/25/22]

- President Biden Signed The Inflation Reduction Act Into Law On August 16, 2022. [The White House, 08/16/22]

Synopsys, Inc. Is An S&P 500 Company That Claims To Be “A Global Leader In Electronic Design Automation (EDA) And Semiconductor IP.” “Synopsys, Inc. (Nasdaq: SNPS) is the Silicon to Software™ partner for innovative companies developing the electronic products and software applications we rely on every day. As an S&P 500 company, Synopsys has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP and offers the industry’s broadest portfolio of application security testing tools and services.” [Synopsis, Inc. SEC Form 8-K Exhibit 99.1, 08/25/22]

Synopsys, Inc. Spent Over $753 Million On Stock Buybacks In Its FY 2021. “During the fiscal year 2021, we repurchased 2.8 million shares of common stock at an average price of $270.84 per share for an aggregate purchase price of $753.1 million.” [Synopsis, Inc. SEC Form 10-K, 12/13/21]

Synopsis, Inc. Had An Effective Tax Rate Of 6.1% In Its FY 2021, Including A $45.5 Million Tax Benefit From The U.S. Federal Research Tax Credit. “Our effective tax rate for fiscal 2021 was 6.1%, which included a tax benefit of $45.5 million of U.S. federal research tax credit, a foreign derived intangible income (FDII) deduction of $31.2 million, and excess tax benefits from stock-based compensation of $94.0 million.” [Synopsis, Inc. SEC Form 10-K, 12/13/21]

August 31, 2022: Dover Corporation—A “Global Manufacturer And Solutions Provider” With About $8 Billion In Revenue—Established A $500 Million ASR, With A “Substantial Majority” Of Shares Expected To Be Received The Next Day, After Spending $21.6 Million On Stock Buybacks In Its FY 2021.

August 31, 2022: Dover Corporation Established A $500 Million Accelerated Share Repurchase Program. “On August 31, 2022, Dover Corporation (the ‘Company’) established an accelerated share repurchase program (the ‘ASR’) with Bank of America, N.A. (‘Bank of America’) to repurchase $500 million of its common stock, par value $1.00 per share (‘Common Stock’). The Company is conducting the accelerated share repurchase under a repurchase authorization for an aggregate of 20,000,000 shares approved by its board of directors in November 2020.” [Dover Corporation SEC Form 8-K, 08/31/22]

- President Biden Signed The Inflation Reduction Act Into Law On August 16, 2022. [The White House, 08/16/22]

Dover Expected A “Substantial Majority” Of The Shares From This ASR To Be Received By September 1, 2022. “Approximately [∙] shares of Common Stock repurchased under the ASR will be received by the Company on September 1, 2022, representing a substantial majority of the shares expected to be retired over the course of the ASR.” [Dover Corporation SEC Form 8-K, 08/31/22]

Dover Corporation Is “A Diversified Global Manufacturer And Solutions Provider With Annual Revenue Of Approximately $8 Billion.” “Dover is a diversified global manufacturer and solutions provider with annual revenue of approximately $8 billion. We deliver innovative equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services through five operating segments: Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions and Climate & Sustainability Technologies.” [Dover Corporation, accessed 09/01/22]

Dover Corporation Spent $21.6 Million On Stock Buybacks In Its FY 2021. “Repurchase of common stock: During the year ended December 31, 2021, we repurchased 182,951 shares of common stock at a total cost of $21.6 million.” [Dover Corporation SEC Form 10-K, 02/11/22]

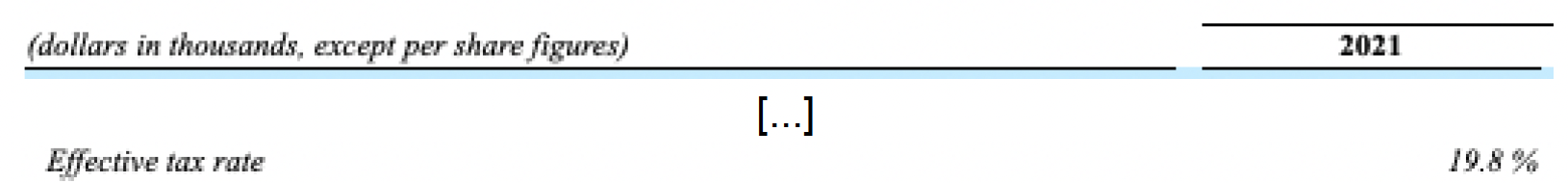

Dover Corporation Had An Effective Tax Rate Of 19.8% In Its FY 2021:

[Dover Corporation SEC Form 10-K, 02/11/22]

[Dover Corporation SEC Form 10-K, 02/11/22]

In Addition To These Accelerated Buyback Programs, Johnson & Johnson And T-Mobile Announced $19 Billion In New Authorizations In September 2022, While Comcast Announced It Would Be Doubling Its Current Buyback Authorization To “A Record $20 Billion After Increasing It To $10 Billion In January [2022].”

In September 2022, Johnson & Johnson Announced A New $5 Billion Stock Buyback Program In Order To Help “‘Deliver Shareholder Returns And Drive Long-Term Growth.’”

September 14, 2022: Johnson & Johnson Announced A New $5 Billion Buyback Program In What CEO Joaquin Duato Stated Was A Move To “‘Deliver Shareholder Returns And Drive Long-Term Growth.’” “Johnson & Johnson (NYSE: JNJ) today announced that the Board of Directors has authorized the repurchase of up to $5 billion of the company’s common stock. ‘The last few years have demonstrated the resilience of Johnson & Johnson. With continued confidence in our business and pipeline, the Board of Directors and management team believe that Company shares are an attractive investment opportunity,’ said Joaquin Duato, Chief Executive Officer. ‘With our strong cash flow and lowest level of net debt in five years, we have the ability to invest in innovation, grow our dividend, execute strategic acquisitions, and take this action to deliver shareholder returns and drive long-term growth.’” [Johnson & Johnson, 09/14/22]

In September 2022, T-Mobile Announced A New $14 Billion Stock Buyback Program Set To Expire At The End Of September 2023.

September 8, 2022: T-Mobile Announced A New $14 Billion Stock Buyback Program Through September Of 2023. “On September 8, 2022, T-Mobile US, Inc., a Delaware corporation (the ‘Company’), announced that its Board of Directors has authorized a stock repurchase program for up to $14.0 billion of the Company’s common stock, par value $0.00001 per share, through September 30, 2023. Repurchases are expected to be made from available cash on hand and proceeds of one or more debt issuances or other borrowings, based on the Company’s evaluation of market conditions and other factors.” [T-Mobile via SEC, 09/08/22]

In September 2022, Comcast Announced It Would Be Doubling Its Current Stock Buyback Authorization To A Record $20 Billion After Increasing It To $10 Billion In January 2022.

September 14, 2022: Comcast “Doubled Its Share Buyback Authorization To A Record $20 Billion After Increasing It To $10 Billion In January [2022].” “Comcast Corp (CMCSA.O) and Johnson & Johnson (JNJ.N) on Wednesday unveiled buybacks worth billions of dollars as they joined a rush of U.S. companies seeking to avoid a new tax on such repurchases. The $430 billion Inflation Reduction Act imposes a 1% tax on buybacks and a minimum 15% tax on corporations from next year. Comcast doubled its share buyback authorization to a record $20 billion after increasing it to $10 billion in January, while J&J announced a repurchase program of up to $5 billion.” [Reuters, 09/14/22]