Press Releases

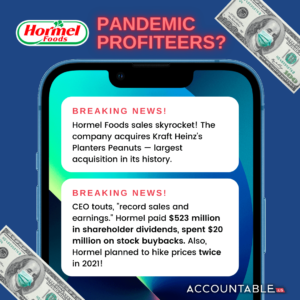

Pandemic Profiteering: Hormel, Kroger, McDonald’s

PROFITS BEFORE LOWER PRICES: While Republicans in Congress play the blame game on inflation challenges, they’re conveniently letting their big corporate donors off the hook for the outsized role they play. Much like Congressional Republicans are exploiting the struggles of working families and small businesses navigating a once-in-a-lifetime pandemic, it’s clear many corporations are taking advantage of this moment for their own selfish gain.

More and more companies are using the pandemic to increase their wealth and line their shareholders’ pockets as they boast to their investors of record profits and healthy balance sheets. These corporations have a choice: they can reward themselves with lucrative stock buybacks and bigger CEO bonuses — or they can pass their success onto their customers with lower prices. As Accountable.US continues to document, too many companies are choosing to profiteer rather than do right by consumers and the economy.

TOP TAKEAWAYS

- Hormel Foods Corporation is having a very good year. In June, it completed a $3.35 billion acquisition of Kraft Heinz’s Planters peanuts — the largest acquisition in the company’s history. Its CEO touted “‘record sales and earnings'” and paid $523 million in shareholder dividends, spent $20 million on stock buybacks, and planned on hiking prices — not once, but twice, in 2021.

- As Dole PLC acknowledged that the company increased prices on its goods, it reported “strong results” with $29.89 million in net profits in its third quarter. To no surprise, it also used those price increases to pad their shareholders’ pockets with $17 million in shareholder dividends this year.

-

We’re not loving how McDonald’s is hitting customers with higher prices despite billions in profits. McDonald’s reported a $2.15 billion profit that “topped analysts’ estimates” due in part to price hikes in its third quarter — all while the company increased its shareholder dividend by 7%, was expected to pay over $1 billion in dividends in the fourth quarter, and resumed stock buybacks worth over $14 billion.

-

Grocery store chain Kroger’s Chairman and CEO recently said the company is “‘in a position of strength'” as the company reported a third quarter operating profit of $868 million and spent $297 million on quarterly stock buybacks just months after it said it was “‘passing along higher cost to the customer.'”

-

ICYMI from Axios: “Economist group touts Build Back Better as inflation offset”

EARNINGS CALLS HIGHLIGHTS

- Hormel Foods Corporation (December 9): From Hormel CEO Jim Snee himself: Hormel “‘benefited from increased volume and pricing actions across many categories.'” The $523 million in shareholder dividends and $20 million on stock buybacks speak for themselves.

- United Natural Foods, Inc. (December 8): United Natural Foods, Inc. — the “primary wholesale grocery” distributor of Amazon subsidiary, Whole Foods Market — reported a net income of $76 million in its first quarter: a $77 million increase over the prior-year period.

- Campbell Soup Company (December 8): Campbell Soup Company reported $389 million in adjusted earnings in its first quarter of 2022 while it paid $116 million in shareholder dividends, held $63 million in stock buybacks, and noted that price hikes had not driven customers away.

- Dole (December 3): In the first nine months of 2021, Dole has paid $17.09 million in dividends to shareholders and $20.44 million to noncontrolling interests. In the third quarter, Dole’s net income was $29.89 million — over $10 million more than the $18.56 million it posted in the third quarter of 2020.

CORPORATE GREED IN ACTION

- Hormel Foods Corporation Chairman, President, And CEO Jim Snee: “We posted incredible sales growth of 72% in the foodservice channel, or 33% compared to pre-pandemic levels, which is a result of our differentiated portfolio, dedicated direct sales team and our commitment to the industry throughout the pandemic. Additionally, we continue to drive strong double- digit sales growth in the retail, deli and international channels, led by the strength of our global brands.'”

- United Natural Foods President Chris Testa: “All three major sales channels experienced year-over-year growth, which was driven by two primary factors: new business wins and inflation. Modest market contraction and continued supply chain challenges were also partial offsets to these favorable sales drivers.”

- Dole CEO Rory Byrne: “As increasing inflationary pressures emerged, we initially focused our efforts on optimizing our supply chain to limit cost impacts. However, now that it’s clear that inflation is pervasive and persistent, we have reacted by increasing prices in the segment of our business that have longer-term contracts, such as our tropical fruit division and value-added solids.”