Press Releases

Pandemic Profiteering: FedEx, AutoZone, Academy Sports

PROFITS BEFORE LOWER PRICES:

While Republicans in Congress play the blame game on inflation challenges, they’re conveniently letting their big corporate donors off the hook for the outsized role they play. Much like Congressional Republicans are exploiting the struggles of working families and small businesses navigating a once-in-a-lifetime pandemic, it’s clear many corporations are taking advantage of this moment for their own selfish gain.

More and more companies are using the pandemic to increase their wealth and line their shareholders’ pockets as they boast to their investors of record profits and healthy balance sheets. These corporations have a choice: they can reward themselves with lucrative stock buybacks and bigger CEO bonuses — or they can pass their success onto their customers with lower prices. As Accountable.US continues to document, too many companies are choosing to profiteer rather than do right by consumers and the economy.

TOP TAKEAWAYS

- The holiday season is in full swing, and so is FedEx’s operating income. FedEx reported a $130 million increase in its second quarter operating income from the previous year.

- Academy Sports & Outdoors is having a “record” year. During the third quarter, its net income increased 170% thanks to a record $1.59 billion in sales. Where’s that money going? The company used it to buy back $350 million worth of company stock in 2021, including $250 million in the third quarter alone.

-

ICYMI from Senator Warren: “Once deemed essential, workers in grocery stores now say they feel expendable, and have been rewarded with only marginal increases in wages they say leave them unable to cover their own rising food costs. Meanwhile, producers and grocers are exploiting the pandemic to jack up prices more than necessary to pass on increased costs to consumers…”

EARNINGS CALLS HIGHLIGHTS

- FedEx (December 16): FedEx recently “authorized a new $5 billion share repurchase program” in addition to its 2016 repurchase program that still has 2.3 million shares left to buy.

- Academy Sports (December 10): Thanks to consumers bearing the brunt of “effective pricing and promotions management,” Academy Sports saw its gross margin increase 27.3% to $560.8 million. The company still has around $254 million worth of shares left to buy.

- Campbell Soup Company (December 8): Campbell Soup Company reported $389 million in adjusted earnings in its first quarter of 2022 while it paid $116 million in shareholder dividends, held $63 million in stock buybacks, and noted that price hikes had not driven customers away.

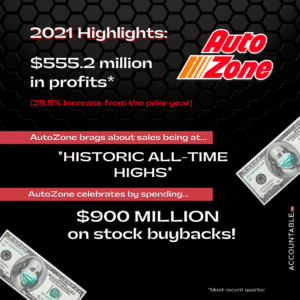

- AutoZone (December 8): AutoZone spent $900 million on stock buybacks in its first quarter and still had over $1 billion remaining in its current stock buyback program.

CORPORATE GREED IN ACTION

- Academy Sports Chairman, President, and CEO Ken Hicks: “By operating more efficiently and effectively in a tempered promotional environment, we achieved record gross margin of $560.8 million. Like most retailers, we saw an increase in freight cost, but we’re able to absorb the majority of them with higher merchandise margins while maintaining our everyday value proposition for our customers.”

- AutoZone CEO William C. Rhodes: “Let me also address what we are seeing from inflation and pricing. This quarter, we saw our sales impacted positively by about 4% year-over-year from inflation, while our cost of goods was up about 2% on a like-for-like basis. We believe both numbers will be higher in the second quarter as cost increases in many key merchandise categories continue to work their way through the system.”

- FedEx CEO Frederick W. Smith: “Firstly, the first and most important point is the demand for our services is very robust. The pricing environment is very robust. The labor headwinds start to recede in the second half. The investments that we have made get more efficient as we go into the second half and the technology investments that make us more efficient as well. So we expect in the second half, our profit and operating margins to improve year-over-year, and we get double-digit.”